Welcome to

On Feet Nation

Members

-

bobbie48uio Online

-

Ritha Haak Online

-

Andrew Online

-

Tracy Online

-

Jerold Galarza Online

-

Thomas Shaw Online

Blog Posts

customised maps uk

Posted by bobbie48uio on April 19, 2024 at 10:34am 0 Comments 0 Likes

https://www.cosmographics.co.uk/custom-and-personalised-maps-uk/

hktpcbiu

Posted by Andrew on April 19, 2024 at 10:27am 0 Comments 0 Likes

Top Content

What Are Mortgage Factors And Just How Do They Function?

Special rules relate to assets acquired with gift or inheritance, in addition to to the value of supply funds held for a period throughout which profits are reinvested. The term is often used to define adjustments to interest rates. For example, if a home mortgage's price goes from 4.63 to 4.41 percent, you would state that it dropped by 22 basis factors. This term is more exact than stating it went down by 0.22 percent.

I broker informed me that when acquiring factors, the first factor will decrease the price by 1/4, yet additional factors acquired will decrease the price by 1/8, or much less? He informed me that if i got 3 factors on a 388,000 mortgage it would reduce the rate 3/8. They are just charging total source fees of $1,390 after they forgoed the application fees of $300 and also funding cost of $250, which appears really low.

- This in turn substantially raises the number of months it requires to recover cost.

- It is not to be confused with the electronic term Bias factor.

- Steve Lander has actually been a writer considering that 1996, with experience in the fields of financial solutions, property and also innovation.

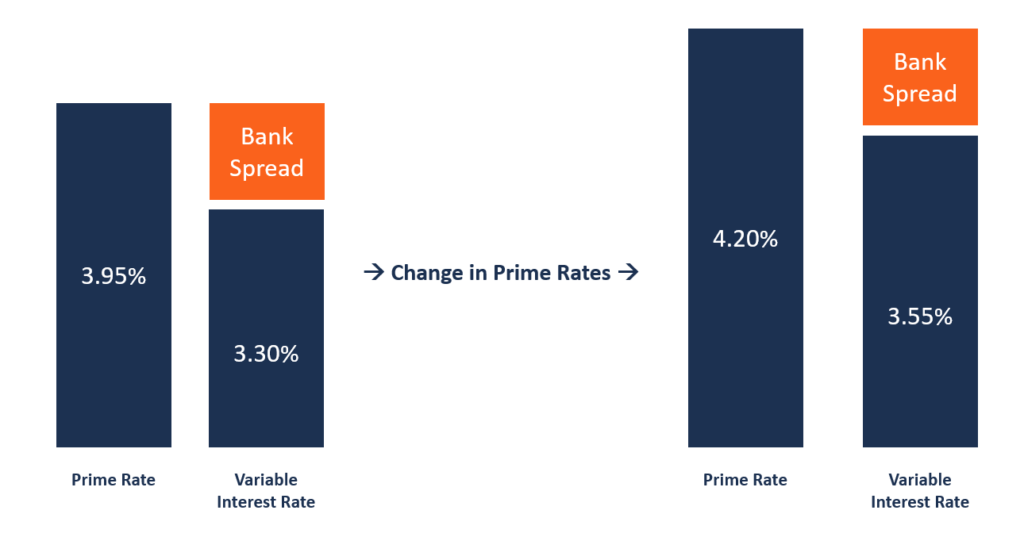

( e.g. 60-day rate lock) Used frequently in an increasing price market. A mortgage which is accepted by First Hawaiian Bank under the financial institution's own terms. Usually the car loan is not marketed to one more organization, and therefore FHB births the threats of payment and also interest. The routine evaluation of escrow accounts to identify if present month-to-month down payments will certainly supply sufficient funds to pay insurance policy, property taxes as well as other bills when due. Modifications to the CIBC Prime Price are often defined in regards to boosts or decreases in basis points.

Basis Factor Example

This indicates that it will certainly cost you one-half of 1 percent of your home loan balance to secure your price for 60 days. As discussed, a basis factor represents 1/100th of a percentage factor. By contrast, one discount rate point equates to 1% of the loan quantity. As an example, one factor on a $200,000 home loan would certainly work out to $2,000. When you obtain a mortgage, you can get price cut points to decrease the interest rate over the life of the financing.

When Are Percents As Well As Bps Used At The Exact Same Time?

Mortgage basis points impact the rate of interest you pay, where one basis factor amounts to 0.01 percent in rate of interest. We make every effort to supply you with details concerning products and services you might discover intriguing as well as beneficial. Relationship-based advertisements and online behavioral marketing help us do that.

I'm thinking it's to do with the Qualified Mortgage policy to make certain the more info lending doesn't end up being high price. They probably simply imply a producer can not be paid by both the lending institution and the debtor. This might be https://yemle.com/news/compare-todays-home-mortgage-and-refinance-rates the lender's payment bundled up into one how to get out of timeshare ownership fee that covers things like underwriting, handling, and more. There are 2 sorts of home loan factors you could be charged when acquiring a home loan. The larger your financing quantity, the a lot more costly mortgage factors end up being, so factors might be extra abundant on smaller home loans if they're being used for compensation.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation