Welcome to

On Feet Nation

Members

-

Popular Online Online

-

Mitul Hasan Online

-

Catherine Online

-

Melissa Online

-

Marcus Online

-

Jerold Galarza Online

Blog Posts

Orleans Pelicans Not On Herb Shirts

Posted by Mitul Hasan on April 18, 2024 at 2:48pm 0 Comments 0 Likes

https://www.pinterest.com/probondhon85/orleans-pelicans-not-on-herb-shirts/…

Continue

Top Content

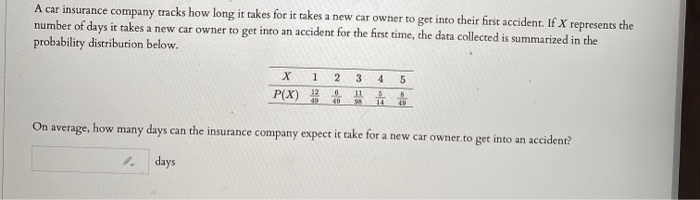

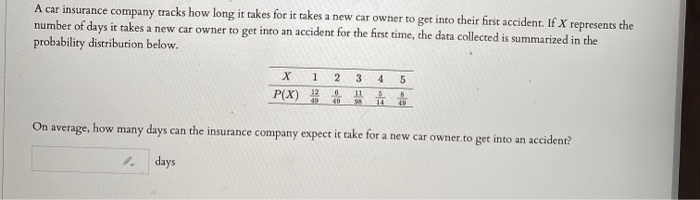

How How Does New Car Insurance Work? - Progressive can Save You Time, Stress, and Money.

An essential question typically asked by brand-new vehicle proprietors is, 'How much time do you have to guarantee a brand-new cars and truck?' The answer is promptly after the purchase - automobile. No matter whether you are financing or paying cash, you will have to get car insurance coverage prior to driving the automobile out of the dealer's whole lot.

Insurance Policy Requirements for Purchasing a New Automobile, When financing a new vehicle, the loan provider mandates you to have thorough and collision protection for the life of the finance. Your state calls for obligation protection to cover any kind of damages or injuries brought on by an at-fault accident. To secure on your own if your car is completed in a crash, Progressive recommends getting the optional coverage known as space insurance.

Your present cars and truck insurance policy will also have an effect on your short-lived insurance coverage, relying on if you already have detailed as well as collision (affordable auto insurance). Otherwise, it's likely your momentary coverage will not have these protections either. It's a wonderful concept to consult your insurance policy carrier concerning extending short-lived insurance coverages for a new automobile.

These smaller firms also tend to have lower insurance rates for you to take advantage of. There are different discount rates readily available that can result in lower insurance coverage rates when you: Bundle other policies such as your homeowner's insurance with your car insurance.

Some Ideas on Transferring Your Auto Insurance From One Car To Another You Should Know

Automobile insurance coverage belongs to the overall cost of having a brand-new car. What Insurance Do You Need When Purchasing a New Cars and truck, When purchasing cars and truck insurance, there are two demands you will certainly probably demand for a brand-new car. One is the minimum insurance coverage mandated by your state.

Some states need you to have an individual injury protection plan as well as without insurance vehicle driver coverages. Second of all, you will need to have crash and extensive protections as a demand of the funding or lease firm you are funding with. These coverages pay to fix any kind of damages to the brand-new car, assisting the lender shield its investment in the brand-new cars and truck.

Usual factors for high auto insurance policy expenses include your driving record, age, coverage choices, where you live, the automobile you drive, your credit rating or otherwise making use of price cuts. The ordinary auto insurance costs has actually likewise come to be extra pricey as it boosted by even more than 50% in the previous ten years - risks.

insurance company cheap car insurance cheapest auto insurance cheap

insurance company cheap car insurance cheapest auto insurance cheap

You Have a Poor Driving Record Your driving document is possibly the most crucial variable in identifying your automobile insurance coverage prices - prices. If your document is poor, with accidents and also driving offenses, and also you have a background of insurance claims, your prices will certainly be high. You will certainly likewise pay more than typical if you misbehave with debt, young (especially young and also male), or single.

The Greatest Guide To Do You Need Car Insurance Before Buying A Car? - My Choice

cheaper cars affordable cheaper credit score

cheaper cars affordable cheaper credit score

A number of variables enter into this, such as the history of accidents in the area, population thickness, the variety of without insurance chauffeurs, criminal offense statistics, negative weather condition patterns, and so on (car insurance). If you live far from job and have a lengthy day-to-day commute, the high annual mileage can increase your price.

You Have High Protection Amounts If your protection limits are high as well as your deductibles are reduced, you will enjoy if you require to make a case, however not as satisfied when you're paying your costs. If the insurance provider takes the chance of having to pay out more in the future, you will certainly need to pay more now.

Price cuts are offered to almost every person, and also you may certify for some that you aren't obtaining debt for - affordable car insurance. 6. You Are Also Young or Too Old Teens are statistically most likely to trigger auto accidents than the typical vehicle driver, so insurer charge them the greatest premiums. Motorists that get their permit at 16 years old generally see their premiums decrease with annually of experience, nonetheless, and also age 25 is generally considered a turning factor when costs become considerably lower.

Prices start to climb once again after age 65. 7. You Have a Low Insurance Rating Every major insurer utilizes a credit-based insurance coverage rating to determine premiums where enabled by legislation. Like credit report, insurance ratings are based upon credit scores report details, just they are utilized to predict a vehicle driver's possibility of suing.

The Ultimate Guide To Do I Need To Purchase Car Insurance Before I Buy A New Car?

Insurance scores are debatable, so they are banned in Massachusetts, Hawaii, and The golden state. Many various other states additionally have restrictions on their use, which can be located on the state insurance policy regulatory authority's website. 8. Boost General Record-setting all-natural calamities, more phone-related automobile crashes, high rates of insurance coverage fraudulence, and expensive-to-repair cars and truck technology have actually all raised expenses for insurer.

From 2010 to 2019, the typical expense of vehicle insurance coverage boosted by even more than 50%. Prices have actually gone up annually. This steady surge in insurance coverage expenses has actually outstripped various other consumer expenses - auto. Also escalating medical facility expenses delay a little behind automobile insurance. Vehicle Visit the website Insurance coverage: 52. 2% Hospital Solutions: 49. 1% Price of Living: 17.

If you desire to lower your own insurance policy prices, address as numerous of your personal factors as you can. Get quotes from several insurance coverage business as well as contrast. cheaper auto insurance.

Greet to Jerry, your new insurance agent. We'll call your insurance company, evaluate your current strategy, then find the protection that fits your needs and also conserves you money. low-cost auto insurance.

The Basic Principles Of Transfer Insurance To Your New Car

While you can buy a car without having vehicle insurance, no dealer will enable you to repel the lot without adequate protection. Vehicle dealers need to see proof of insurance before you leave (insurance companies). If you're just adding a vehicle to your existing vehicle insurance coverage policy, an elegance duration must offer you a long time to do so.

You may have heard concerning a "moratorium" for getting car insurance policy. To make clear, this only uses if you have an insurance plan in area for another automobile that you can add the new vehicle to. Get in touch with your car insurance provider to discover how much time you have. vehicle.

How do I obtain evidence of insurance policy when I get a car? Most car dealerships approve digital evidence of insurance if you don't have a difficult duplicate.

If you do not have cars and truck insurance policy already when acquiring the car, the majority of dealers will certainly allow you utilize their computer to find protection online if you don't have your phone convenient to do so. You can call an insurance company on the phone too, yet it may be tough to reach someone if you're buying a car on the weekend break.

Some Known Factual Statements About Car Insurance Faqs : Auto Insurance : State Of Oregon

Some dealerships use the opportunity to acquire vehicle insurance coverage straight via them, but bear in mind that your options will possibly be based around their favored providers. This implies you may not be getting the most effective, most inexpensive quote you can. If none of these choices work, purchase the car as well as leave it at the dealer.

Do I need insurance to examine drive a car? As long as you have a current, valid chauffeur's license, you need to be able to examine drive a cars and truck from an automobile car dealership. Till you complete the acquisition of the car, the car dealership possesses it and also their insurance policy will certainly supply protection in case of a crash.

There are various other add-on automobile insurance plan types you might desire to consider acquiring:: this insurance policy pays for the substitute of an amounted to car with one of the very same make, model and also features - prices. Vehicles lose their value swiftly, so the advantage of this kind of protection is great for the first pair of years of having the vehicle.

Quote, Wizard - affordable car insurance. com LLC makes no depictions or service warranties of any kind of kind, express or implied, regarding the procedure of this website or to the

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation