Welcome to

On Feet Nation

Members

-

geekstation Online

-

-

zoom88 Online

-

PH the vintage Online

-

-

Blog Posts

Adventure Awaits Exploring the Most useful On line Casino Slots

Posted by jackharry on April 18, 2024 at 5:53am 0 Comments 0 Likes

qumar

Posted by jack on April 18, 2024 at 5:50am 0 Comments 0 Likes

Rhythmic Resonance: The Power of On-Hold Audio

Posted by Harry on April 18, 2024 at 5:47am 0 Comments 0 Likes

Enhance Your Beauty: The Art of Choosing the Right Hair Extensions

Posted by hr executive search firms on April 18, 2024 at 5:44am 0 Comments 0 Likes

Top Content

The 5-Second Trick For How Much Is Motorcycle Insurance For An 18-year-old

Another common discount rate provided by numerous insurance provider is an "Away At School" discount rate. This discount rate could apply if your 18-year-old is going to college a minimum of 100 miles away from home and leaving their cars and truck behind. If they take their vehicle with them to school, the discount rate does not use.

If you purchase a new automobile with a loan, the lender might require that you carry thorough and collision protection. In contrast, a car that costs numerous thousand dollars to replace in the event of a mishap may need to carry full coverage even if you aren't handling a loan provider.

Select a Sedan Over a Sports Car, Choosing the right car for your teen can conserve you hundreds of dollars each year. A cars or high-end lorry might be enjoyable to drive, but these vehicles will significantly increase insurance coverage expenses for a brand-new chauffeur. A safe, simple sedan is frequently the cheapest automobile to insure for a teenager.

Getting The How Much Is Car Insurance Per Month In 2021? Get Tips For ... To Work

On the other hand, the cost of guaranteeing a Mustang GT has to do with $4,171 each year. You can conserve an average of $1,304 annually by choosing a Camry over a Mustang. Why Is Automobile Insurance Coverage So Costly for an 18-Year-Old? Automobile insurance coverage for 18-year-old chauffeurs is costly because insurance provider utilize your driving history to determine your insurance rates.

Insurance companies also do a reasonable quantity of research study into analytical groups, with years of records indicating that teen drivers are most likely to be negligent behind the wheel than motorists in other age. Traffic Stats for 18-Year-Old Drivers, Score motorists on these elements may seem rare, but the variety of deadly crashes, injuries and other accidents do not lie.

75 fatal crashes for every 100 million miles driven. The numbers reveal that 18- and 19-year-old motorists were just associated with 2. 47 fatal crashes, while 20- and 21-year-old drivers were associated with 2. 15 deadly crashes. Driving does get safer as you age and have more driving experience.

Some Known Facts About Teen Driving - Nhtsa.

States With the Highest Vehicle Insurance Coverage Cost for a 18-Year-OldCar insurance coverage rates are determined at the state level. This means that the very same person might see a considerable difference in their insurance rates by moving from one state to another. Teenagers in Michigan, Louisiana and New York will have some of the highest insurance rates in the country.

Sometimes this is since the legislature does not allow insurance provider to rate clients based upon age. Other times, it is due to the fact that the population of an area is much lower, lowering the possibility that a motorist of any age will remain in an accident. Hawaii and Iowa are the states with the most affordable rates for 18-year-old motorists.

Since insurance coverage rates are based upon a range of personal factors, your rates may be higher or lower than those listed in this post. You can see the info used to figure out these averages on our methodology and disclaimer page. Read More on Vehicle Insurance Coverage, Automobile Insurance Coverage, Vehicle Insurance Coverage, About the Author.

Unknown Facts About Best Car Insurance For Teen Drivers: How To Save On Your ...

There comes a time in a lot of young chauffeurs' lives when they have to ask themselves an important question: Should I get my own automobile insurance plan or include myself to the one my moms and dads currently have? A new research study recommends the latter choice is the way to go. A recent Quadrant Info Services study, commissioned by, examined the financial effect of a young driver getting his or her own insurance plan versus being contributed to a moms and dad's existing policy.

According to the research study, U.S. drivers between the ages of 18 and 24 pay, on average, eight percent more for their own specific insurance policies than they do when contributed to a grownup's. But in some states-- and for specific kinds of motorists-- the boost can be more than half." The bottom line is that young chauffeurs are more costly to insure, and if they want their own specific policy, it's going to come at an expense," states Mike Barry, spokesman for the nonprofit Insurance coverage Information Institute.

" Moms and dads will typically have several policies with the very same insurer, so our sense is that the insurance providers ... will try to keep a cover on premiums when it pertains to adding their kids." To be sure, the expense of a private policy differs depending upon the chauffeur's age. According to the study, 18-year-old chauffeurs will pay, on average, 18 percent more for a private policy than they would if included to their moms and dads' policy.

The How To Save Money On Teen Car Insurance - Dave Ramsey Statements

For circumstances, drivers in between the ages Click for source of 18 and 24 in Rhode Island will pay, typically, 19 percent more for their own policy than they would if included to a parent's existing policy. Meanwhile, chauffeurs of the same age in Arkansas and Mississippi will pay simply 5 percent more for their own policy than they would if contributed to an existing policy.

South Carolina-- 5 percent. The picture becomes even more intricate when breaking down the results by age. An 18-year-old motorist in Rhode Island will pay an average of 53 percent more for an individual policy than he or she would if included to an existing policy.

On the other hand, an 18-year-old motorist in states such as Illinois, Alaska and Florida pays simply seven percent more for a private policy compared to being contributed to an existing one. And in Arizona, Hawaii and Illinois, it really becomes more affordable, on average, for a young motorist to get his/her own policy after turning 19.

The Best Guide To The Best Car Insurance For 18-year-olds - The Zebra

The average cost of car insurance in the U.S. is around $1,652 each year (or about $137 each month), based on rates for 30-45-year-old chauffeurs, according to a 2021 analysis of vehicle insurance coverage rates by Policygenius. Vehicle insurance rates are various for every motorist, which makes it hard to anticipate what you'll pay for coverage.

The most inexpensive states for cars and truck insurance coverage typically have lower minimum coverage requirements, indicating you can conserve by deciding out of particular kinds of protection. Idaho, for example, doesn't mandate individual injury defense (PIP), which is needed in no-fault states and covers your injuries after a mishap, or uninsured/underinsured vehicle driver protection, which covers damage triggered by a driver without insurance.

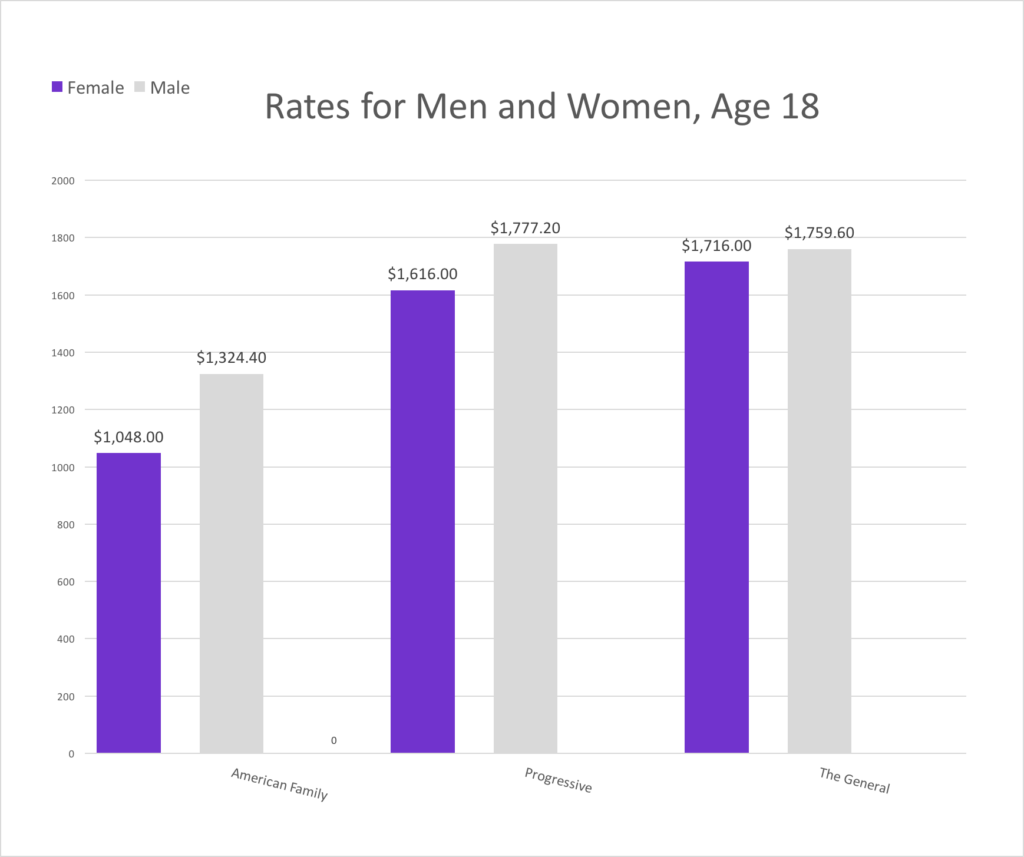

Younger, less experienced chauffeurs pay more due to the fact that they're most likely to have an accident and sue. Your gender can likewise have an effect on your rates, although some states do not enable car insurance companies to utilize gender as a factor when calculating just how much to charge for protection.

3 Simple Techniques For The Complete Guide To Car Insurance For Teens - Your Aaa ...

You ought to still have fairly high liability limitations, even if your car is a car, due to the fact that you might easily cause countless dollars worth of damage in a mishap. But if your automobile deserves less than a common detailed or accident deductible and you would be fine paying out of pocket to change it if it were stolen, you can limit your protection to liability-only, and conserve by not paying for comp and crash.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation