Welcome to

On Feet Nation

Members

-

Ahmed Kobir Online

-

Michael Online

-

George Online

Blog Posts

Top Content

AI machine learning: 11 Thing You're Forgetting to Do

Establishing a digital procurement approach has never been so important

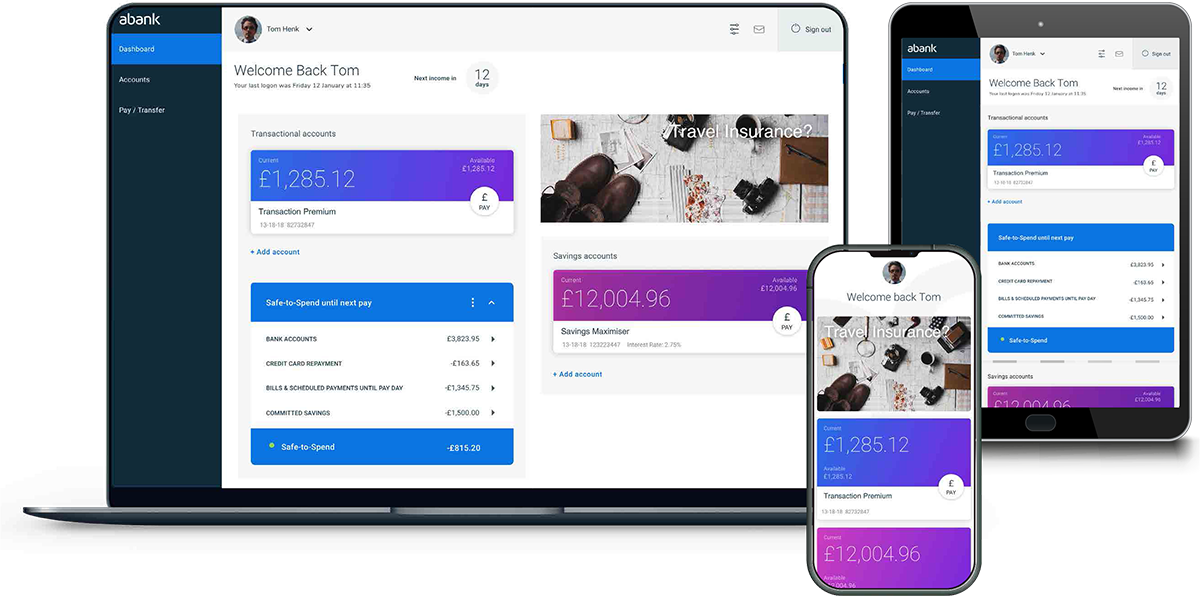

Getting faithful, lucrative financial consumers in today's climate is an interesting difficulty. You're marketing attracting offers, and visitors are striking your internet site in document numbers. You're talking to more possible clients than ever before, even in an increasingly crowded and fragmented market. Nevertheless too many prospective customers are quiting of the process. Inadequate are settling their applications or awaiting final authorization. And way too many are pulling out prior to completion of the cooling-off period.

Consumers have actually ended up being increasingly wise when concerns electronic interaction with brand names they recognize and depend on. And these brand names comprehend the importance of a seamless digital purchase procedure and exactly how that can play into the overall consumer experience. What do we imply by purchase procedure? Here we're speaking about the process from the very first time a consumer investigates your brand name online, via to them sending an application online, getting approval as well as totally onboarded as a customer-- the point of settlement or deposit.

Below we lay out exactly how banks can increase the success of their digital procurement strategy.

5 methods banks can improve digital purchase

1. Wed up all pertinent teams as well as evaluation software program capacities

Digital Acquisition in the banking sector is complicated. Converting internet site visitors to customers is far more than having a fantastic Interface (UI) on your website. You've most likely already obtained a fast, intuitive front end, yet you have actually crunched the numbers, and also it's just not transforming. Your UI/Digital Team have done their best, but they're only dealing with one piece of the challenge. They're possibly unaware of the complexities other teams face-- combination with back-end as well as outside systems for identification checking and debt choices, to celebration and also reviewing customers' supporting paperwork, to call just two.

Departments throughout your organisation will certainly require to team up to produce a reputable online procurement process. At this stage it's likewise worth finishing https://www.sandstone.com.au/en-gb/idp a gap analysis to identify pain factors as well as technological gaps. A lot more just recently many organisations are adopting Open Financial to enable clients to promptly give service providers accessibility to your economic info to quicken application times. Do you have the appropriate resource capability in home to efficiently supply your digital approach or would it be beneficial to bring in a expert economic modern technology partner?

2. Find out where your consumers are dropping off on the trip

Recruit your business analysts to deep dive into the analytics of your ecommerce website. They'll be able to see hand over factors at each stage of the application. Maybe there's a pest in the application, possibly the concerns postured aren't relevant or complicated. Ensure you are only asking inquiries pertinent for the application-- numerous organisations discover they can minimize their application procedure considerably by merely removing unneeded data capture. In order to boost your electronic acquisition approach, you need the realities regarding what is failing-- dealing with assumptions is likely to lead to wasted efforts from your group and also not address the problem.

You need to guarantee your digital purchase method allows signing up for a new economic providers or opening up extra accounts conveniently yet with adequate proper friction to guarantee candidates you are appreciating their data and also following water-tight safety protocols.

3. Put yourself in the applicant's shoes

While you analyse where while doing so you are shedding beneficial clients, take some time on your own to understand your organisation's site. Sometimes when economic organisations are making their websites, colleagues remove their 'human being' hat and just focus on the commercials. Getting on this mindset types below average digital experiences. We are often drawn into the technicalities of exactly how an task ought to look from a service view instead of how it may feel for a client to finish. Make certain you also obtain an account utilizing your site-- not with examination data-- as a real consumer to truly recognize the experience. Consider your target market when completing this step. If your goal to bring in older customers with a bigger share of wallet, an on the internet application which is gamified with little font style is unlikely to appeal to them. If your target market is more youthful, you might think about including some added worth tools on your site to nudge them through the application processes these could be calculators, item guides, personal financing monitoring widgets, and so on.

For a seamless user experience, customers that have successfully onboarded electronically shouldn't be informed that they need to wait to get qualifications or short-term credentials prior to they can visit to check out and also handle their accounts. For some procedures-- such as waiting on a debit card and also PIN in the post individually after developing an account-- there are unavoidable hold-ups.

4. Can you safely recognize a potential customer electronically?

Consumers obtaining an account online do not want to visit a branch or call a handling team to confirm their identification-- this disturbs the terrific electronic experience they have until now had with you. Remember-- this might be the first dealing a prospective client has actually had with your brand. As economic organisations increase their electronic onboarding solutions, taking into consideration just how tighter integration of identity onboarding and ongoing authentication can improve safety and security and also lead the way for even more adaptable risk-based verification strategy is critical. If financial institutions obtain digital identification right, they stand to realise benefits in streamlined sales procedures as well as consumer onboarding, decreased losses from scams and also governing fines, and the potential for brand-new income creating identity-based services and products. More significantly, they can preserve their central function as moderators of trust and remain appropriate in the changing electronic economic climate.

5. The job proceeds after your client has actually effectively onboarded

Digital Procurement is complicated since it is the excellent marital relationship in between your bank's as well as clients' demands and also needs. It's not practically filling in a form or having a showy web site. Consumers desire problem complimentary, engaging and gratifying experiences on the course to them realising their economic objectives. They want their dream house, not to need to submit their work information three times. You must convert the customer by providing a quick decision; while gathering other helpful details for cross/upselling. However, you also need to fulfill your regulatory and also conformity demands, risk as well as credit scores monitoring criteria and cover functional necessities.

In summary

Digital Purchase is complicated because it is the ideal marriage in between your financial institution's as well as clients' needs and also needs. It's not practically filling in a kind or having a flashy web site. Consumers desire inconvenience free, interesting and satisfying experiences on the course to them knowing their financial objectives. They want their desire residence, not to have to fill in their work information 3 times. You must convert the consumer by giving them a fast decision; while collecting various other useful info for cross/upselling. Nevertheless, you also require to fulfill your governing and compliance needs, risk and also credit scores administration requirements as well as cover functional needs.

Sandstone Technology

Concordia Works, 30 Sovereign St, Leeds LS1 4BA, United Kingdom

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation