Welcome to

On Feet Nation

Members

-

Lura Online

-

alvinrabin Online

-

Harry Online

-

Prajakta Online

-

Jonathan Online

-

Kristen Stewart Online

-

Latest Market Trends Online

-

Bill Online

-

Nicholas Online

Blog Posts

cce32ce52wfw2fttwr622yet37yte3

Posted by Derra Widyass on April 25, 2024 at 8:05am 0 Comments 0 Likes

The Precision Engineering of Smith & Wesson Firearms

Posted by alvinrabin on April 25, 2024 at 8:04am 0 Comments 0 Likes

Step into the world of Smith & Wesson's iconic firearm designs, and you're entering a realm where innovation meets tradition.

Every Smith & Wesson piece in our esteemed collection is meticulously chosen, ensuring its authenticity, craftsmanship excellence, and historical value.

Luxus Capital sells Smith & Wesson original Antique items and Collectible Firearms. Famed for their precision engineering and unwavering…

ContinueTop Content

7 Basic Steps To Start Investing In Stocks - Investing In Stocks ...

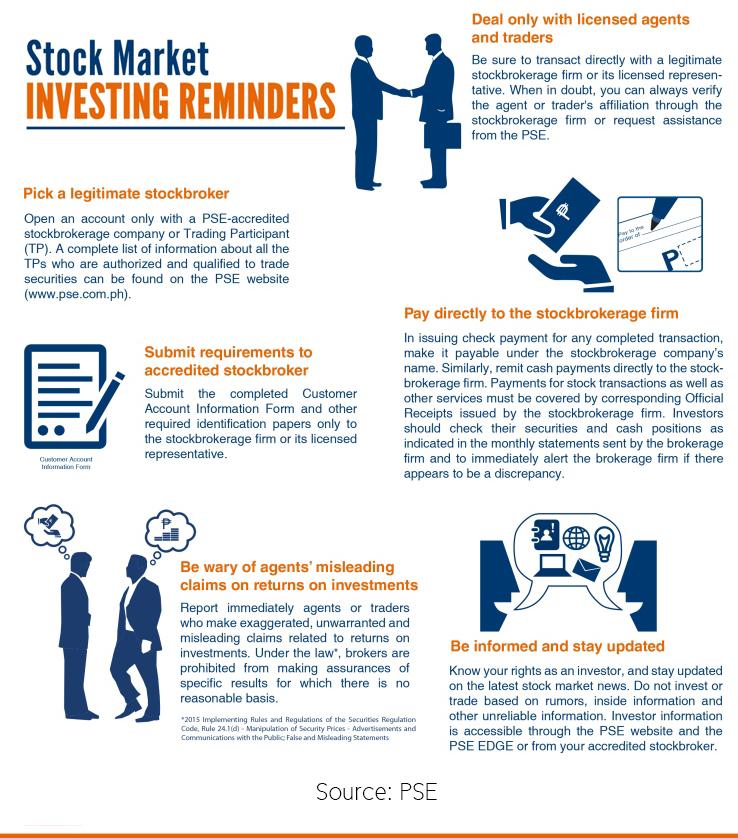

Aiming to optimize your cash and beat the expense of inflation!.?. !? You desire to purchase the stock market to get greater returns than your average savings account. But learning how to purchase stocks can be daunting for somebody just starting. When you buy stocks, you're buying a share of a company.

There are numerous methods to invest and utilize your money. There's a lot to know prior to you get begun investing in stocks. It is essential to understand what your fundamental objectives are and why you wish to start investing in the very first place. Understanding this will help you to set clear goals to work towards.

Do you want to invest for the short or long term? Are you saving for a down payment on a house? Or are you attempting to construct your nest egg for retirement? All of these circumstances will affect just how much and how aggressively to invest. Investing, like life, is naturally risky And you can lose cash as easily as you can make it.

One last thing to think about: when you expect to retire. If you have 30 years to conserve for retirement, you can utilize a retirement calculator to assess how much you may need and how much you must conserve each month. When setting a spending plan, make certain you can manage it which it is helping you reach your goals.

For example, buying small-cap, mid-cap, or large-cap stocks, are a method to purchase different-sized business with varying market capitalizations and More helpful hints degrees of risk. If you're aiming to go the Do It Yourself path or want the option to have your securities professionally handled, you can consider ETFs, mutual funds, or index funds: ETFs are a kind of exchange-traded financial investment item that must sign up with the SEC and allows investors to pool money and invest in stocks, bonds, or assets that are traded on the US stock exchange.

Index-based ETFs track a particular securities index like the S&P 500 and invest in those securities included within that index. Actively managed ETFs aren't based upon an index and rather goal to achieve an investment objective by purchasing a portfolio of securities that will meet that objective and are handled by a consultant.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation