Welcome to

On Feet Nation

Members

-

Florence Online

-

geekstation Online

-

Blog Posts

Connected Medical Devices Market Size, Analysis and Forecast 2031

Posted by Prajakta on April 25, 2024 at 10:09am 0 Comments 0 Likes

FutureWise Research published a report that analyzes Connected Medical Devices Market trends to predict the market's growth. The report begins with a description of the business environment and explains the commercial summary of… Continue

Sustainable Development Goals

Posted by Hibbah on April 25, 2024 at 10:06am 0 Comments 0 Likes

pewddgzd

Posted by Helen on April 25, 2024 at 10:05am 0 Comments 0 Likes

Top Content

Not known Incorrect Statements About How Much Does Car Insurance Cost? - Lemonade

The less experienced the driver, the greater the rates. That's because statistically, inexperienced chauffeurs crash a lot and so they are the riskiest classification of chauffeurs to guarantee. Car insurance rates show this high risk. Obviously, the vast bulk of inexperienced chauffeurs are teenagers and those under age 25.

All of this helps insurance companies discern the danger connected with guaranteeing your car because ZIP code, whether you ever have actually made a claim or not. All other aspects equivalent, your postal code can change your rate by numerous dollars. How does my marital status affect my vehicle insurance rate? Automobile insurance provider state that married couples have actually been found to have less mishaps and claims than single motorists do, which is why married motorists pay less than single motorists - liability.

There are likewise other automobile insurance discounts couples can anticipate when they integrate their policies, such as a multi-car discount, or a multi-policy discount rate if they have an occupants or homeowners policy with the very same insurance provider. An insurance provider considers you single if you have actually never ever been wed, or are widowed or separated. low-cost auto insurance.

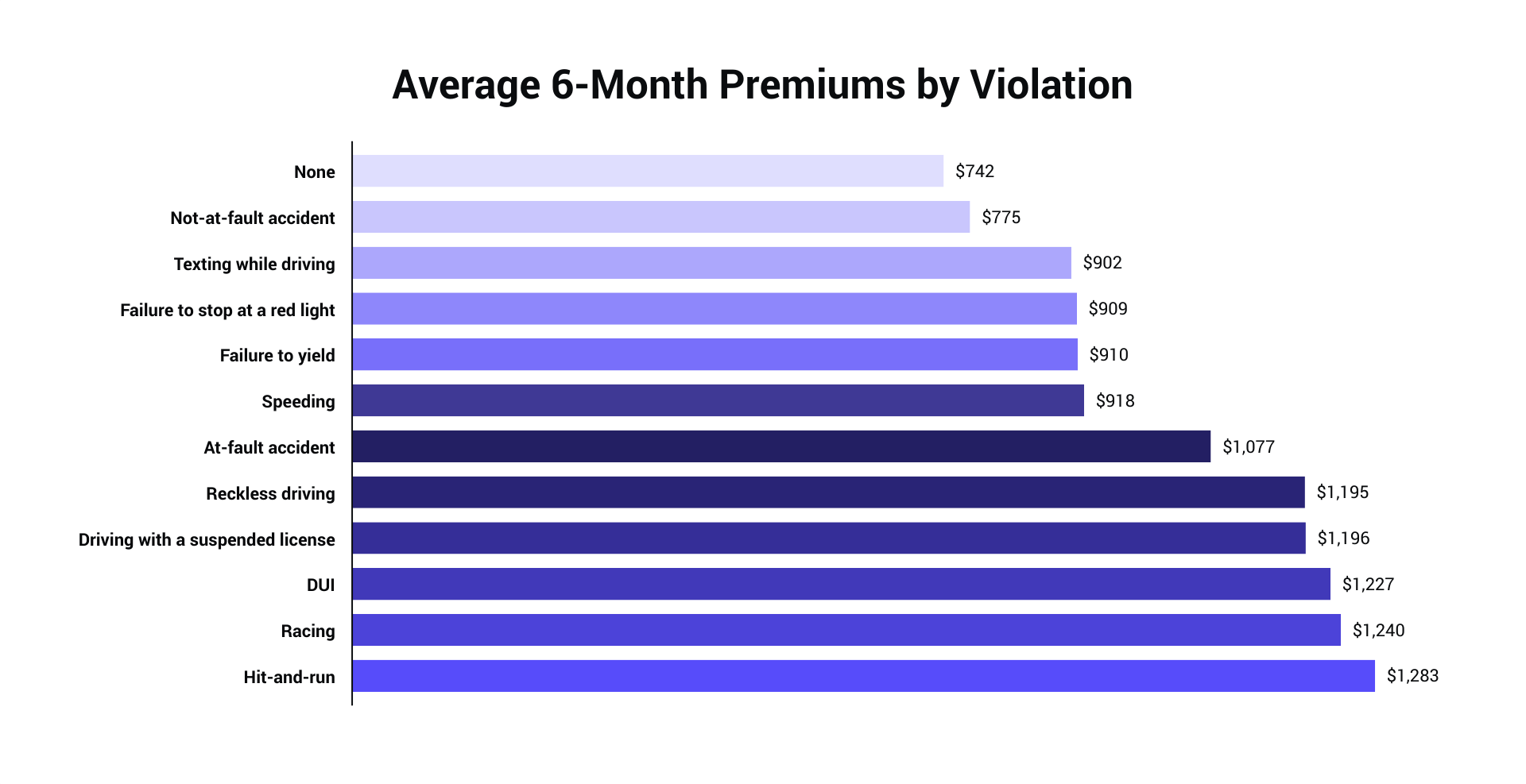

Some insurance providers reject anybody with four or more chargeable mishaps in 3 years, or more than 3 DUIs in seven years, or more than 15 points on the chauffeur's motor car record. In general, a small infraction such as a speeding ticket can enhance your rates, on average, by 25% to 43%.

5% less, on average, compared to chauffeurs with longer commutes, a Vehicle, Insurance coverage. How does mileage affect car insurance rates? If you drive 12,000 miles a year, or less, your insurance coverage business will normally consider that to be lower than average, and you'll likely pay a lower rate than those who drive more than that.

To get the very best low-mileage discounts, which have to do with 7% on average, you typically should drive under 7,000 or 5,000 miles every year. Based on a Los Angeles driver with a full protection policy, the cost of a policy when the driver logged 20,000 or more miles was 12% more pricey than if simply 5,000 miles were driven a year.

We asked Charles, the following concerns about credit report and insurance rates: What are the pros and cons of using a motorist's credit history when setting cars and truck insurance rates? Recognizing and rewarding motorists with great credit habits can yield consistent revenue and business stability for insurers. A customer's credit report says a lot about them.

Facts About Mercury Insurance: Auto, Home, Business Insurance & More Uncovered

In the long term, insurance business's development might be restricted if some customers are priced out of the market, this can have a cascading effect where lower sales lead to decrease revenues and lower ROI. It might be best to take calculated dangers and make policies available at budget-friendly rates to those with lower credit history (suvs).

Traditional customers, with good credit scores, are a necessary base for a solid insurance coverage business. These customers are consistent about paying their costs and insurance providers must reward them with the best rates.

Insurance providers are all about danger and numbers, and if their research says that individuals with bad credit are typically bad chauffeurs, one might make the argument that charging higher dangers is sensible. Even if it sort of feels like the insurance company is kicking the person with bad credit while they're down.

Customers with low credit rating sometimes won't qualify for monthly billing, or they might need to pay a big percentage of the policy in advance and the rest monthly. In any case, reasonable or not, credit history frequently do have an influence on one's insurance premiums. If you desire them to go down, it makes sense to attempt to make your credit rating go up.

The more protection you get, the more you will pay. If you get a bare-bones liability policy that covers only what the state needs, your cars and truck insurance costs are going to be less than if you purchased coverage that would fix your own vehicle, too. Liability protection tends to cost more due to the fact that the amount the insurance provider risks is greater - insured car.

If you don't have adequate liability coverage, you could be taken legal action against for the distinction by anyone you hurt. The higher the deductible, the less the insurance company will have to pay-- and the lower your rates.

Without some type of medical protection, if you don't have medical insurance elsewhere, you might not be able to spend for treatment if you are injured in an accident you caused. One way some chauffeurs can limit their insurance expenses is with pay-as-you-drive insurance coverage. This kind of insurance coverage bases the expense of your premium on just how much you drive, and may take into consideration other driving practices as well.

Not known Facts About Average Car Insurance Costs In March 2022 - Policygenius

Otherwise, these drivers "pay approximately the very same yearly fixed costs for insurance as another chauffeur with high annual mileage. Low mileage chauffeurs would have the strongest rewards to change to pay-as-you-drive."Besides possibly conserving money for low mileage chauffeurs, pay-as-you-drive insurance coverage might offer a reward to drive less. Explains Parry: "By raising the limited expense of driving it would influence people to drive a bit less - specifically for those with high danger factors as reflected in high score elements (as they have higher insurance coverage costs per mile)."Parry adds that the benefit of this reward to drive less may extend beyond the money conserved by customers with pay-as-you-drive insurance."There would be some modest take advantage of minimizing opposite effects from automobile use - some modest decrease in carbon and local air emissions and traffic jam as aggregate car miles driven is reasonably minimized."How much is car insurance coverage each year? Here's just how much the average driver, with excellent credit and a clean driving record, would pay for the following protection amounts, based upon Cars and truck, Insurance.

The average rate for 50/100/50 is. The typical rate for 100/300/100, with detailed and collision and a $500 deductible is (accident). Bumping state minimum up to 50/100/50 expenses just $129, so it's almost $11 a month-- Going to 100/300/100 from 50/100/50 expenses, to double your liability protection.

These hypothetical chauffeurs have clean records and excellent credit. Typical rates are for comparative functions. Your own rate will depend upon your personal elements and automobile.-- Michelle Megna added to this post.

Insurance coverage companies wish to see shown accountable behavior, which is why traffic mishaps and citations are elements in determining automobile insurance rates. Points on your license do not stay there permanently, however how long they remain on your driving record varies depending on the state you live in and the intensity of the offense.

For circumstances, a new cars will likely be more costly than, state, a five-year-old sedan. If you choose a lower deductible, it will result in a higher insurance coverage expense which makes selecting a greater deductible appear like a quite great deal. Nevertheless, a higher deductible could imply paying more expense in the event of a mishap.

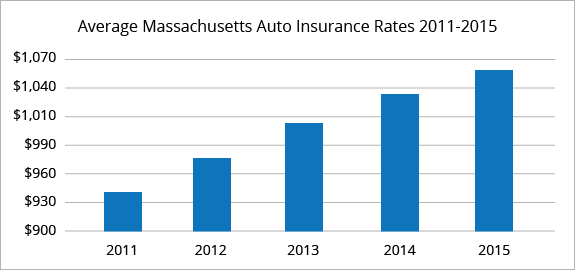

What is the typical car insurance cost? There are a wide array of factors that influence how much automobile insurance expenses, that makes it hard to get a precise idea of what the typical person pays for automobile insurance coverage (laws). According to the American Car Association (AAA), the typical expense to insure a sedan in 2016 was $1222 a year, or around $102 monthly.

Nationwide not just provides competitive rates, but likewise a series of discount rates to help our members save a lot more. So, how do I get vehicle insurance? Getting a cars and truck insurance coverage quote from Nationwide has never ever been much easier. Visit our vehicle insurance coverage quote section and enter your zip code to start the vehicle insurance quote procedure.

Not known Facts About Average Cost Of Car Insurance (2022) - Quotewizard

In nearly every state, a minimum of some quantity of car insurance coverage is required by law to get behind the wheel. Besides being lawfully needed, vehicle insurance coverage is essential to keep you protected from the financial burden of a series of bad things that can happen in, around, and to your vehicle.

We'll break down how we price Lemonade Vehicle policies, so you can get the truths and make an application for the coverage you need with self-confidence. cheap. The most simple method to get a sense of how we price Lemonade automobile insurance coverage is by making an application for coverage. It's quickly, simple, and easy to compare.

Choosing a greater deductible will usually lead to lower premiums, given that it suggests you 'd be accountable for more of the preliminary costs in the event of a mishap. accident. What the cost of Lemonade Cars and truck covers If you wish to take a deep dive into all of the coverage types provided by Lemonade Automobile, we've got you covered

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation