Welcome to

On Feet Nation

Members

Blog Posts

Top Content

The Best Strategy To Use For Best Car Insurance Companies For April 2022 - Bankrate

Most of the ads talk about how that company has the finest cost. We developed an automobile insurance calculator so you can understand what's a fair price. Remarkably, the cost or insurance can, and does, vary drastically.

Just click the button below. Insurance coverage prices differs a lot by state. Therefore, we developed a vehicle insurance calculator for each of the 50 states. Val, Option does not get paid to rate insurance coverage companies. We do this as a service to customers.

Every insurance provider wants your business, but how can you tell which to opt for for your vehicle insurance? If you desire to discover the very best vehicle insurance, it might take a little research and mindful factor to consider. In this guide, we'll reveal you how to compare various rates and suppliers, go over factors that can affect your vehicle insurance quotes, and offer a list of recommended comparison sites that will reduce the time it takes you to discover the very best car insurer.

Here are a couple of ways you can compare auto insurers and their rates: 1. Research specific insurance coverage providers Pulling up a specific insurance coverage provider's website is usually simple to do on your phone, computer, or other gadget.

When you have actually finished taking a look at one company's website, you can move onto the next and do more research with them. It's a basic method and appears simple enough, however this process can be lengthy. cheap car. To get a quote from an insurance coverage supplier, you have to input all your details and potentially your spouse's information also.

In addition, it can get confusing looking at various provider websites. Terminology is not standardized across the insurance industry. The terms business utilize for certain coverages may be different, even if they imply the exact same thing. This can make it tough to comprehend just what is being provided by each company.

Nevertheless, finding the exact automobile insurance plan that's right for you can take a while and might cost you more in time than it saves you considering that you most likely haven't become aware of each and every single supplier out there. 2. Go to an insurance coverage agent Insurance coverage representatives can be an useful resource for vehicle insurance coverage info considering that they're the professionals on the topic? It's real, they ought to know what they're talking about, however that doesn't mean you're going to have an objective interaction with an agent.

What Does Best Car Insurance Companies For 2022 - The Ascent By ... Mean?

It's in their finest interest to do so because that's who they work for. If you meet with an independent insurance representative, you'll at least get an appearance at rates from multiple insurance coverage companies.

It's also not the most hassle-free to establish a conference with a representative when you're unsure if it'll be worth your time. If you want to get the facts from every business about what they use, you 'd need to satisfy a specific agent from each company or deal with an independent agent.

Overall, this technique might have made sense in the past, today it appears out-of-date and ineffective. 3. Utilize an automobile insurance coverage comparison website If you want to know how to save cash on cars and truck insurance coverage, utilize an car insurance coverage comparison website. Auto insurance contrast websites are usually the simplest and most comprehensive technique of comparing vehicle insurance provider and rates.

You can then look at the various deals and compare them (cheapest). In a manner, this is the very same strategy as looking up specific insurer yourself, other than much quicker. You just need to submit your information one time, and then the comparison website instantly fills in the forms on each business's website for you.

Our suggestions for the finest cars and truck insurance comparison sites Vehicle insurance contrast sites offer an easy and straightforward way to quickly have a look at quotes and coverages from different insurance companies. If you were to go to each specific insurance coverage website yourself to do research, it would take a lot more time.

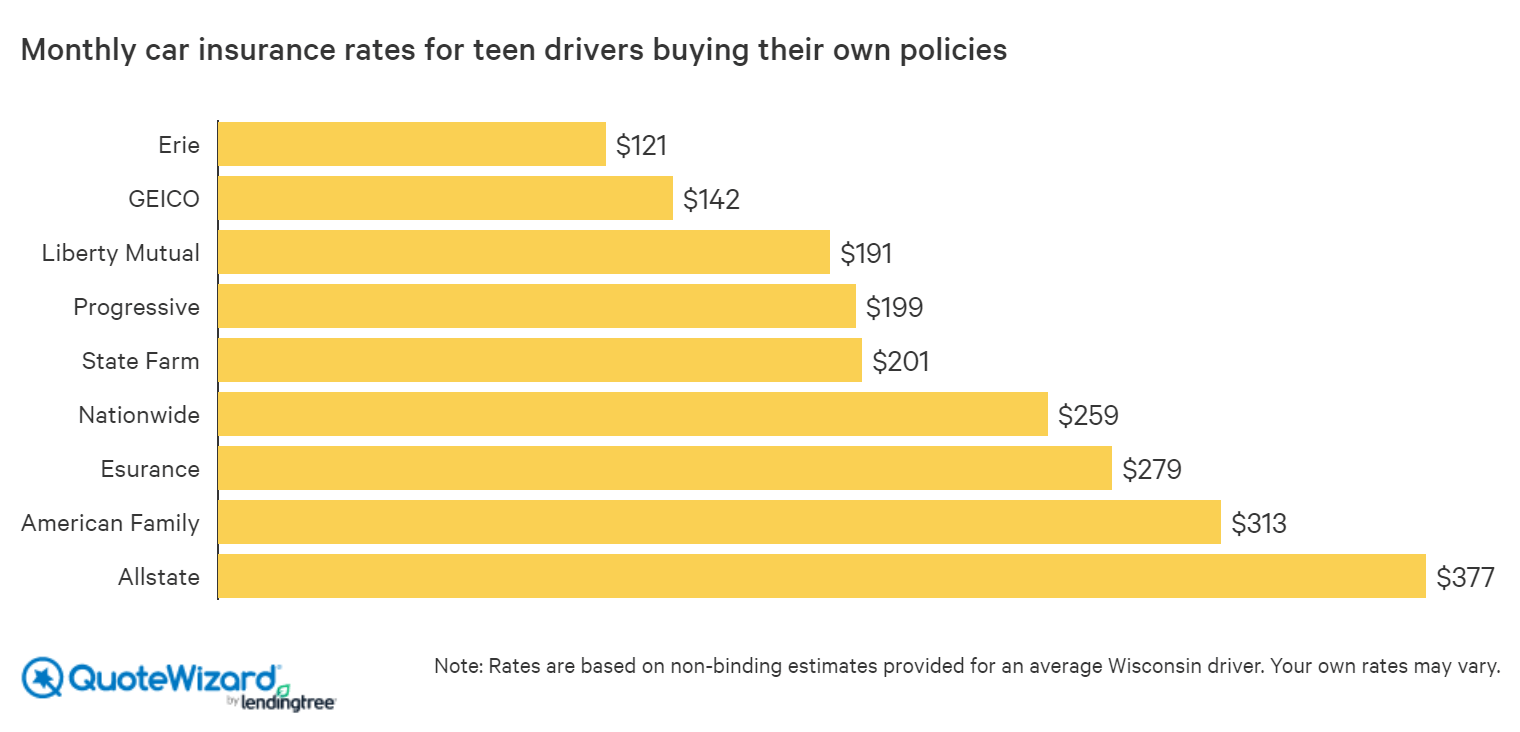

Here are our suggestions for the best automobile insurance coverage contrast websites: Price quote Wizard Quote Wizard is a straightforward comparison site that streamlines the procedure of comparing car insurance quotes - insured car. In just minutes, you could be on your way to the finest vehicle insurance rate and coverage you have actually ever had. There's absolutely nothing challenging about Quote Wizard's procedure.

There's no expense for these services, and service providers include State Farm, Allstate, Farmers, Progressive, and Liberty Mutual. The Zebra The Zebra offers quotes from over 100 suppliers and states you can save up to $670 a year by utilizing their services. For how quick they bring up rate quotes for you, that's a lot of potential cost savings.

The Definitive Guide for Best Jobs In Car Insurance - Onrec

When you've quickly constructed your profile, Supply will find the most relevant alternatives for you based on the details you supplied. There's no cost to utilize Provide Insurance's services, and there's no pressure to go with any particular business.

When comparing quotes, it's essential you compare the precise very same car insurance coverage in between different providers. You'll want to make sure the crash coverage is for the same quantity or has the very same deductible. This is necessary because one company might appear like it's providing low-cost vehicle insurance coverage, but if they don't offer the very same protection, it's not a fair comparison. risks.

Here are the key things to think about when you're taking a look at a car insurance plan: The amount you pay of pocket before insurance starts. Covers you if your car remains in an accident, consisting of with another vehicle, an object, or by itself (such as a rollover). Covers theft, vandalism, or damage to your automobile that isn't covered by accident insurance coverage.

May cover rehab expenses and lost salaries also. May likewise be called other things by the provider, but it usually means guaranteeing the distinction or some portion of the distinction in between what you owe on a vehicle loan and what your car is in fact worth. Usually covers any costs required if you break down, such as towing, battery jump-start, blowout change, and more.

Depending upon your personal preferences, you might also desire to investigate any perks or benefits that come with an insurance plan from a particular business. Some companies have great mobile apps, while others do not (auto insurance). Finally, as part of your research, make sure to take a look at consumer insurance coverage evaluations and customer fulfillment rankings of any service provider you're thinking about.

Here are some of the significant factors that impact vehicle insurance rates: Those with a great driving record may get a lower rate at-fault accidents and traffic offenses will increase your rates. cheapest. Good motorist discount rates could decrease your premium. The more costly your vehicle, the greater your rates will be.

A good credit score will help you get lower rates. If you drive more, your rates may be higher.

The Best Strategy To Use For Best Car Insurance Companies For April 2022 - Bankrate

For the quickest and most efficient way of discovering the very best rates, utilize a car insurance coverage contrast website. This will take the hassle out of searching through various insurance coverage items and spending a lot of time to discover your answers.

Rate comparisons provided here are based on our Progressive Direct automobile insurance price and item, and do not consist of prices and items offered from Progressive agents. Call Your Price is readily available in many states for brand-new policies. Rate and protection match limited by state law. Quantities got in outside of our variety of coverage costs will be shown the closest readily available coverage package.

with insurance companies associated with Progressive and with unaffiliated insurers. Each insurance provider is exclusively accountable for the claims on its policies and pays PAA for policies offered. Costs, protections and privacy policies vary among these insurance providers, who might share details about you with us. PAA's settlement from these insurance providers may differ between the insurance providers and based upon the policy you buy, sales volume and/or success of policies offered.

efforts to estimate each applicant calling us for a quote with a minimum of among these insurers by utilizing its Company owner, General Liability, Expert Liability and Workers' Payment estimating standards for the applicant's state. cheap insurance. These standards will figure out the company quoted, which may vary by state. The company quoted might not be the one with the lowest-priced policy readily available for the candidate.

Protection subject to policy terms. insurers.

Entering a mishap, specifically if you're at fault, will likely cause greater rates in the future. Some companies, such as Allstate and Farmers, might offer accident forgiveness that avoids an accident from increasing your rates. USAA, GEICO and State Farm might provide the least expensive rates if you have

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation