Welcome to

On Feet Nation

Members

-

Annie Online

-

rimeton454 Online

-

Frances Online

Blog Posts

Top Content

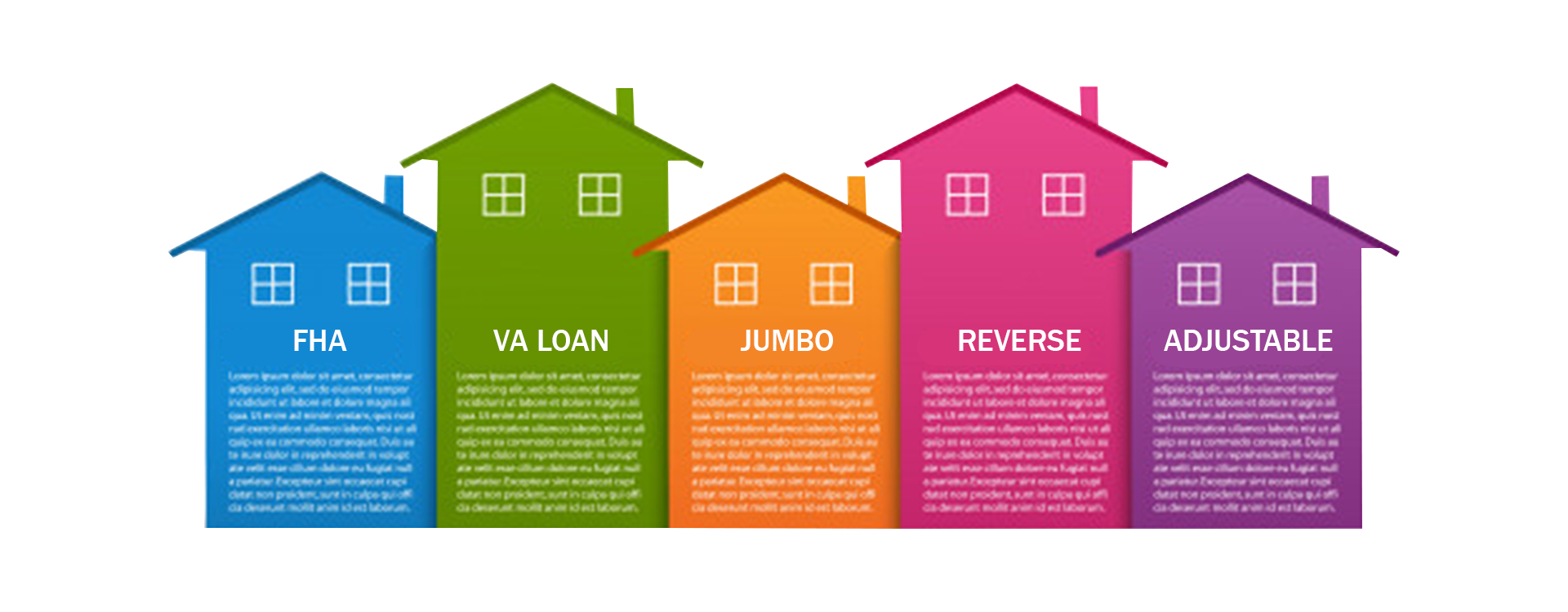

Reverse Mortgage And Also House Equity Launch

I generally pay regarding 2% average tax rate on my revenue-- and also we have nearly 40K of yearly earnings. With little to no housing price as well as a spent for automobile-- that 40K goes a lengthy way. That 2% tax does nonetheless occur from a 22% limited tax obligation rate-- 15% bracket with 50 cents of SS advantage becoming taxable on the next dollar of gross income. If at the time of death, the line of credit scores has grown to $1.184 M and the home is only worth $1M, they can compose a check out of the line and also make use of the total of the line during that time. The opposite is a non-recourse car loan, suggesting there is no shortage declares against the estate, the building is the only security for the lending.

- Your successors have 30 days from receiving the due as well as payable notice from the loan provider to get the house, offer the house, or turn the home over to the loan provider to please the financial obligation.

- The cost is a set portion of the fund's equity in your house.

- House Equity Conversion Home mortgages are federally-insured reverse mortgages and also are backed by the U.

- Consequently, this settlement may influence how, where and in what order items appear within listing groups.

- You heirs may have to scuff with each other the cash from their cost savings or offer the house to repay the lending.

We understand that everybody has cash needs that continue deep right into retirement. That company is Tulsa, Okla.-based Urban Financial of America, that makes loans up to $2.5 million. Closing prices for a typical 30-year home mortgage may run $3,000. Bankrate is compensated in exchange for featured positioning of funded products and services, or your clicking web links posted on this Florida Timeshare Rescission Period website.

Sources For All Consumers

They must be used to spend for a particular, lender-approved thing. This is generally the most economical type of reverse mortgage. Regrettably, way too many individuals delayed decisions concerning their future financial health as well long.

About Government

If you get a reverse mortgage, you can leave your house to your heirs when you pass away. However you'll leave much less of an asset to them, https://www.onfeetnation.com/profiles/blogs/compare-present-home-loan-prices as well as they may have problem maintaining the property. Nicole Pedersen-McKinnon, author of Exactly how to Obtain Home Mortgage Totally Free Like Me, claims there was a substantial tightening out there after the GFC. Financial institutions became progressively risk unfavorable, and the open-ended nature of reverse home loans equates to risk they do not intend to storage facility on their books, she says.

There are buddies, loved ones or other roommates dealing with you. In the event of fatality, your residence will be offered so the reverse mortgage can be paid off by your estate. If you have friends, family or various other flatmates remaining at your residence, they'll likely have to abandon the building.

The reverse mortgage is a mobile lending; as a result, if you relocate, you can take it with you. However, if you decide you would after that like to repay your reverse home loan or if you are moving right into a house where you are not the principal proprietor, these are the next steps. If you're in the market for a residence, look out for these 3 sorts of realty fraudand learn about financial considerations for first-time property buyers.

Retirement Planner

The loan provider isn't making a bet that you're mosting likely to die soon. He doesn't appear anymore in advance by you keeling over the year after you get the reverse home loan than thirty years later on. His revenue comes from the up-front charges, as well as if you consist of the financier in the securitized note in your definition More help of loan provider, from the years of interest.

They make a decision to get economic advice and also consider obtaining a smaller quantity. Federal government benefits-- Examine if you're qualified for the Age Pension or government advantages. The carrier pays you a minimized (' discounted') quantity for the share you sell.

So, if you assume you could want to move to a brand-new location or downsize to a smaller area anytime quickly, avoid a reverse home loan. Among one of the most considerable drawbacks of reverse mortgages is the significantly higher rates of interest. Effectively, the rate of interest billed on reverse mortgages tend to be materially greater than the rates charged on comparable kinds of lending items such as a conventional home loan or a HELOC.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation