Welcome to

On Feet Nation

Members

-

goditac499 Online

-

Lima Online

-

Genaro Online

Blog Posts

Top Content

Examine This Report on Best Car Insurance Companies For 2022 - The Ascent By ...

Lots of auto insurer provide numerous ways to conserve, such as discounts for risk-free chauffeurs, university student, or armed forces members.: A lot of insurance business cover the standard comprehensive and collision protection, but there are likewise various other, specific coverages that might not be so commonly discovered, such as electric or classic automobile insurance - credit.: Each type of protection includes an optimum limit that reveals exactly just how much of your losses will certainly be covered by your insurer.

What Does Car Insurance Cover? Car insurance coverage covers damage to your lorry, in addition to various other vehicles or property if you're associated with a mishap. It can likewise cover medical costs should there be any kind of injuries and any kind of lawful charges that might occur after a collision. What Are the Different Types of Car Insurance Coverage? There are several sorts of car insurance, including crash coverage for accidents as well as extensive insurance coverage for natural acts, like typhoons or hailstorm.

For further info regarding our option criteria and also process, our total method is available.

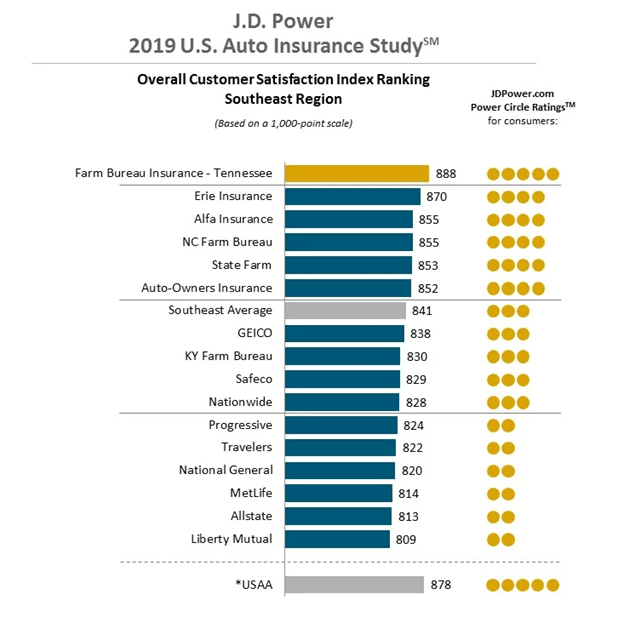

ALL SET TO DISCOVER THE VERY BEST CAR INSURANCE COVERAGE FOR YOU? Or use Cash, Nerd's company matcher to compare companies in your state. Why Depend On Cash, Geek? The Ideal Car Insurance Coverage Firms for 2022Money, Nerd has ranked the best automobile insurance provider based on numerous aspects, including J.D. Power consumer complete satisfaction scores, economic security ratings from AM Finest and cost.

GEICO received the highest marks in Learn here our scoring system for 24 out of 50 states, while State Farm ranked as the top firm in 10 states. These rankings, and our study on what makes these business stand out, can help you when purchasing auto insurance. Those simply seeking the most economical alternative can compare this checklist to our positions of the most affordable car insurance provider (cars).

Best Car Insurance Companies - Auto Express Fundamentals Explained

GEICO could not be the ideal alternative for those with a brand name brand-new cars and truck. The firm doesn't offer new cars and truck substitute coverage, which permits those with brand-new versions to be completely compensated for a new auto after an accident (cheap car insurance). Without this, you'll just be reimbursed for the depreciated value of your car.

insurance company risks insurers cheaper cars

insurance company risks insurers cheaper cars

You can conserve also much more on your monthly expense by packing with State Farm's house insurance coverage. State Farm does not offer much in the way of one-of-a-kind protections: you'll primarily locate common auto insurance coverage protections as well as common attachments such as roadside assistance as well as rental automobile cost coverage - cheaper. Although it supplies couple of special rewards, you're more probable to get great value with State Farm than the majority of various other major insurers.

Like GEICO, State Farm does not offer new car replacement insurance coverage, so it may not be the most effective alternative for those with all new cars that are bothered with obtaining value back if they enter an accident not long after their automobile acquisition. Contrast Car Insurance Policy Fees, Ensure you're obtaining the most effective price for your vehicle insurance policy.

The Top Cars And Truck Insurer in Your State, Because insurance is managed at a state degree, Cash, Nerd rated the finest auto insurance in each state based on regional rates and regional J.D. Power scores. Leaving out, which is not readily available to a lot of chauffeurs, the majority of often rated as the most effective insurance company in a state (24 times).

affordable auto insurance vans insurers car insurance

affordable auto insurance vans insurers car insurance

Click on your state to discover even more about the ideal vehicle insurance policy company where you live.

How Farmers Insurance: Insurance Quotes For Home, Auto, & Life can Save You Time, Stress, and Money.

We have actually given our suggestions for the very best automobile insurer for young drivers, chauffeurs with bad credit and also chauffeurs with a crash on their records, all of whom are generally charged greater rates than the typical driver. THE MOST EFFECTIVE AUTO INSURANCE PROVIDER BY Motorist PROFILEBest Automobile Insurance Company for Client Service: Auto-Owners, If cost is not as crucial for you as ensuring you're going to obtain the best possible solution when you require to sue, Money, Geek located that has the finest mix of high satisfaction as well as reduced complaints. insure.

It additionally has a reduced client problem price, as measured by the National Organization of Insurance Coverage Commissioners. Additionally, Auto-Owners uses new automobile substitute coverage as an add-on. If you acquire this, you won't need to worry that your new car sheds worth as soon as you drive it off the whole lot - cars.

If you're a vehicle driver with tickets or crashes on your record, Money, Geek found that is usually the finest option. 2/ 5)pros, This is a symbol, Affordable for those with violations on their records, This is a symbol, Offers both roadside support and also rental cars and truck reimbursementcons, This is a symbol, Does not use crash forgiveness, In 22 states much more than any kind of various other firm State Ranch is the best balance of price and also solution for risky chauffeurs.

And also it doesn't sacrifice its solution reputation to achieve those reduced rates. Like most insurance companies, State Farm supplies roadside aid and also rental cars and truck expenses protection. On the occasion that you do get into difficulty when driving, these coverages can aid you get back residence and offering replacement transport while your vehicle is in the shop.

EVEN MORE CONCERNING HIGH-RISK INSURANCEBest Car Insurance Business for Young Drivers: Allstate, If you're including a young vehicle driver to your policy, there are a number of top notch policy options readily available. cars. Both GEICO as well as Allstate place high in Cash, Nerd's scoring system for over 15 states for a plan with a young driver, but we picked as our champion considered that it provides a distant trainee discount rate and also GEICO does not.

9 Simple Techniques For Usaa Tops List Of America's Best Auto Insurance Companies

Allstate is an outstanding choice if you're letting your teen drive your brand-new vehicle. If you add new automobile replacement insurance coverage, you can replace your lorry with an entirely brand-new imitate a crash, as long as the model is two years old or less. As well as, if you include crash forgiveness, you won't need to fret about your insurance policy prices raising after your teen's very first mishap. car.

Of the insurers satisfying this requirement, rates top. Top Choose: Allstate (Average Money, Nerd Rating: 3. 6/ 5)pros, This is a symbol, Uses brand-new auto replacement protection, This is an icon, Has a reduced price of customer complaintscons, This is an icon, Does not rate among the most inexpensive insurance firms, Allstate offers a balance of price and also excellent client solution while providing its motorists the alternative to buy new car replacement insurance coverage.

cars trucks car insurance trucks

cars trucks car insurance trucks

You can conserve with a lot of one of the most common discounts for being a secure driver, packing home and car and also anti-theft and having airbags and also other safety functions. Ideal Vehicle Insurance Policy Business for Distinct Coverages: Freedom Mutual, At the end of the day, many auto insurance policy firms use coverages called for by state regulation as well as bit much more.

Finest Vehicle Insurer for Reduced Gas Mileage Drivers: Metromile, Low gas mileage discounts are fairly rare as well as tend to be quite minor. If you hardly drive, the ideal way to save may be with a pay-per-mile insurance firm such as Metromile. Money, Geek found that pay-per-mile insurance coverage can be worth it if you just have a tendency to drive a few miles per day.

Currently, it's the only insurer completely focused on pay-per-mile insurance policy - insurers. Nonetheless, the company does have a high rate of customer grievances. As standard insurer enter the market for pay-per-mile insurance, it may make sense to attempt a few of their programs, such as Nationwide's Smart, Miles as well as Allstate's Milewise, which are broadening their availability.

Some Known Questions About Best Car Insurance Companies For April 2022 - Financebuzz.

Combine that with wonderful rates, as well as USAA is likely to offer you the very best worth for your money. USAA does not supply numerous special options insurance coverages, however it does have the most extensively relevant ones, such as roadside help, rental cars and truck reimbursement as well as mishap forgiveness. It is also an excellent option if you benefit Uber or Lyft as it provides rideshare insurance policy. laws.

Compare Automobile Insurance Coverage Fees, Ensure you are getting the very

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation