Welcome to

On Feet Nation

Members

-

Shabaz Sayyed Online

-

jack452 Online

-

Ashley Online

-

Khalid Shaikh Online

-

Lima Online

-

Esther Online

Blog Posts

Healthcare Cloud Infrastructure Market Share, Overview, Competitive Analysis and Forecast 2031

Posted by Prajakta on April 25, 2024 at 5:40am 0 Comments 0 Likes

FutureWise Research published a report that analyzes Healthcare Cloud Infrastructure Market trends to predict the market's growth. The report begins with a description of the business environment and explains the… Continue

Top Content

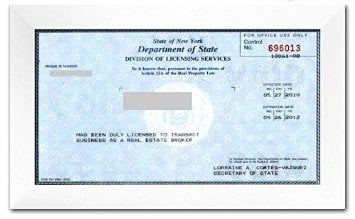

What Is The Commission For Real Estate Agents Things To Know Before You Get This

Private mortgage insurance coverage is a policy that protects your loan provider in case you default on paying back the loan. It covers all or a portion of your staying mortgage. The customer pays for the policy although it benefits the lender, and it's in some cases required. Like other insurance coverage, private mortgage insurance includes a yearly premium and often an upfront premium as well. There's at least one thing you can do to prevent spending for it, however. Private mortgage insurance coverage has belonged of some home loans because 1957. It efficiently guarantees the loan provider that its loan will be paid, so having such a policy in location can help some debtors get approved for a loan they wouldn't otherwise qualify for.

Some loan providers will permit you to make a down payment of less than 20% without PMI, but these loans usually include steeper rates of interest. Like any other type of insurance plan, you're paying premiums to cover damages ought to an unfortunate occasion take place. The insurance coverage company is responsible for paying off your loan if for some factor you discover yourself not able to do so. Lenders consider that this is most likely to take place if you have less of an ownership stake in the propertyyour equity is less than 20% at the start since you didn't put this much cash down.

Home mortgage protection insurance coverage will not settle the entire balance of your loan if you default, but will make some payments for you for a while if you come down with particular covered challenges, such as job loss, special needs, or major health problem. Insures against total default on the loan Covers some missed out on home mortgage payments Insures the lending institution Guarantees the debtor Pays in case of foreclosure May pay in the occasion of the borrower's death Is often required by lending institutions Is a voluntary election by the borrower There are both benefits and drawbacks to PMI. On the advantage, it can make it simpler to qualify for a loan because it reduces the risk you present to a lending institution.

And premiums are tax deductible, a minimum of through December 31, 2020. PMI also gives you more buying power because it reduces the down payment you're required to bring to the table. This can how to cancel llc be very practical if you're short on funds or simply want a less significant preliminary investment. The primary drawback of PMI is that it increases your regular monthly home loan payment and in some cases your closing expenses, too. PMI payments are also no longer tax deductible, although you might still be able to compose off the premiums on a loan gotten prior to 2017, depending upon your earnings and the terms of your mortgage.

It provides no security for you at all if you fall back on payments. Pros May make it easier to qualify for a home loan Allows you to make a smaller sized deposit Cons May increase your month-to-month payment May increase your closing costs Provides no protection for the customer Premiums are not normally tax-deductible PMI typically costs between 0. 5% and 1% of your loan value on a yearly basis, but the expenses can differ. Your lending institution will information your PMI premiums on your preliminary loan price quote, in addition to on your last closing disclosure form. You can expect to pay your premium either upfront at closing, regular monthly as a part of your home mortgage payments, or both.

How Does A Real Estate Agent Get Paid for Dummies

This isn't real of all lenders, but it's an excellent guideline. See what your regular monthly payments might appear like with a 20% or more down payment using our home loan payments calculator. You might consider delaying your home purchase up until you can collect the cash, or asking for present money from a moms and dad or household member if you don't yet have 20% conserved up. There are likewise crowdfunding platforms you can utilize to enhance your deposit savings, along with down payment support wesleyan financial programs if you certify. The good idea about PMI is that it's not permanent. You can generally ask for that your PMI be canceled and gotten rid of from your payments as soon as you have actually developed up 20% equity in the house.

Reach out to your lending institution as you near the 20% mark to get full details on how you can cancel yours. Your loan provider is needed to terminate PMI in your place as soon as your balance falls to 78% of the house's worth. You should be current on your payments prior to they can cancel your policy. Private home mortgage insurance (PMI) secures loan providers against possible default by borrowers. It will settle the home mortgage balance in the occasion of foreclosure. PMI is frequently needed when homebuyers make less than a 20% down payment on the loan. This insurance coverage provides borrowers a much better possibility of being authorized for a home loan if their credit is less than outstanding, or if they do not have a great deal of cash to put down.

permits lenders to offer low deposit loans by insuring timeshare selling scams the top 15-20% of the loan versus default. To put it simply, this kind of insurance coverage secures the in a low cash down loan, by insuring the quantity lent over 80% to a customer. The debtor pays the premium for PMI and normally does so by paying a portion at closing and a monthly premium together with their mortgage payment. No, they only guarantee above a particular percentage. For instance, state a customer obtains $95,000 on a residential or commercial property they purchased for $100,000. How to get started in real estate investing. The lender would need the buyer to purchase private home mortgage insurance to cover the quantity they owe above $80,000 to $95,000, which is $15,000.

Private home loan insurance coverage is used by lots of nationwide insurance business. No, as soon as a debtor reaches a particular level of equity in a residential or commercial property, the lender will enable them to drop this protection. Typically, the quantity of equity required to be accomplished is 20% before a loan provider will let a debtor drop the personal home mortgage insurance. No, is not PMI, it is an optional policy purchased by a borrower who is concerned they might pass away or end up being disabled and will be unable to make their home mortgage payments. If the debtor dies, the insurer will pay a death benefit to the loan provider to settle their mortgage.

Other pointers to assist you pass your property licensing exam on your very first effort: Also, take a look at our concern of the day videos on our You, Tube channel: (What is wholesaling real estate).

Some Ideas on What Is Escheat In Real Estate You Need To Know

Some house buyers are required to acquire personal home mortgage insurance, or PMI, when obtaining a mortgage. Typically, the property owner pays the PMI's monthly insurance premium when paying your house payment every month. Personal mortgage insurance coverage is a particular kind of insurance plan that enables lenders to increase the loan-to-market-value ratio. When a house buyer purchases a home, they normally give a money down payment, which is a percentage of the house's worth at the time of purchase. Federal government regulations specify that some lenders can just loan as much as 80 percent of the residential or commercial property's value. PMI permits some house buyers, who can't provide the entire 20 percent down payment, to buy the property with a lower down payment.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation