Welcome to

On Feet Nation

Members

Blog Posts

Top Content

The Best Strategy To Use For Auto Insurance Premium Comparisons - Mass.gov

That's a pretty significant amount of cash.

A few of these risks pertain to your driving record. If you have actually entered into previous scrapes or received citations for driving recklessly or under the influence, your rates will probably be higher than a driver with a squeaky-clean record. Some of Homepage the factors have to do with traits outside of your control, like your age and gender.

Since of these trends, your cars and truck insurance coverage will cost more as a teenager, especially as a teenage kid. Teenagers getting into more accidents than older motorists makes intuitive sensein basic, they've had much less experience behind the wheel.

7 Simple Techniques For How Will Your Social Security Benefits Stack Up To The ...

Teenagers trigger the highest rates of automobile accidents: per mile driven, teen chauffeurs are nearly three times more most likely than chauffeurs aged 20 and older to be in a fatal crash. Average Automobile Insurance Coverage Expense for Young Drivers The early twenties can be an unique time in numerous people's lives.

Young their adult years also marks a time of modification for cars and truck insurance coverage premiums. As chauffeurs gain more maturity and experience on the roadway, their rates decrease typically, though male drivers continue to pay higher premiums than female motorists. There's one fascinating element you might not anticipate in insuring young people you might not expect: their educational status.

Insurify's information on car insurance estimates for young adults reveals Why does the data recommend that college trainees pay more on average per month? There are a few factors: trainees tend to be younger than non-students, and typically remain on their household insurance coverage policies.

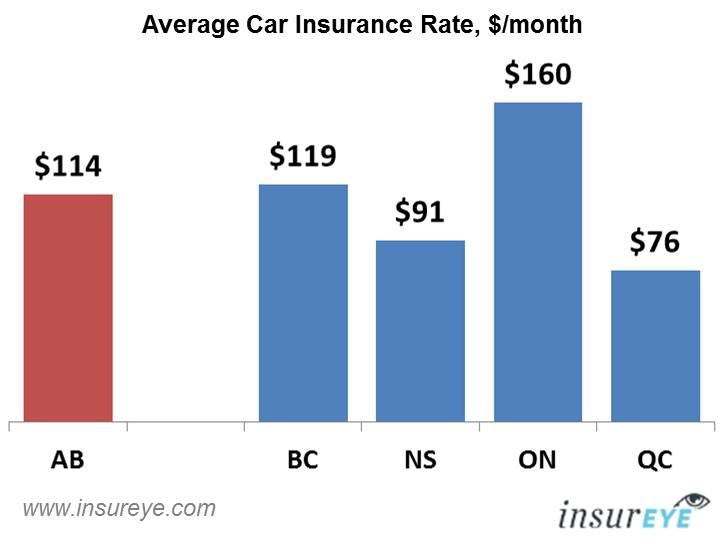

State legislators determine just how much car insurance coverage drivers need to buy, what qualifies as an uninsured driver, what accident-related costs insurance companies are required to cover, and other insurance-related concerns. These guidelines impact how much cars and truck insurance expenses in each state. Regulations aren't the only location-related elements affecting typical cars and truck insurance coverage cost: Americans drive in a different way in each state and deal with different obstacles and dangers.

How Monthly Or Annual Auto Insurance Premium: Which Is Best For ... can Save You Time, Stress, and Money.

Typical Automobile Insurance Expense by Insurance coverage Business Some chauffeurs might be curious about the typical regular monthly car insurance coverage expenses of each insurance company. Insurify compared the data from millions of automobile insurance prices estimate to determine typical month-to-month cars and truck insurance expenses by business.

Male $245 Female $236 Average Vehicle Insurance Coverage Cost by Marital Status One unexpected factor in your regular monthly cars and truck insurance premiums is marital status. If you've been waiting for a factor to pop the question, think about that you may conserve on your vehicle insurance!

Typical Regular Monthly Car Insurance Expense by Marital Status Married $238 Single $266 Typical Automobile Insurance Expense: Clean Record vs. A minimum of One Mishap Since the primary cost for insurer consists of paying for medical and property expenses after auto mishaps, a motorist with a history of accidents is generally even more costly to guarantee, particularly if they were discovered to be at fault in several of them.

The 4-Minute Rule for How Much Does Business Insurance Cost?

If you spend great deals of time on the roadway, you're statistically most likely to enter a mishap, so your premiums will be greater. Mishaps, moving offenses, and DUI's will all considerably raise your rates. Conclusion: How To Save on Vehicle Insurance Hopefully, this short article assisted you find out more about average vehicle insurance costs nationwide, in addition to the lots of elements that enter into determining the rate of a chauffeur's automobile insurance premium.

What is the average cost of car insurance per month? Drivers in the United States face an average monthly premium of around $234 for their automobile insurance.

If you remain in the marketplace for automobile insurance, you likely have a lot of questions. Amongst them is probably just how much does car insurance expense? The response, obviously, depends on a number of elements. Understanding how insurance coverage companies determine automobile insurance rates can assist you not just estimate your budget plan, but also conserve cash by knowing what to avoid in the future.

Keep in mind that points on your license don't stay there forever, but the length of time they remain on your driving record varies depending upon the state you live in and the seriousness of the offense. The price, style and age of your vehicle all add to just how much car insurance coverage expenses will be.

The 9-Minute Rule for Here's Exactly How Much To Save Each ... - Statesville.com

According to the American Automobile Association (AAA), the typical expense to guarantee a sedan in 2016 was $1222 a year, or approximately $102 each month. Remember that this is a ballpark figure based upon nationally collected data; depending on your situation, it might be basically. Nationwide not just provides competitive rates, however also a variety of discounts to help our members conserve much more.

Within a couple of minutes, you'll have an automobile insurance quote based on your specific scenarios.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation