Welcome to

On Feet Nation

Members

-

George Online

-

Donna Online

-

nangkeupvina Online

-

goditac499 Online

-

mshahid Online

-

DANGERBOY Online

-

Ruby Online

-

Avelina Sumiko Online

-

Thomas Shaw Online

Blog Posts

Cara Mengambil Uang di TikTok Money Calculator

Posted by Lovina Lindy on April 24, 2024 at 11:04am 0 Comments 0 Likes

Cara Mengambil Uang di TikTok Money Calculator

glbgyndt

Posted by Donna on April 24, 2024 at 11:01am 0 Comments 0 Likes

Top Content

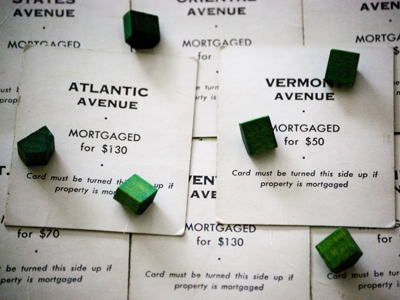

Just How Mortgage Rate Of Interest Is Calculated?

Buying MBS as well as http://juliusidqm996.trexgame.net/what-is-a-reverse-mortgage treasury bonds, as well as this increased demand has actually led to the lowest home loan rates on record. Many professionals agree home mortgage rates will get to 3.6% to 4% by the end of 2022. The rise in home loan rates will be gradual, with prices hitting 3.6% by year's end, according to a current prediction by primary economist at Realtor.com, Danielle Hale. Houses' ordinary rates of interest on brand-new bank down payments was 0.10 percent.

- They usually have a short life, commonly two to 5 years.

- Adjustment frequency describes the rate at which a variable-rate mortgage rate is adjusted once the initial duration has actually run out.

- ARMs come with an interest rate cap over which your lending can not increase.

- If you're acquiring a house, the correct time to lock a rate seeks you've secured an acquisition contract and also bought your best home loan bargain.

Fundings commonly have a payment lifetime of three decades, although shorter lengths, of 10, 15, or two decades, are additionally extensively readily available. Shorter car loans have larger regular monthly repayments however reduced total passion expenses. Today's rate setting is considered extremely well-priced for customers. Nonetheless, depending onyour monetary circumstance, the price you're provided could be more than what lenders promote or what you see on rate tables. The Interest rate stands for the true annual price of your financing.

Many loan providers use a 30- to 45-day price secure for free. This suggests if the interest rate rises prior to your funding shuts, you obtain the stated rate. However, if prices fall, you will not profit unless you reboot the loan procedure, a costly and taxing endeavor. Interest rates as well as terms can differ substantially amongst lenders depending upon just how much they desire your organization and also exactly how active they are processing fundings. As online and non-bank lending institutions take an ever-greater share of the mortgage market, anticipate to see the bargains get back at better regardless of where interest rates go. Once you understand what kind of mortgage will function best for you, it will be time to contrast three or more loan providers to establish the appropriate home loan price deal for you.

You don't desire the rate to skyrocket right prior to closing, so eventually, you secure the rate. A home loan price lock is the lending institution's guarantee that you'll pay the agreed-upon interest rate if you close by a particular date. Your locked rate will not transform, no matter what occurs to interest rates in the meantime. Shorter-term home loans generally have lower home loan prices than lasting financings. If your down payment is much less than 20 percent, you'll normally get a greater interest rate as well as need to spend for home mortgage insurance.

Your Home Mortgage Illustration

If you obtain a home loan with desirable terms, your funding can come to be significantly more costly complying with an extension. As a result, be sure to account for increasing interest rates when planning your financing. The fine print-- inspect your lending institution can't raise prices even when the price your home mortgage is connected to hasn't moved.

We're always trying to enhance our website and solutions, and also your responses assists us comprehend how we're doing. You might need to pay an early settlement fee if you intend to switch before the offer ends. Bank B has a 1.5% price cut off a SVR of 5% (so you'll pay 3.5%). You'll see them advertised as 'two-year solution' or 'five-year repair', as an example, in addition to the interest rate billed for that duration.

Are Home Mortgage Rates Rising Or Down?

You rise to 60% of your building's market price as the sanctioned finance quantity. There's a non-utilisation fee of up to 1% that is billed on quantities over 25% of your approved funding. The maximum amount you can obtain is Rs.10 crore and the maximum tenure of the loan can extend up to 15 years. You can get up to 70% of your residential or commercial property's market value sanctioned as the lending.

Purchasing a residence needs you to pay countless bucks in ahead of time costs. If you sell the house in the following 2 or three mywfg website years, after that you might not have adequate equity accumulated in the home to balance out the costs you would not have actually paid if you were leasing. You likewise need to factor in upkeep and also maintenance prices with owning a home.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation