Welcome to

On Feet Nation

Members

-

Thomas Shaw Online

-

jack452 Online

-

Prajakta Online

-

Mohamed El-Sadany Online

-

Benjamin Online

-

Diane Online

-

sara James Online

-

Ab12 Online

-

Tractor Gyan Online

Blog Posts

RNA Interference (RNAi) Drug Delivery Market Share, Overview, Competitive Analysis and Forecast 2031

Posted by Prajakta on April 24, 2024 at 8:38am 0 Comments 0 Likes

FutureWise Research published a report that analyzes RNA Interference (RNAi) Drug Delivery Market trends to predict the market's growth. The report begins with a description of the business environment and explains the… Continue

Top Content

Some Ideas on How Much Does Car Insurance Cost? You Should Know

Age: Younger drivers pay more for vehicle insurance coverage since they're more most likely to enter an accident. Insurance coverage rates decrease as you build a safe driving history, but this can take years. Costs may likewise begin to increase when you reach age 65 and older as the threat of being hurt or eliminated in a car crash increases.

Reasons Your Cars And Truck Insurance Coverage Rates Might Increase The Insurance Services Workplace reports an average increase of 20 - 40% of the state's base rate after an accident. The state's base rate is the typical rate prior to any discount rates are applied. If you have a one-car policy, your rate will increase 40%.

Average Car Insurance Cost Per Month - Autoinsurance.org Can Be Fun For Anyone

If there's any incentive to follow the law and avoid speeding, it might be the 22% increase your premiums can experience with simply one ticket. This is just the average. The actual increase depends upon the offense and where you live. It's not unusual to see over a 100% boost in your premium.

Texting while driving might impact your rates in some states, depending on if your state considers it a moving infraction. Basic violations, such as a minor speeding ticket, may only affect your rates for 3 years. However, significant offenses, such as a DUI, could impact your rates as long as 10 years.

The Basic Principles Of Twins Who Built $1.3 Billion Marshmallow App Take On Insurers

The most typical is bundling homeowners insurance and automobile insurance, with a typical savings of $295 per year. The biggest cost savings are generally seen in Georgia and Oklahoma, both of which provide an average 22% savings for bundled insurance coverage policies.

Shopping for Car Insurance coverage The average American stays with the same carrier for 12 years. About 14% of Americans utilize the very same carrier for 20 - thirty years. Only about 16% of chauffeurs examine to see if they are qualified for any brand-new discounts on their cars and truck insurance. A few key occasions that may certify you for lower rates consist of: Marital relationship, Working in some markets such as health and education, Paying renewal premiums early, Short day-to-day commutes (less than 5,000 miles per year), specifically for usage-based insurance companies such as Metromile.

Some Known Details About What Is The True Cost Of Owning A Car? - The Balance

These discount rates are not automatic. The driver needs to inform a representative of their eligibility to get the discount rate. More than 50% of Americans say they simply don't have the time to shop around for insurance coverage quotes. Simply over 40% likewise believe the process is too complicated. Teen Drivers and Automobile Insurance Including a female teen chauffeur to your insurance policy instead of a male teenager usually leads to a lower premium boost.

The death rate for motor vehicle mishaps for males is double that of females. Teenage boys increase the average insurance bill by as much as 176%.

How Much Is Car Insurance Per Month In 2021? Get Tips For ... Can Be Fun For Anyone

You might be paying hundreds of dollars more each month without realizing it. Keep in mind: This website is made possible through financial relationships with some of the items and services discussed on this website.

If you have an interest in finding an insurance coverage representative in your location, click the "Agent, Finder" link at any time to go to that search tool. If you have an interest in finding an agent that represents a particular company, you can also click on the company name in the premium comparison which will link you to that business's website.

Rumored Buzz on Insurance Built For The 21st Century - Lemonade

The average cost of automobile insurance coverage in the United States is $2,388 per year or $199 monthly, according to information from almost 100,000 insurance policy holders from Savvy. The state you live in, the level of coverage you wish to have, and your gender, age, credit rating, and driving history will all aspect into your premium.

Automobile insurance coverage policies have lots of moving parts, and your premium, or the expense you'll spend for coverage, is simply one of them. Insurance coverage is managed at the state level, and laws on required coverage and rates are different in every state. Insurance provider take into consideration various elements, including the state and area where you live, in addition to your gender, age, driving history, and the level of protection you 'd like to have.

The Only Guide for What Are Car Insurance Premiums? [2021 Guide] - Marketwatch

Here are the most significant aspects that will Click here for more influence the cost you'll pay for coverage, and what to consider when looking at your cars and truck insurance coverage choices. There have actually been some big changes to vehicle insurance expenses during the coronavirus pandemic.

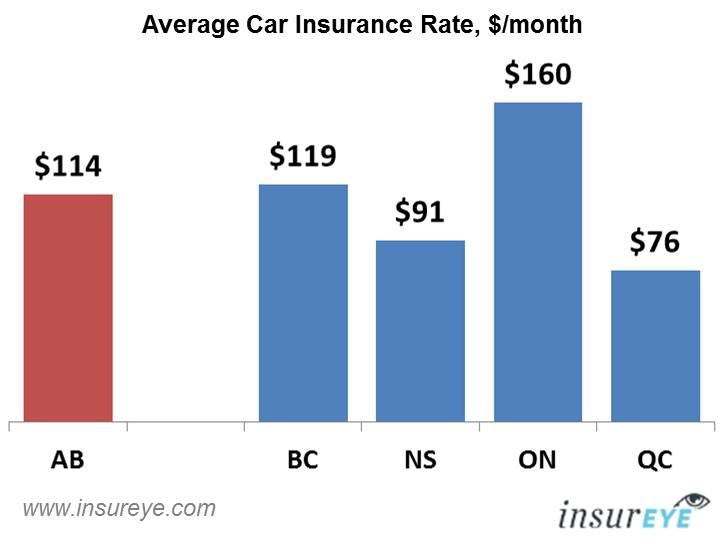

Company Expert put together a list of average automobile insurance coverage prices for each state. Here's a variety vehicle insurance coverage expenses by state.

What Does You Really Can Lower Your Car Insurance Cost - The New ... Mean?

And from Company Expert's information, cars and truck insurance provider tend to charge ladies more. Service Expert gathered quotes from Allstate and State Farm for basic coverage for male and female chauffeurs with a similar profile in Austin, Texas. When swapping out just the gender, the male profile was quoted $1,069 for protection per year, while the female profile was quoted $1,124 per year for protection, costing the female motorist 5% more.

In states where X is a gender choice on driver's licenses including Oregon, California, Maine, and quickly New York insurance providers are still figuring out how to compute costs. Typical car insurance premiums by age, The variety of years you have actually been driving will affect the rate you'll pay for protection. While an 18-year-old's insurance coverage averages $2,667.

Tesla Insurance Will Disrupt All Auto Insurance - Torque News - An Overview

This information was offered to Service Insider by Savvy. How automobile insurance coverage rates change with the variety of automobiles you own, In some ways, it's sensible: the more cars you have on your policy, the greater your vehicle insurance coverage bills. There are likewise some cost savings when numerous vehicles are on one policy.

Vehicle insurance coverage is less expensive in postal code that are more rural, and the exact same is real at the state level. Guarantee. com information reveals that Iowa, Idaho, Wisconsin, and Maine have the least expensive car insurance coverage of all states, which's due to the fact that they're more rural states. Other elements that can impact the expense of car insurance There are a few other elements that will contribute to your premium, including: If you don't drive many miles each year, you're less likely to be associated with a mishap.

Not known Details About Monthly Car Payment Calculator - Allstate

Each insurer takes a look at all of these aspects and costs your coverage differently as an outcome. It's important to compare what you're used. Get quotes from several various car insurance provider and compare them to ensure you're getting the very best offer for you. Personal Financing Press Reporter.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation