Welcome to

On Feet Nation

Members

-

Tommy Online

-

Christopher Online

-

Frances Online

Blog Posts

Celebrities Showcase Glamorous Summer Dress Styling A Fashion Extravaganza

Posted by Andy Stephen on April 23, 2024 at 10:31pm 0 Comments 0 Likes

As the mercury rises and the sun beams down, it's time to embrace the season's hottest trend: summer dresses. From flowy maxis to chic minis, these wardrobe staples offer endless opportunities for showcasing style and glamour. And who better to look to for fashion inspiration than our favourite celebrities? With their impeccable taste and access to the latest designer pieces,… Continue

zoguknyo

Posted by Denise on April 23, 2024 at 10:31pm 0 Comments 0 Likes

vovihnft

Posted by Leisa on April 23, 2024 at 10:31pm 0 Comments 0 Likes

Top Content

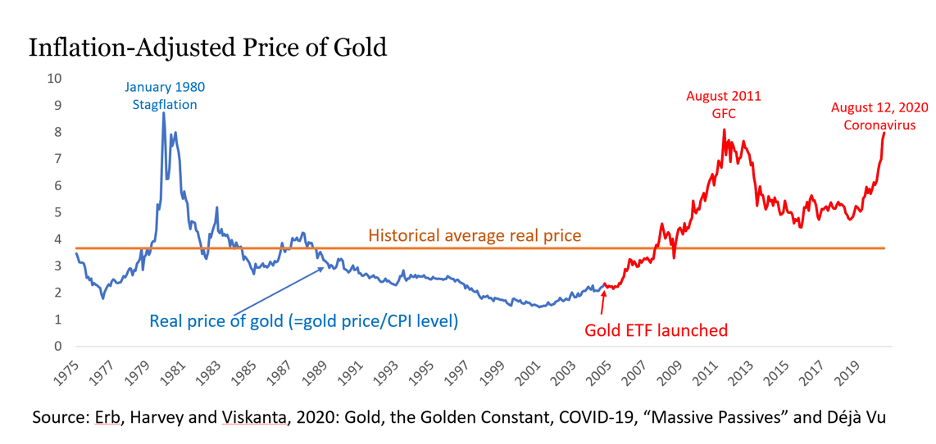

Ask Me Anything: 10 Answers to Your Questions About Gold as a Hedge Against Stock Market

In times like these when you have a substantial portfolio of stocks is nerve-racking. The market for equity has reached new record highs, however, the economic rationale for these price increases seems rather shaky.

Older people who managed their the money they earned through Black Monday (1987) and the Dot-com bubble (1995-2000) warn about the potential for similar events today in the same way that Wall Street encourages retail investors to take on more risk.

Famous investors such as Ray Dalio and Mark Mobius are publicly stating that investors should have between 5 and 10% of their investable funds that are held by physical Gold. For instance, the Ray Dalio All Weather Portfolio as an illustration, has an 7.5 percent allocation to Gold.

These highly successful investors are recommending physical Gold to hedge against the stock market while also pointing out the risk of currency devaluations aftermath of massive pandemic-related monetary and fiscal stimulus.

In this brief article we'll explore different strategies for hedging an Investment Portfolio against both stock market and Inflation risk.

The way in which to dodge against Inflation

There are many assets that are commonly considered inflation hedges:

Precious metals (Silver particularly)

Commodities

Real estate investment trusts (REIT)

Treasury Inflation Protected Securities (TIPS)

Like all potential Investments, each one of the asset types has advantages and disadvantages that an investor must consider.

Precious metals

Purchasing and holding physically Gold as well as Silver are a tried and true method for protecting yourself from Inflation. Metals that are precious are also an effective method to diversify an Investment portfolio and hedge against risk in the stock market.

During the Great Inflation of the 1970s (1963 to 1980) Gold gained 1600% in price and Silver rose by 2700%. Investors who had the foresight to buy Silver for $1.29 or Gold for $33 an one ounce as of 1963. In 1980 these https://sites.google.com/view/registeredinvestmentadvisor/precious-metals savvy investors could make a profit from their investments of $50 and $800 per an ounce.

The ideal method to invest to invest in Silver or Gold is to take personal possession of those Precious metals and store them locally.

There is also the possibility to gain exposure to the metals using ETFs and gold Trusts (e.g., GLD) and Silver Trusts (e.g., SLV) and certificate programs (e.g., Perth Mint).

Investors who have retirement savings that are tax-deductible can invest in physical Precious metals using those funds through the creation of an auto-directed Gold IRA. Both tax-exempt and tax deferred retirement accounts can be moved to Gold IRAs.

Commodities

Commodities can be considered real asset, such as orange juice or rolled steel. During inflationary times prices on real products tend to rise.

From an Investment perspective there are two categories of commodities that you should know about: hard and soft.

Hard commodities must be mined or drilled and this category includes the Precious metals including aluminum, copper, natural gas, crude oil, etc.

Soft commodities are cultivated in the ground or walk across it on four hooves. Corn, wheat live hogs, corn, and feeder cattle are all examples of the soft commodity.

ETFs enable investors to make investments in soft commodities.

Futures on commodities are not advised because of the assignment risk. Options on commodity futures can be an opportunity to hedge stock prices however, they carry an extremely high risk.

The Real Estate Investment Trust (REIT)

REITs are investment vehicles that manage pools of income-producing Real Estate. Inflation tends to push both rental rates and property prices higher.

Investors buy individual shares of a REIT to gain exposure to Real Estate without taking on the responsibility of finding the properties, financing them, or operating the properties themselves.

Residential REITs are specialized in housing units, single-family homes mobile homes, single-family houses, and student housing. Commercial REITs focus on retail stores, office buildings hotels, and other types of commercial properties that earn income.

A small percentage of REITs are focused on the holding of the mortgages (Mortgage REIT) however the majority of REITs concentrate on holding properties that generate income (Equity REIT).

Treasury Inflation Protected Securities (TIPS)

TIPS which is also known as Treasury Inflation Protected Securities, combine the security of a Treasury bond with the assurance that the purchaser will receive at least their original Investment back.

The principal amount of a TIPS bond can be adjusted to match that of the CPI (Consumer Price Index) throughout the term of the bond. The annual coupon payment is based on the principal amount of the bond. This means that the investor gets an Inflation-adjusted payout on their TIPS.

As an illustration, imagine an investor who has $15,000 worth of 5-year TIPS that have the 1% coupon rate. If inflation (as determined using CPI) is 4%, then the bond's value CPI) is 4percent, the $15,000 worth of bonds are adjusted upwards to $15,600. The bond's coupon amount is then calculated on the adjusted value of the principal so the investor receives $156 interest for the duration of the year.

Note that the original investment (the primary of the bond) is adjusted to reflect inflation in this case, but the investor is locked into a 1% interest rate vehicle in an environment where higher coupon rates are likely to be offered.

For investors who are cautious about risk, the lower return from TIPS could be acceptable for the sense of security that comes with a US Treasury bond.

Specifically how to hedge against rising prices

We have to be careful when we start talking about the best of anything in the investing world. The best hedge against Inflation is likely to be different for a 25-year old than for a 65-year old.

An investor's tolerance for risk also affects what their ideal Inflation hedge will look like. A risk-averse investor may avoid commodities because of volatility while the risk-tolerant investor loads up on physical Silver and shares of energy ETFs.

Why is Gold a quibble in contrast to Inflation

Gold is perceived as a security against Inflation because the price of Gold tends to increase as the purchasing power of the currency in which the metal is valued diminishes.

The price of the gentleman’s costume is provided to illustrate the classic example of Gold acting as a hedge against Inflation.

In 1922 a hand-tailored wool suit (a tailor-made suit) along with an additional pair of pants cost around $25 US Dollars, and Gold was priced at $20.67 per one ounce.

Fast-forward to today and an equivalent manaEUR(tm)s suit is priced between $1500 and $2000, with Gold being sold for approximately 1800 dollars an ounce.

That's 100 years where one ounce of Gold has protected its owner from the devastation of Inflation.

Exactly how to invest in Gold

There are many ways for you to make an investment in Gold. As already stated the most effective Gold Investment involves purchasing the physical metal and keeping it somewhere that you have easy access to it.

After that foundation is laid There are a variety of ways to invest in Gold:

Physical Gold Trusts and ETFs (e.g., Sprott Physical Gold Trust PHYS, or GLD)

Mining stocks, warrants and options

Self-directed Precious Metals IRAs (Gold IRAs)

Gold futures

Optional options on Gold futures

Physical Gold Trust

It is true that the Physical Gold Trusts, such as GLD (SPDR Gold Shares Trust) are deceptive as they provide investors with the appearance of owning physical Gold when all the investors actually own is shares of an investment that is (supposedly) connected in some manner with physical Gold.

It is important to recognize this fact: Gold Trusts are not actually securities, they are Gold itself. These are physical derivatives Gold but they don't give an investor any ownership stake in the actual metal.

Gold Trust shares are supposedly redeemable for physical metal, but only investors who have a solid financial foundation can do so.

The Sprott Physical Gold Trust (PHYS) will require investors to redeem shares in 400 oz increments. With gold at around $1780 an ounce, this means an investor needs $712,000 worth of PHYS before it is possible to get the actual metal.

GLD which is which is the SPDR Gold Shares Trust, has an an even greater threshold for taking delivery of physical Gold.

Investors who have been approved to redeem 100,000 shares of GLD at a time and request delivery of physical Gold. At today’s value (01/07/2022) this amounts to an Investment of approximately $16.8 million US Dollars.

Self-directed Precious metals IRA

Precious metals IRAs offer investors a way to build an Gold stock market hedge using the tax-advantaged retirement money.

Unless an investor is prepared to pay the 10% penalty for early withdrawal of their tax-deferred , tax-exempt money (401K 403b or traditional IRA, etc. ) The money is essentially stuck in some kind of IRS-approved investment vehicle up to the age of 59 1/2 .

Gold IRAs fall into this category of approved Investments and allow investors to gain the protection and security that comes with physical Gold ownership, without paying taxes or penalties as part of the process.

Verdicts

In this short article we've discussed primarily the use of Gold to protect against stock market risk due to Inflation.

Stock Portfolios are exposed to several other risks besides inflation. There is equity risk and liquidity risk as well as currency risk that investors need be aware of and perhaps,

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation