Welcome to

On Feet Nation

Members

-

Helen Online

-

Poddar College Online

-

Frederick Online

-

Maria Online

-

Nitin Chaudhary Online

-

jack452 Online

-

BABU Online

-

Yashi Vaidya Online

-

Harry Online

Blog Posts

qumar

Posted by jack on April 25, 2024 at 3:19am 0 Comments 0 Likes

ibujarvv

Posted by Cassandra on April 25, 2024 at 3:16am 0 Comments 0 Likes

HEYAPK - Download APK Games & Apps Free for Android

Posted by Typingone on April 25, 2024 at 3:16am 0 Comments 0 Likes

Best HEYAPK Features:

No Registration Required:

On HEYAPK, you don't have to log in or create an account to download the content. Just search and download your favorite apps… Continue

Top Content

10 Easy Facts About Driver's License - Scdmv Shown

2. Prior to you buy an automobile, compare insurance coverage expenses Prior to you buy a brand-new or secondhand vehicle, examine into insurance expenses. Car insurance coverage premiums are based in part on the cars and truck's cost, the cost to repair it, its overall security record and the probability of theft. Many insurance companies provide discounts for functions that decrease the risk of injuries or theft.

Evaluation your coverage at renewal time to make sure your insurance coverage requirements haven't changed. Purchase your property owners and auto protection from the same insurance company Numerous insurers will offer you a break if you purchase two or more types of insurance coverage.

Ask about group insurance Some companies offer decreases to drivers who get insurance coverage through a group strategy from their companies, through professional, service and alumni groups or from other associations. Ask your company and inquire with groups or clubs you are a member of to see if this is possible.

Facts About Cheap Car Insurance For New Drivers - Comparethemarket.com Uncovered

Look for other discount rates Companies use discount rates to insurance policy holders who have not had any accidents or moving infractions for a number of years. You may likewise get a discount rate if you take a protective driving course. If there is a young chauffeur on the policy who is an excellent trainee, has taken a motorists education course or is away at college without a cars and truck, you may likewise certify for a lower rate.

The essential to savings is not the discounts, however the last price. A business that offers few discounts may still have a lower total rate. Federal Person Information Center National Consumers League Cooperative State Research Study, Education, and Extension Service, USDA.

Portland Press Herald, Getty Images Cheap car insurance for brand-new motorists under 21 is not constantly easy to discover. Younger chauffeurs are thought about to be at a higher risk for protection, implying they often get the greatest insurance rates. Knowing the typical expense of car insurance coverage for younger chauffeurs, and learning what discounts are offered, can assist you minimize your insurance rates, even if you are a brand-new driver.

The Basic Principles Of Cheap Car Insurance - Affordable Auto Insurance Company

Stats reveal that younger chauffeurs are more most likely to be in an accident and submit a claim. According to The Zebra, the average 21-year-old chauffeur pays about $850 more annually. Besides having less experience, finder discovered that younger chauffeurs have greater rates of remaining in a severe mishap. The top insurance providers for chauffeurs under the age of 21 tend to be Allstate, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, and USAA.

State Farm provides the second-best rates, with approximately $1,319 yearly. Lots of aspects, including your age, the automobile you drive, and whether you are on your moms and dad's policy, will increase or reduce this average. Chauffeurs under 21 pay the greatest insurance rates, you may receive a substantial drop when you turn 21 years old.

What Aspects Influence Insurance Rates for New Drivers Under 21? Knowing what aspects contribute to your insurance rates can assist you determine discount rate possibilities. The list below elements are thought about when identifying insurance coverage rates for a motorist under 21: Considering that chauffeurs under 21 have less driving experience, they are thought about to be at higher risk of filing an insurance claim.

Our The Best Car Insurance Companies For Young Adults - Money ... PDFs

Where you park your automobile each night impacts your insurance coverage rates. If you live in a location with high crime rates, your rates will likely be greater. You can also receive discount rates for keeping your lorry in a locked garage. How typically you drive and where you drive usually can likewise affect your rates.

In addition to risking your life, a DUI can result in high insurance coverage rates. Some insurance coverage companies offer discounts if you pay for your policy annually. This method can lead to a higher out-of-pocket cost however can save you cash monthly. Numerous companies provide discount rates that you might qualify for.

Without it, you might face pricey fines and even a suspended license. In numerous states, the fines that feature driving without insurance coverage are much costlier than spending for an insurance plan. Insurance is meant to protect you and other motorists if you remain in a mishap. Depending upon the kind of coverage, an insurance coverage might cover medical bills and automobile damages.

Excitement About Cheap Car Insurance ~ Get Affordable Auto Insurance - Geico

Finding low-cost vehicle insurance coverage can be difficult if you're a brand-new driver. If it's your very first time behind the wheel, vehicle insurance providers interpret that absence of driving history as a high-risk aspect. Due to the fact that of this, you might see higher rates than a skilled driver. To get your finest vehicle insurance rate, compare a number of quotes from various providers.

These can help balance out new motorist premium expenses. After that, buying a policy ought to fast. This short article will cover: Just how much does auto insurance cost for new drivers? Based on our research, the average expense of cars and truck insurance coverage for a brand-new chauffeur is $4,762 a year, or $397 a month.

Your real expense for new chauffeur automobile insurance coverage depends in part on the insurer you pick and the state you reside in, to name a few aspects. The table listed below programs the average annual rates from various nationwide service providers for full-coverage car insurance coverage for brand-new motorists. How to get low-cost automobile insurance as a brand-new driver Policy choices, discount rates and vehicle insurer programs are available to help you get your best and most affordable auto insurance coverage rates as a brand-new driver.

Some Known Details About 7 Ways To Find Good, Cheap Car Insurance - Credit Karma

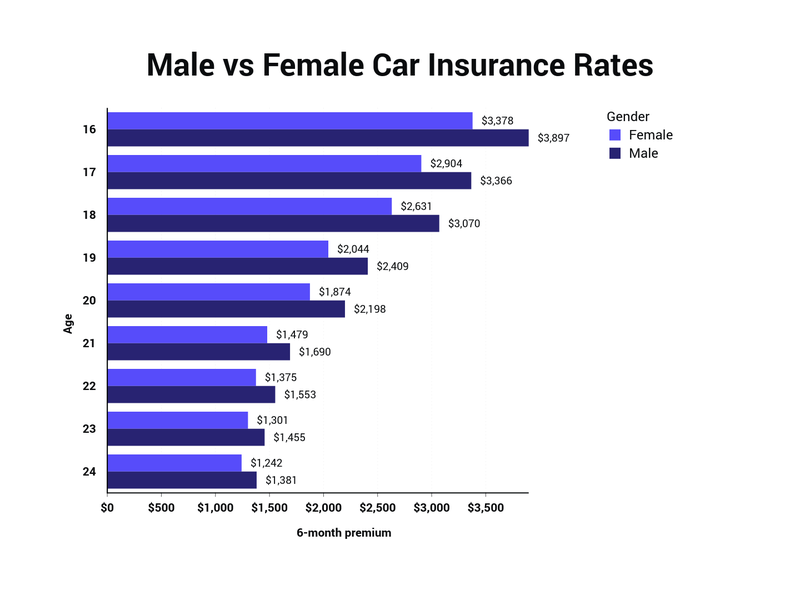

Teenagers are considered the greatest danger group of chauffeurs in the eyes of car insurance coverage companies. It will still raise their total annual premium, however no place near the total cost if you had your own cars and truck insurance policy. To offer you a sense of the expense difference, the graph listed below programs the average cost of full-coverage auto insurance for a brand-new chauffeur with their own auto insurance coverage versus the average rate on a parent's policy.

The 2-Minute Rule for Car Insurance Rates For New Drivers - Policygenius

Getting on another's automobile insurance policy can save over 50%. New adult drivers see greater rates than experienced motorists of the very same age.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation