Welcome to

On Feet Nation

Members

-

Zola Montero Online

-

Amy Online

-

jack452 Online

Blog Posts

Top Content

9 Simple Techniques For The Cheapest Car Insurance For Teenagers - Business Insider

Turning 18 years old is the start of the adult years. You are eligible to vote, open your own credit lines, and in lots of states, own a cars and truck. Whether you're looking for auto insurance coverage for the very first time or looking for a less expensive policy, automobile insurance for 18-year-olds can be expensive.

When you're all set to begin comparing car insurance for 18-year-old motorists, enter your zip code listed below or call our group at for totally free, individualized quotes seven days a week.: What Is The Typical Automobile Insurance For 18-Year-Olds? Due to the fact that 18-year-old chauffeurs don't have much experience behind the wheel, these chauffeurs are thought about high-risk.

The smart Trick of Cheap Car Insurance For Teens & Young Drivers - Obrella That Nobody is Talking About

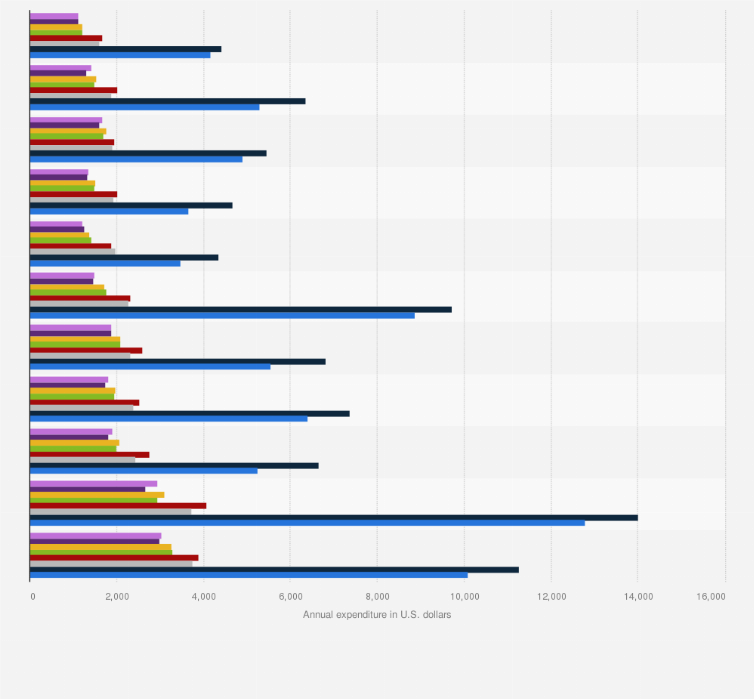

According to The Zebra's State of Car Insurance study, the average vehicle insurance coverage for 18-year-old drivers runs about $4,700 per year or almost $400 each month. The very same research study discusses the cost savings 18-year-olds can see if they remain on their parents' insurance plan rather of beginning their own it has to do with $2,600.

Even at 18, you are still thought about reasonably unskilled and more at risk on the road to car insurance provider. This is why the average cars and truck insurance coverage for an 18-year-old is greater than somebody who is in their mid-twenties. Being an 18-year-old girl could mean lower vehicle insurance coverage rates compared to an 18-year-old-boy.

Get This Report on How To Save Money On Car Insurance For Teens - The General

The less claims, mishaps reported, or citations you've had, the less of a risk you are seen to the insurance provider. Mishaps occur, and when they do, do not be alarmed if you see your policy drastically increase. If you remain in the marketplace for the very best automobile for your teenager, you're probably thinking about two things: safety and price.

Thinking about just how much you can pay out-of-pocket for your teen's cars and truck influences the cost of your vehicle insurance premium. The limitations and deductibles you select will determine how pricey your cars and truck insurance coverage rates are, so it is very important to go shopping around for policies. How To Conserve On Car Insurance Coverage For An 18-Year-Old From discounts to usage-based savings programs, there are many methods for teens to save cash on car insurance coverage.

The 9-Second Trick For Teen Safe Driving Program & Discount - American Family ...

If you accelerate and brake safely, you can save on automobile insurance. Usage-Based Car Insurance For Teenage Chauffeurs Usage-based programs can assist you conserve money on teenager car insurance. When you consider how costly the typical cars and truck insurance coverage for 18-year-old chauffeurs is, putting in the time to drive safely can have fantastic rewards.

A few of the cars and truck insurance coverage discounts you can get for 18-year-old drivers consist of: Excellent trainee discount rate for preserving a B average or greater Chauffeur training course discount for finishing pre-approved courses Far-off trainee discount for students who go to school over 100 miles far from house without a car Newly independent discount rate for drivers who were previously noted on their moms and dads policies and are now opening https://blogfreely.net/galdursyuz/age-younger-chauffeurs-pay-more-for-cars-and-truck-insurance-coverage-because their own New teen benefits for clients of over one year that are including a teen to their policy The Roadway Ahead Guide gives you basic driving suggestions, suggestions on driving in dangerous climate condition, and more.

The Adding A Teenage Driver To Your Insurance Policy - Njm Statements

In addition to Drive Safe & Save, State Farm likewise provides Steer Clear an unique discount offered to chauffeurs more youthful than 25. To get this discount rate, you should: Have a legitimate chauffeur's license Have no at-fault mishaps or moving infractions during the past three years Total the program requirements within six months of enrolling Clients who enroll have to complete modules about safe driving.

Our research found that these service providers have economical rates and good protection for young motorists. Enter your zip code in the quote box listed below or call to get started.

Our Temporary Car Insurance For 18 Year Olds - Tempcover Ideas

It is an established brand name that has actually been serving young adults and moms and dads with dependents because 1912, which has made it a 4. Some of the protection benefits that are beneficial for young motorists are: This strategy will protect your premium versus heightened rates after your first at-fault accident, which can be useful for newer drivers.

The discount is based upon total miles driven, nighttime driving, braking, and acceleration. If you're interested, we advise reading our evaluation of Liberty Mutual completely and getting in touch with a representative to get matched with the very best quotes in your location. If you're searching for a trusted service provider to secure your current high school trainee or recent graduate, State Farm insurance coverage is for you.

An Unbiased View of Cheap Car Insurance For An 18 Year Old Car Driver

The best method to reduce your teen's car insurance coverage rate is to include them to your existing insurance policy if they currently have their own and then look for discounts to even more reduce the expense. Other significant methods to decrease the expense of teenage cars and truck insurance coverage include reducing your teen's protection and getting multiple quotes.

For example, they might have the ability to get a discount if they take an approved defensive driving course or remain accident-free for a certain time period. Lower protection Considering how expensive car insurance is for young drivers, your teenager might save on their premium by restricting the amount of coverage they include on their policy.

More About Cheapest Car Insurance For Teens

Get numerous quotes The finest way to lower teenager cars and truck insurance is to search for quotes from a minimum of 3 different service providers, particularly if your teenager is getting their own policy. Every insurer uses their own approaches to determine premiums, so the rate that you receive from one company might not be the very same as another.

To learn where to start, have a look at Wallet, Hub's choices for the finest teen car insurance coverage companies. You can also discover more details in our guide on how to decrease vehicle insurance expenses.

Examine This Report about Car Insurance For Teens - Safeauto Insurance

(NHTSA) reveal that car accidents are the leading cause of teenage deaths in the nation, with over 2,000 young motorists in between ages 15 and 19 eliminated in 2018 alone.

Average cost of men vs. ladies, Gender is a crucial consider determining cars and truck insurance premiums. On top of higher premiums since of your age, you can expect to pay more for insurance if you are male. Male chauffeurs statistically participate in riskier driving behaviors, which can cause a higher number of and more severe accidents.

Teen Driving - Nhtsa Things To Know Before You Get This

It is crucial to keep in mind that insurance laws differ by state which there are states which ban the usage of gender as a rating factor. In these states, males and females pay near the exact same amount for insurance if all other aspects are equal. Average annual full protection premium Typical yearly minimum coverage premium Male $5,646 $1,753 Female $4,839 $1,551 Least expensive vehicle insurer for 18-year-olds, Among the most convenient ways to conserve money on your cars and truck insurance is to pick a business with low typical premiums.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation