Welcome to

On Feet Nation

Members

-

GRAHAM MULFY Online

-

George Online

-

Ebony Online

-

Robert Online

-

munda324234 Online

-

Marc Online

Blog Posts

Top Content

Rumored Buzz on Top 10 Tips When Adding A Teenager To Car Insurance

Teen Driving Security A teenager's very first 6 months of unsupervised driving are the most dangerous, according to two separate research studies on teenage driving3. If your teen is new to driving, please print out and share the following security pointers and cautions.

National General Insurance coverage provides these ideas to enhance your teenager security on the roadway. Share these teen driving ideas from National General Insurance coverage that will help keep your high schooler safe on the road.

2 Insurance Institute for Highway Security. (2018) 3 Insurance Coverage Institute for Highway Safety. Couple of months of driving unsupervised are most harmful.

The Ultimate Guide To Helping Cut Costs For Teen And New Drivers - Geico

is important for any chauffeur (it's even obligatory in 48 states), however it's particularly important for brand-new chauffeurs, whose inexperience makes them more likely to have mishaps. Discovering the best policy, however, can be a challenge. What sort of protection do you need? How do you stabilize expense and coverage? Do you really need collision protection? It's a lot-- however we're here to help.

Nationwide 5 things to do before choosing a cars and truck insurer for a teen, Choose if you're getting a separate vehicle insurance plan for your teen or if you desire your teenager listed on your insurance coverage. The former is typically thought about less expensive in the short term as your own vehicle insurance premium will not increase.

Choose which car insurance coverage advantages are important to you, and make certain to view out for them when speaking to an insurance coverage representative. For example, many insurance companies will not extend accident forgiveness to younger drivers, however Nationwide will. Examine which cars and truck insurance discount rates your teen may be qualified to receive.

The 2-Minute Rule for Ways To Reduce The Cost Of Insurance For Teens In New Jersey

Leave it to Geico to provide budget-friendly automobile insurance coverage that makes things uncomplicated and simple, no matter the job. Geico's private policy rates vary on a state-by-state basis, however it's routinely ranked amongst the cheapest options in any state.

It also provides the very same discounts as much of its rivals, consisting of benefits for great trainees and for chauffeurs who have actually taken driving training courses. Likewise excellent is that teenagers that transition from a household policy to their own automobile insurance coverage might receive a 10% Legacy discount on their insurance coverage.

Nationwide Automobile insurance is more pricey for teenagers since of the perception that their lack of experience makes them most likely to be included in mishaps. Whether this is true or not, the truth remains that one in five 16-year-old chauffeurs gets an accident on their driving record in their very first year behind the wheel.

The Greatest Guide To At What Age Do Car Insurance Rates Go Down? - Money ...

No one wishes to spend a lot on a cars and truck insurance coverage policy, particularly when the vehicle in question might only be used on unusual celebrations. Simply the thought of costs thousands a month in insurance coverage expenses on a lorry that's usually in a parking lot is stress-inducing. Not just does Progressive use everyday low costs, however it's likewise developed a series of discount rates that use particularly to university student.

Teenagers can likewise take benefit of Progressive's Snapshot program, which rewards chauffeurs for driving safely with discount rates and other cost savings. Progressive's site also offers a list of tips to help moms and dads figure out if they must include teenagers on their plans or get them their own. Erie Insurance Pennsylvania-based Erie Insurance has actually been guaranteeing motorists for nearly 95 years, and its track record for sterling service extends to young motorists.

"If there is a young chauffeur on your policy who is ... away at college without a car," says Ruiz, "you may also qualify for a lower rate." Every insurance provider uses different discounts depending on your protection alternative and other aspects, so it pays to examine which ones apply to you before signing up.

5 Easy Facts About Teen Drivers, Insurance And Safety Explained

Progressive deals a variety of discount rates for college trainees to conserve on vehicle insurance coverage. The finest coverage for you is the one that fits your needs, addresses your issues, and makes sense for your scenario.

2021 I Drive Safely We Develop Safer Drivers.

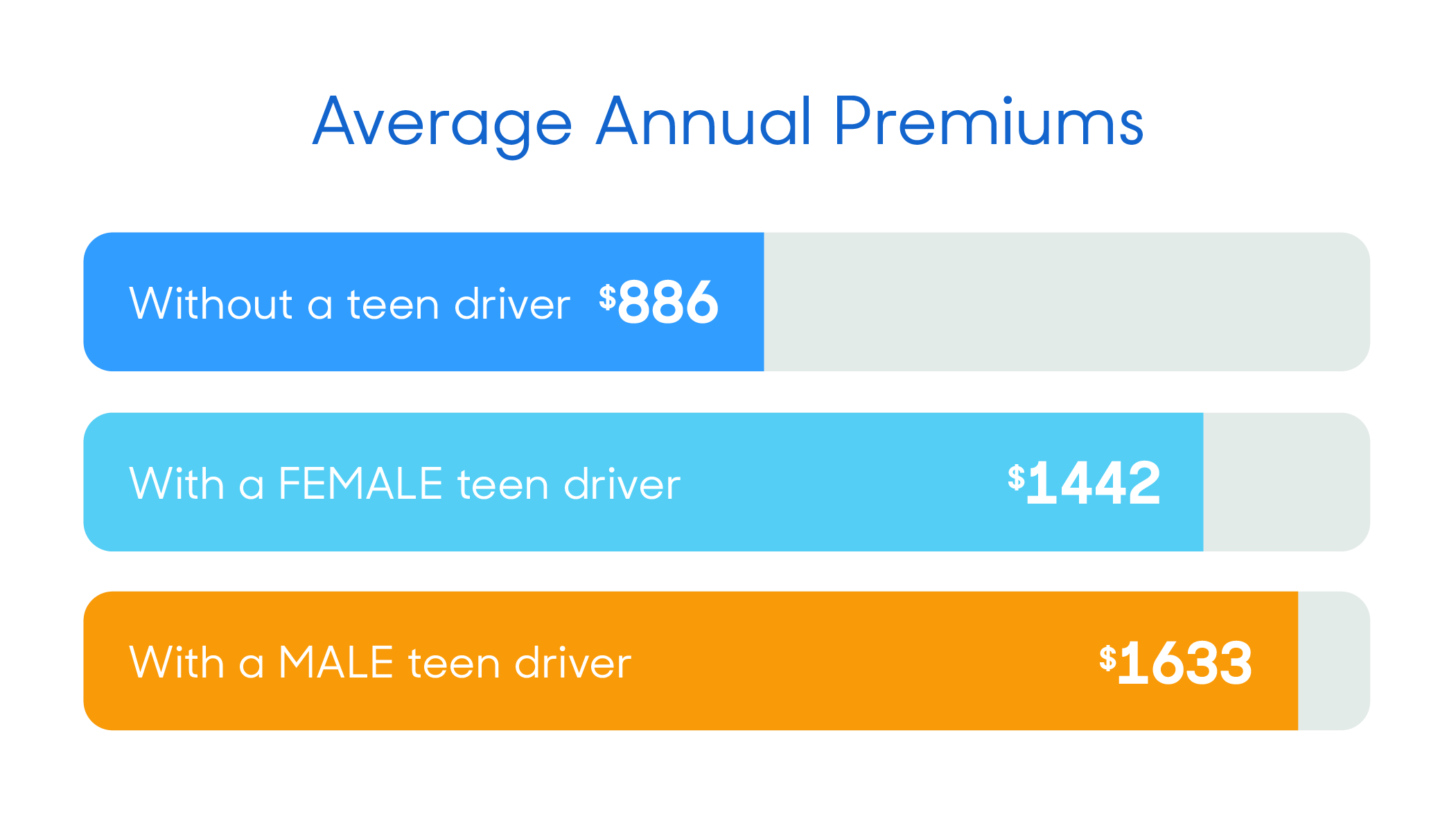

Your daughter or son has actually spoken about it permanently - the day they finally get their chauffeur's license. With that new independence comes some big cost - in the type of greater insurance rates. Moms and dads of a new teenager driver can expect their insurance coverage expenses to almost double, according to a recent study.

Average Cost Of Car Insurance For Teens - Quotewizard - The Facts

Nationally, the average boost was 79. 73 percent, Insurance, Estimates. com reports. For moms and dads of drivers in their teens and early 20s - there is some hope. Insurance coverage business do normally provide a range of discount rates that can help reduce the bottom line. Here are 8 things you can do to lower vehicle insurance coverage premiums if you have a teen chauffeur: If your teenager motorist is a great trainee you might get approved for discounts.

Your insurance coverage carrier might offer discounts if your teenager gets involved in a driver security course. This may be an official motorist's education course or it may be a course provided by your insurance provider straight.

This depends on your insurance company. Keep in mind that some insurance companies do discourage this given that numerous trainees return home often and will need insurance coverage to drive the car when they're back.

An Unbiased View of Teen Drivers, Insurance And Safety

Once you've recognized the most safe lorries and innovation, validate with your agent whether these will decrease your insurance coverage expenses and by how much. As a guideline of thumb, an older cars and truck is generally a less costly insurance choice for your teenager motorist. Expensive, more recent cars generally cost more to guarantee so there could be some savings if your daughter or son isn't driving the household's new high-end sedan.

If the automobile is really old, you may even think about dropping this protection all together, if possible. If you have separate insurance carriers for your home, cars and truck, or other items think about a multipolicy discount.

Extra sources used in this story.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation