Welcome to

On Feet Nation

Members

Blog Posts

Never Fight Uphill Me Boys Trump Shirt

Posted by teechipshop on April 19, 2024 at 4:37pm 0 Comments 0 Likes

“Trump Never Fight Uphill Me Boys Shirt: A shirt featuring a quote attributed to Donald Trump, referencing a statement he made about General Robert E. Lee.

Shop Now=> https://viralstyle.com/teeshopbuzz/never-fight-uphill-me-boys-trump-shirt

Grabs yours today. tag and share who loves it.

TIP: SHARE it with your friends, order together and save on shipping.

Top Content

Things about 5 Ways To Help Lower Auto Insurance Rates - Usaa

Offenses that don't always reveal that you're a dangerous chauffeur might be less likely to trigger a premium hike than others. If you have actually received a parking ticket, there's little reason for an insurer to utilize that event to validate raising your rates. The exact same goes for tickets for having your windows too heavily tinted or not using a seatbelt, as well as fix-it tickets.

It's at the discretion of the insurance company to define threat and how offenses affect rates. Which Infractions Are Likely to Cause Rate Increases?

Dismissing A Ticket With Defensive Driving for Dummies

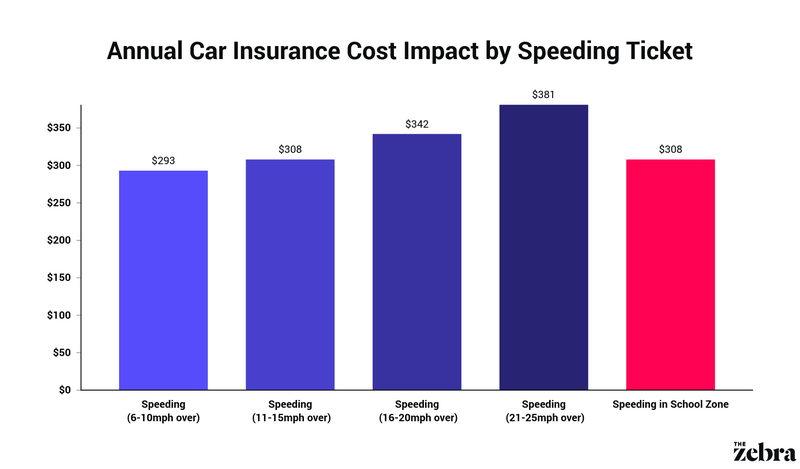

Here's what the comparison website found: Source: The Zebra, What Can You Do to Avoid the Additional Cost? It's clear that not all traffic violations are equal when it pertains to your insurance coverage rates. The length of time offenses remain on your driving record can likewise differ depending on where you live.

In some cases, though, you might be able to avoid the ticket from being contributed to your driving record, which will prevent your insurance provider from learning and raising your rate: In some states, you may have the option to go to a protective driving course to avoid the court from adding certain infractions to your record.

Indicators on How To Lower Car Insurance Costs In 2021: 8 Best Ways You Should Know

Some courts may offer the possibility to postpone the effects of your infraction in lieu of participating in traffic school. In this circumstance, you'll typically need to plead guilty and pay a charge on top of the fine for the violation. In exchange, the court will put you on probation for a predetermined period.

If you think the ticket is unreasonable or inaccurate, you can litigate and argue to have the case dismissed or decreased to a lesser infraction. If you can manage to produce doubt of the circumstances through witnesses and proof, you could succeed. For more serious infractions, think about hiring a lawyer to assist.

Top Guidelines Of 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

It won't harm to reach out to the court and discuss some alternatives it might have to keep your insurance coverage premiums from spiking. Keep in mind that more serious infractions can cause your insurer to drop you completely, which could make it difficult to get coverage from another insurance business without paying incredibly high rates.

Other Ways to Lower Your Automobile Insurance Costs, Whether or not you're facing the possibility of a rate walking due to a traffic violation, it's a good concept to consider ways to minimize car insurance coverage. Here are simply a couple of choices: Each vehicle insurance provider has its own criteria for figuring out rates, so even with a violation on your record, it's possible to conserve money by changing to a various insurance company.

Not known Facts About How Do Speeding Tickets Affect Your Insurance? - I Drive Safely

Ask your insurance company if there are discounts readily available that you're not benefiting from already. If you're looking around for a policy, do the same with each insurer that gives you a quote. In many states, vehicle insurance coverage companies use a credit-based insurance score to assist determine your rates.

Just be sure to weigh the advantages of saving now versus the expenses you may face if you end up having to file a claim.

The Only Guide to 7 Ways To Lower Car Insurance After An Accident (2021)

After an at-fault cars and truck accident, you're most likely stressed over how your insurance coverage rates will be affected. It's not unusual to see insurance coverage premiums increase, however fortunately there are a couple of ways to get lower automobile insurance after an accident. Vehicle mishaps are not just mentally and physically taxing, they can likewise put a damage in your wallet.

We have actually also taken the time to review the leading auto insurance provider if you are thinking about a brand-new company in the aftermath of a collision. Enter your zip code in our quote comparison tool below to begin with free, tailored vehicle insurance quotes seven days a week. 1. Tell Your Vehicle Insurance Supplier About Your Accident You may be lured to not tell your automobile insurer about an accident if it is small, but informing your insurance agent is a smart choice.

Little Known Questions About Does Running A Red Light Increase Your Car Insurance Rates?.

If a chauffeur sues you and you have not reported the mishap to your insurance coverage company, the insurance service provider can refuse to pay your legal expenses and potential payments to the other chauffeur. While an insurance company might raise your rates if you report a mishap, it is much safer to report than not report it.

Ask Your Automobile Insurer About Mishap Forgiveness Accidents are a part of life, and some vehicle insurance coverage business recognize that by providing mishap forgiveness insurance coverage. The conditions needed by each insurance coverage business for accident forgiveness are various, so it is best to offer your service provider a call and ask what your conditions are.

Does A Speeding Ticket Raise Your Insurance Rates? - Allstate - An Overview

Find out more in our guide to accident forgiveness insurance. Business that provide mishap forgiveness include: 3. Find An Automobile Insurance Service Provider With A Lower Premium Companies differ in their average car insurance coverage rates for motorists with at-fault accidents. In comparison to other leading providers, Geico and State Farm normally provide lower vehicle insurance after a mishap.

In addition to the insurance coverage business you choose, elements such as your age, car make and model, and driving history can affect your premium, so what's finest for your next-door neighbor may not be best for you. Use our tool below to begin comparing inexpensive automobile insurance coverage companies. 4. Enhance Your Credit rating Many chauffeurs know that cars and truck insurer consider a driver's mishap history and whether they have a clean driving record when determining rates, but did you know that a driver's credit rating can also affect vehicle insurance coverage premiums? According to Investopedia, numerous insurers look at a motorist's credit history to identify the insurance coverage rates they will provide.

7 Easy Facts About Traffic Violations & Auto Insurance - Will My Rates Increase? - Iq Explained

Therefore, it's an excellent idea to try to improve your credit. When your credit history is raised, you may have the ability to get a more affordable policy from a various service provider or the one that you currently work with. 5. Look Into Insurance coverage Discounts A number of car insurance provider offer considerable discounts to their customers.

As you can see, many of the discounts differ based on the specific private obtaining a discount rate, so it is best to call the insurance provider to find out what your specific discounts would be. In addition to the discount rates listed below, some insurance provider use a discount for an anti-theft device.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation