Welcome to

On Feet Nation

Members

-

ramy Online

-

adsasf ghykjuyl Online

-

Gustavo Online

Blog Posts

Top Content

Rideshare Insurance For Uber Or Lyft Drivers In Nj - Plymouth ... Things To Know Before You Buy

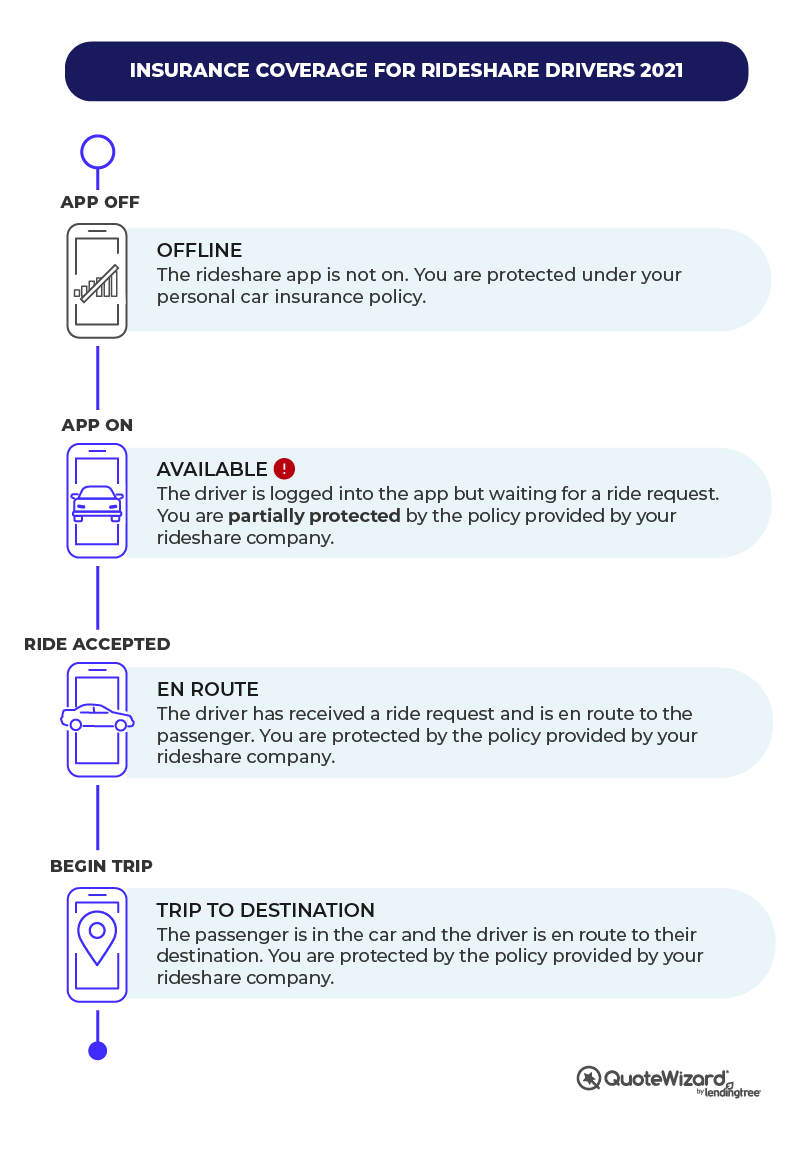

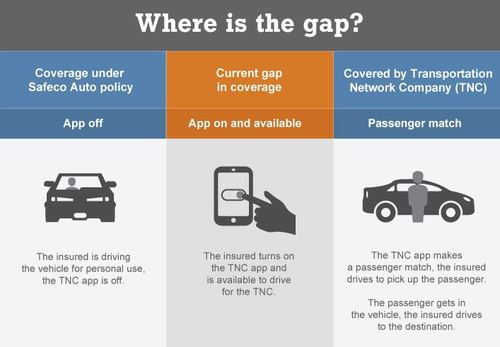

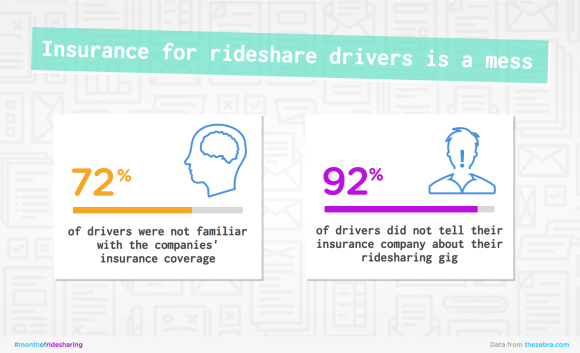

What is Rideshare Insurance coverage? Rideshare insurance is provided by a selection of top-rated insurance coverage service providers to assist safeguard vehicle drivers while functioning their ridesharing changes. suvs. If you remain in your car with your application on and also awaiting a passenger as well as a case was to take place, you would not be covered.

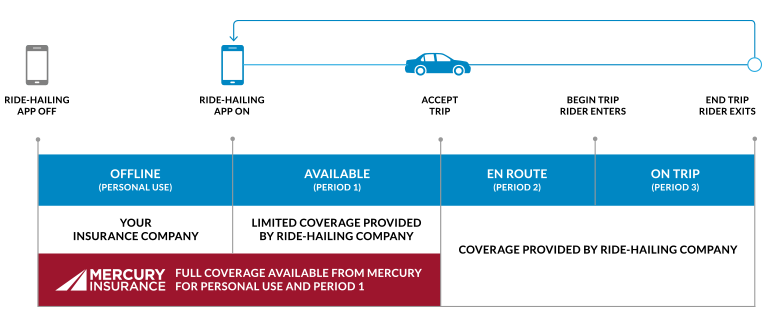

It is likewise important to recognize that despite your employer-issued coverage, you might just have a minimal quantity of coverage such as obligation. To stay clear of a lapse in protection, some endorsements can be added to your automobile insurance coverage plan to maintain you shielded. This consists of both a personal car policy endorsement or a commercial automobile insurance coverage policy.

This recommendation will certainly differ by the insurance coverage carrier, however you can include it to your car plan to avoid gaps in insurance coverage such as a crash that happens while you are awaiting a guest or if you are driving home with your app on - liability. An industrial for-hire livery to change your individual vehicle insurance coverage is one more choice for motorists as they get approved for the coverage due to the fact that they use their automobiles for producing a revenue.

What Does Rideshare Insurance Cover? Rideshare insurance covers you for mishaps that can happen while you are helping a ridesharing app yet are not covered by their security at the time. As repair service expenses as well as medical expenses increase, it is essential to keep in mind that a gap in your protection can reach thousands upon hundreds of bucks in a split second.

Contact our agents today and locate the right rideshare insurance coverage for your coverage needs today (cheap insurance).

The Definitive Guide to Rideshare Insurance

What Is Rideshare Insurance coverage? Rideshare insurance offers insurance coverage options to those who drive their individual automobile for a transport network business (TNC) such as Uber or Lyft. What It Covers Rideshare insurance is established to supply coverage in the occasion of a crash while you are driving your automobile for company use (insured car).

In the regrettable event that you have an accident while you get on the clock driving, rideshare insurance coverage is there to assist fill in the gap between your individual insurance coverage and any insurance coverage your TNC may use. Without this coverage, you could be held responsible for automobile damages and also medical costs.

Roadway crashes take place even to thorough chauffeurs. If you drive for a ride-sharing company, don't assume that the damages for those crashes will certainly be on the firm's dollar. Rideshare insurance policy can shield you and your travelers also when your individual car insurance as well as the ride-sharing firm's insurance coverage don't. Continue reading to determine whether the official security is for you as well as how alternatives like Farmers rideshare insurance can offer you peace of mind when you struck the road.

The insurance is developed to fill the space in coverage supplied by your personal automobile insurance coverage and also the industrial insurance policy supplied by the ride-sharing business. For this reason, Farmers rideshare insurance policy and also comparable options are sold as an add-on to your existing cars and truck insurance coverage policy. The insurance policy is generally not mandated by ride-sharing companies.

Do without rideshare insurance can subject you to substantial financial losses because of the large quantity of time you invest in an automobile and also when driving as a chauffeur. Don't Lyft and also Uber already offer vehicle drivers insurance? Yes, yet the industrial insurance coverage that Lyft and also Uber supply their drivers is not end-to-end coverage. auto insurance.

The Single Strategy To Use For Las Vegas, Nevada Rideshare Insurance

What are some rideshare insurance options? Rideshare insurance policy isn't readily available from every insurance coverage carrier or in every state. Generally, larger insurers are most likely to supply it in the highest possible number of markets. For instance, Farmers rideshare insurance policy is readily available in 30 states and also counting. You can customize the protection to consist of extensive and also collision protection, uninsured vehicle driver insurance coverage and also medical expense as well as accident defense.

trucks Go here low cost automobile auto

trucks Go here low cost automobile auto

Whether or not you inevitably acquire rideshare insurance policy, you should alert your personal vehicle insurance policy company immediately that you drive or intend to help a ride-sharing firm. Do not wait up until a mishap to disclose this fact. Your individual cars and truck insurance service provider can choose to end your protection if they learn that you used your automobile for commercial purposes without informing them - auto insurance.

, you can utilize the tool below to start contrasting totally free quotes. What Is Rideshare Insurance coverage? Rideshare insurance is coverage for motorists who are utilized by transportation network firms (TNCs) like Uber or Lyft or who function for on-demand distribution services.

business insurance vehicle insurance cheapest car cheaper car insurance

business insurance vehicle insurance cheapest car cheaper car insurance

If you are a rideshare driver and also are in a collision while on the job, your personal vehicle insurance may not cover the damages. This is because a personal vehicle insurance plan usually excludes a car if it is being made use of for business. liability. Not educating your insurer you drive for a rideshare solution might result in you being dropped by your company.

insurance car insurance cheaper cars insurance

insurance car insurance cheaper cars insurance

risks cars affordable auto insurance prices

risks cars affordable auto insurance prices

If you want much more defense, you'll need to obtain rideshare insurance. If you can not acquire a rideshare plan, you might have to get industrial insurance.

Rumored Buzz on Get A Quote For California And Illinois Rideshare Insurance

car insurance vehicle insurance trucks cheap car insurance

car insurance vehicle insurance trucks cheap car insurance

How To Acquisition Rideshare Insurance policy As mentioned, rideshare insurance coverage is taken into consideration supplementary protection that can be included to your existing personal vehicle insurance plan. It's additionally not sold as a private insurance policy product, so you'll have to buy it from your present insurance supplier. After registering to be a rideshare vehicle driver, the initial point you ought to do is inform your insurance company that you're benefiting a TNC.

If your present insurance provider doesn't have rideshare insurance, see if it offers industrial insurance coverage instead. credit score. What Takes place If You remain in An Accident On The Task? As stated above, if you get involved in a wreck while driving for a rideshare business or distribution app, the level of protection you get is mosting likely to rely on what phase of job you remained in.

A police officer can analyze the extent of the crash and also make certain the clinical demands of those involved are being met. You could be asked to supply proof of insurance, either your individual plan or protection from the rideshare firm. This is likewise the moment to exchange insurance info with any kind of other vehicle drivers or travelers entailed. cars.

We recommend inspecting if your current coverage carrier provides rideshare insurance policy or business insurance coverage (accident). If you're aiming to switch over insurers to get a lower price or if your present supplier doesn't have rideshare coverage, we advise having a look at any of the companies in the table below. Our study team has actually assessed the top insurance carriers in the United States and discovered these to be standout options for rideshare insurance policy.

Contrast Providers Insurer Why We Picked It Duration 1 Insurance coverage? Duration 2 & 3 Protection? Deductible Gap Insurance Coverage? State Farm Best General Yes Yes Yes Allstate Ideal for Price Yes No Yes Progressive Finest for Multi-Platform Drivers Yes No Yes USAA Best for Armed Force Members Yes No No Erie Insurance Ideal Consisted Of Plan Additionals Yes Yes Yes Regularly Asked Questions What Is Rideshare Insurance policy? To summarize, rideshare coverage comes under 3 time durations specified by what you're doing during that time: Period 1: Visited to your application and awaiting a suit with a rider Duration 2: Matched with a biker and you get on your way to pick them up, Duration 3: Driving the rider to their destination, TNC firms like Uber and Lyft have insurance coverage, consisting of liability

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation