Welcome to

On Feet Nation

Members

-

se Online

-

Khalid Shaikh Online

-

GRAHAM MULFY Online

-

Cecile Online

-

Thomas Shaw Online

-

rimeton454 Online

Blog Posts

Top Content

The 6-Second Trick For Six Tips To Save On Teen Driver's Car Insurance - Icne

Taking benefit of discount rate programs is another method to conserve when adding a teenager chauffeur to automobile insurance coverage.

Getting My Car Insurance For Young Drivers And Teens - Usaa To Work

You need to keep your eye on the huge things when a new driver or teenager starts to drive, like making sure they drive safely. Moms and dads and young chauffeurs also have to see the little things to save cash on vehicle insurance premiums. GEICO has some recommendations that could help the household budget.

Limited use of the family vehicle is the best method to acquire experience and control expenses. New motorists must not have unlimited access to automobiles until they have become more knowledgeable behind the wheel. Young drivers are unskilled and ought to never ever be permitted to drive high-performance cars. Bear in mind, too, that insurance coverage costs are lower on more conventional lorries.

The smart Trick of Best Car Insurance For New Drivers (2021) - How To Lower Car ... That Nobody is Discussing

This uses to all drivers, not simply young teen chauffeurs. Increasing deductibles, which results in sharing a greater part of any detailed or accident loss, can lower auto insurance premiums.

Think about dropping collision and comprehensive protection for an older cars and truck, because they only cover the current value of the vehicle. The very best method to cut teen car insurance coverage costs is to teach young chauffeurs to drive securely and become experienced gradually. Since young drivers are the least knowledgeable, more fatal mishaps happen in this driving group.

The 10-Second Trick For Top 3 Ways To Save On Your Teen's Car Insurance - Liberty Mutual

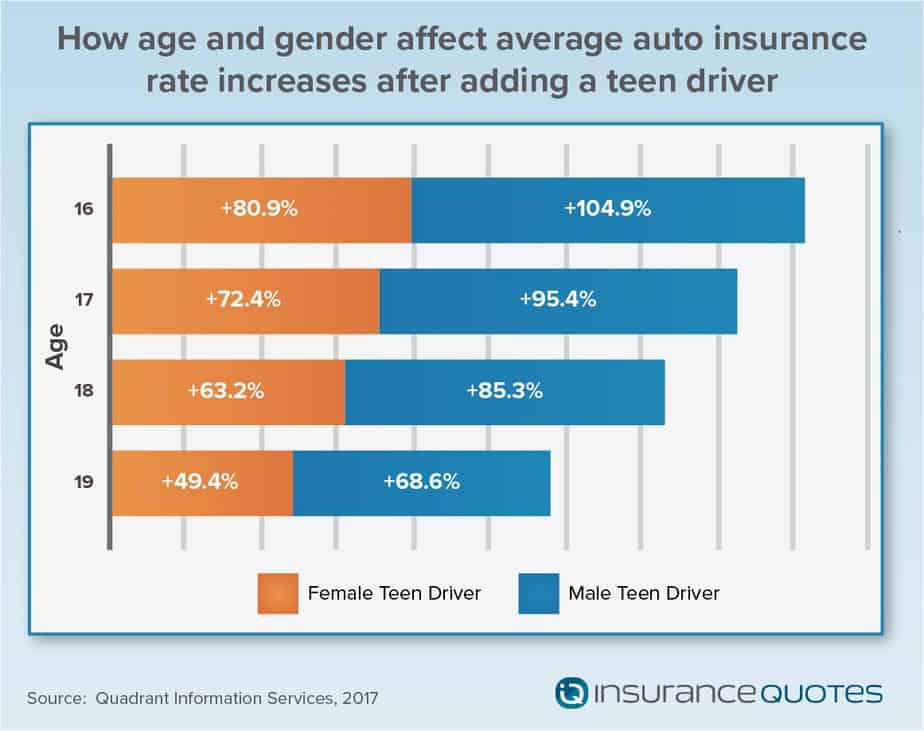

Insuring a 16-year-old motorist can be pricey. Since teenager chauffeurs do not have the benefit of experience for insurance provider to consider when setting rates, they are considered riskier to insure. There are strategies you can utilize to help conserve cash and get the finest vehicle insurance coverage for a 16-year-old driver.

There is one location where moms and dads can score considerable savings: Picking to include a 16-year-old to a family strategy, which is normally more affordable, as opposed to having the teen get a private policy. Insuring a 16-year-old on a specific policy includes an average increased expense of $1,947 annually.

The Only Guide to How To Insure Teen Driver

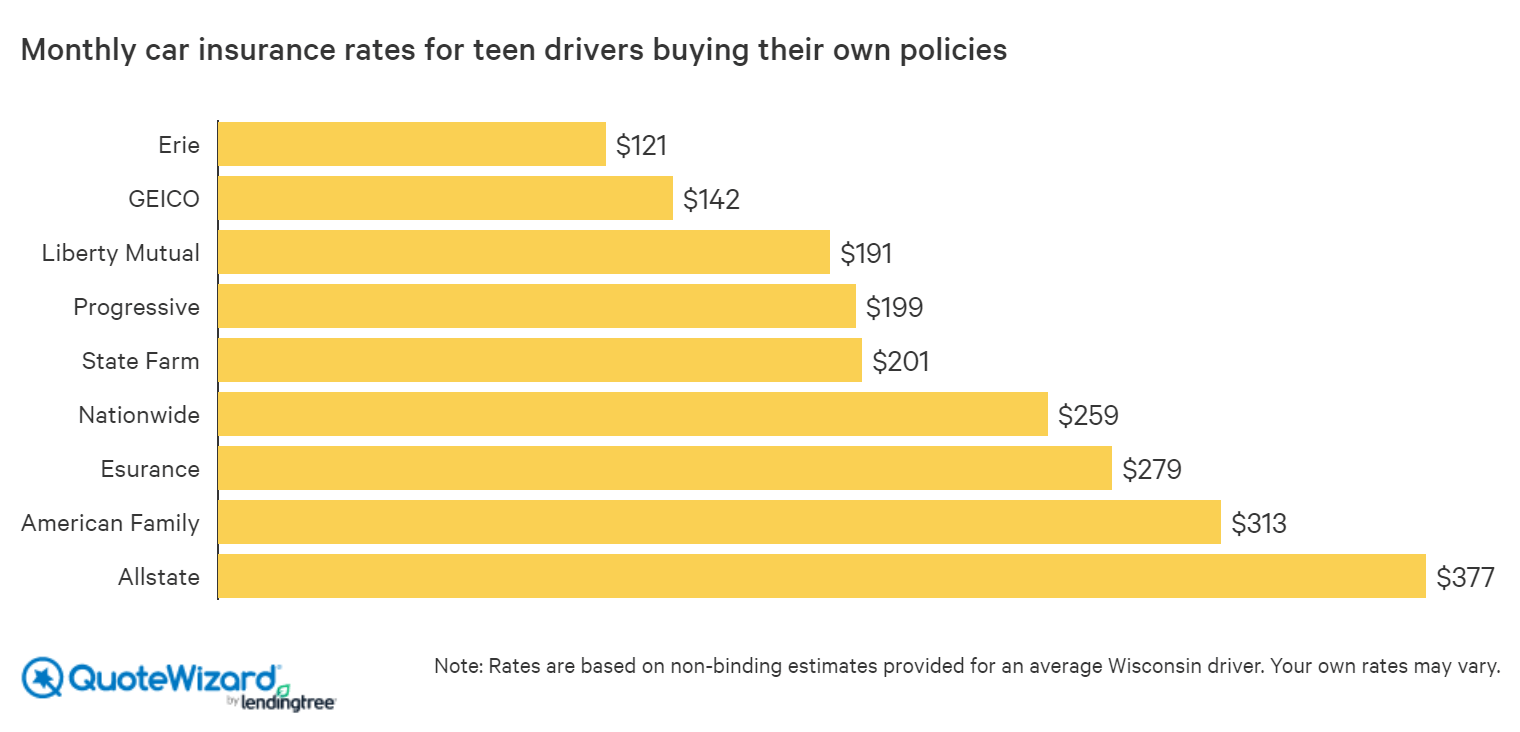

Cheapest Car Insurance Coverage for 16-Year-Old Males and Females, There is a distinction when it comes to gender for insuring new teenager motorists. Usually, it costs more to guarantee a 16-year-old male driver than a female chauffeur of the exact same age. That's since male motorists have a higher mishap rate and more insurance claims and are for that reason more of a threat to insurance provider.

Scroll for more While the least expensive average expense we found for including a 16-year-old to a family policy is $3,146, it costs approximately $5,318 for a private policy for the same-age chauffeur. Just by including a 16-year-old to a family policy, you can save approximately $2,172 annually.

6 Easy Facts About Finding The Cheapest Car Insurance For Teen Drivers Shown

Opting to add one of these young drivers to a household policy is one solid choice to consider, which can save approximately almost $500 annually, even if you opt for the least expensive choice for either type of policy. Compare Quotes for the very best Policy for Your Household, No matter the motorist, when you're purchasing cars and truck insurance coverage, comparing quotes can assist you save.

The more quotes you can get, the much better. Screen Your Teen Chauffeur to Make Sure a Tidy Driving Record, Similar to chauffeurs of any age, guaranteeing your young motorist keeps a clean driving record is a great way to keep cars and truck insurance coverage expenses down. On the other hand, accidents and tickets will significantly increase automobile insurance coverage costs for your 16-year-old.

Car Insurance For Teens Can Be Fun For Everyone

Lower the Protection Amount, The amount of coverage you need will differ, however for those who want, decreasing those can decrease the expense of insurance companies. You'll still have to follow your state's minimum requirements, naturally, but lowering the protections can be a legitimate option for those looking to save.

It's likewise crucial to be aware that by going with this type of coverage, you will not be covered for your own car damage or individual injury costs. In case of a crash, that might develop into a pricey issue if you don't have money on hand to change or fix a wrecked vehicle.

7 Easy Facts About How Much Does It Cost To Add A Teenager To ... - Creditdonkey Shown

Something like a Camry a four-door sedan that made the top-safety pick from the Insurance Coverage Institute for Highway Security will be a less expensive option to insure than a muscle vehicle that focuses on efficiency, like a Mustang. Sports cars and trucks and pricey luxury vehicles, in basic, will be more costly, too.

Traffic Statistics for 16-Year-Old Drivers, The younger the driver, the most likely it is that they'll be included in a crash. According to information for police-reported crashes in 2014 to 2015, chauffeurs aged 1617 were involved in practically double the variety of fatal crashes than 18- and 19-year-olds for every 100 million miles driven.

A Biased View of Buying Car Insurance For Teenagers Can Be A Balancing Act

Limiting the number of miles your teenagers drive might both help cut expenses and keep them safe. States With the Highest Cars And Truck Insurance Cost for a 16-Year-Old, Where you live will likewise impact your vehicle insurance coverage rates, not only due to the fact that the local stats can impact cost, however likewise since you might have more minimal choices.

Like when you add your teen motorist to your car insurance coverage strategy and the month-to-month premium instantly balloons. While your rates are guaranteed to increase (teenagers are thought about high-risk motorists), that increase does not have to break the bank.

The Only Guide to Adding A Teen To Your Auto Insurance Policy - Incharge Debt ...

Get a Better Rate With Multi-Vehicle Household Plans Will your teen have their own car? If so, you may be wondering if they ought to buy a separate policy. Many of the aspects that enable you to get much better rates on your insurance coverage (think: being married or having an excellent credit rating) aren't applicable to your teenager.

They can tell you which designs will be the most affordable to guarantee. You can also inspect out this useful calculator from to get a better understanding of insurance premiums by automobile make and design. Keep in mind: While older cars are normally less costly to fix, some insurance coverage companies offer discounts for newer cars.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation