Welcome to

On Feet Nation

Members

-

DANGERBOY Online

-

umair Online

-

seomypassion12 Online

-

rimeton454 Online

-

-

Jane Maria Online

-

babo Online

-

Micheal Jorden Online

-

farhan Online

Blog Posts

Embrace Wonders with ACIM Store Product

Posted by Ab12 on May 1, 2024 at 8:33am 0 Comments 0 Likes

Top Content

10 No-Fuss Ways to Figuring Out Your Gold as a Hedge Against Stock Market

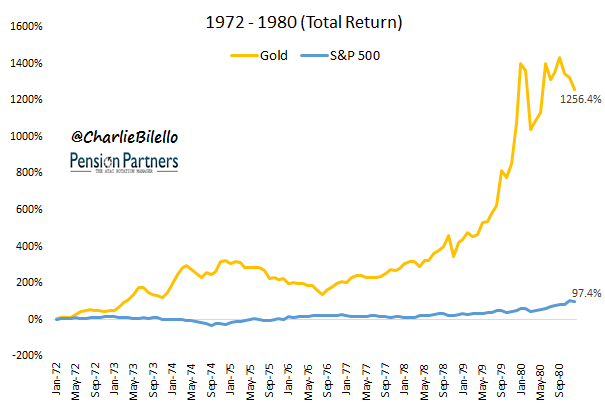

In times such as the present, holding a large Portfolio of stocks can be a stressful experience. The markets for equity have reached new record highs, however, the economic rationale for these price increases seems rather shaky.

Old-timers who managed funds during Black Monday (1987) and the Dot-com bubble (1995-2000) warn about the potential for similar events in the future at the same time that Wall Street encourages retail investors to take on even more risk.

Investors with a prominent name like Ray Dalio and Mark Mobius have publicly stated that investors should have 5 to 10 percent of their funds that they can invest invested physically Gold. For instance, the Ray Dalio All Weather Portfolio as an example, contains the 7.5% allocation to Gold.

Highly successful investors are recommending physical Gold as a way to protect themselves against the stock market , while also highlighting the danger of currency devaluations aftereffects of massive pandemic-related monetary and fiscal stimulus.

In this article, we'll explore different strategies for protecting an Portfolio of Investments against stock market and Inflation risk.

The way in which to evade against rising cost of living

There are several options that are typically thought of as in the category of inflation hedges.

Precious metals (Silver particularly)

Commodities

Real estate investment trusts (REIT)

Treasury Inflation Protected Securities (TIPS)

As with all possible Investments like all investment options, each of these asset classes have pluses and minuses that an investor should take into consideration.

Precious metals

The purchase and keeping of physical Gold or Silver can be a time-tested method for hedge against Inflation. Metals that are precious are also a good method to diversify an investment portfolio and protect against the risk of stock market volatility.

During the Great Inflation of the 1970s (1963 to 1980) Gold gained 1600 per cent and Silver soared 2700%. Investors with a sense of direction could buy Silver for $1.29 as well as gold for $35 an one ounce as of 1963. In 1980 these savvy investors could take profits on their investments at $50 or $800 per one ounce.

The most effective method to invest in Silver or Gold is to own those Precious metals and keep them in a local storage facility.

You can also be exposed to the metals through ETFs, Gold Trusts (e.g. GLD, GLD) and Silver Trusts (e.g. SLV), and certificates programs (e.g., Perth Mint).

Investors who have retirement savings that are tax-deductible can invest in physical Precious metals using those funds through the creation of an auto-directed Gold IRA. Tax-free and tax-deferred Retirement accounts can be moved into Gold IRAs.

Commodities

Commodities can be considered real asset such as orange juice and steel that is rolled. During inflationary times prices on real commodities tend to rise.

From an Investment viewpoint, there are two categories of commodities to know about: soft and hard.

The hard commodities have to be mined or drilled , and this includes precious metals, copper, aluminum crude oil, natural gas and more.

Soft commodities grow in the ground or walk over it on four hooves. Wheat, corn live hogs, as well as feeder cattle are all examples that are soft commodities.

ETFs enable investors to invest in both hard and soft commodities.

Futures on commodities are not advised due to the risk of assignment. Options on commodity futures are a possible stock market hedge however they come with the highest risk.

REIT stands for Real Estate Investment Trust (REIT)

REITs are investment vehicles that have pools of income-producing Real Estate. Inflation is a force that pushes both rental rates and property prices higher.

Investors purchase individual shares of a REIT in order to be exposed the Real Estate without taking on the burden of locating the properties, financing them, or operating the properties the properties.

Residential REITs focus on apartments, single-family houses mobile homes, single-family houses, and student housing. Commercial REITs focus on office buildings, retail stores, hotels, and other types of business properties that generate income.

A small percentage of REITs are focused on holding loans from mortgage lenders (Mortgage REIT) while the majority of REITs focus on holding properties that generate income (Equity REIT).

Treasury Inflation Protected Securities (TIPS)

TIPS also known as Treasury Inflation Protected Securities, provide the security of the Treasury bond with the assurance that the buyer will get at the very least their initial Investment back.

The principal value of TIPS bonds is the principal amount. TIPS bond will be adjusted to match the https://sites.google.com/view/registeredinvestmentadvisor/precious-metals CPI (Consumer Price Index) over the duration of the bonds. Annual coupon payments are calculated on the principal amount of the bond, so the investor receives an inflation-adjusted amount on their TIPS.

For an example, consider an investor who has $5,000 worth of TIPS with a 5-year term paying a 1% coupon rate. If the rate of inflation (as measured using the CPI) is 4percent then the value of the bonds is adjusted upwards to $15,600. The bond's coupon is then calculated based on the adjusted principal value, so the buyer receives $156 in interest for the year.

It is important to note that the investor's initial investment (the principle of the bond) is being Inflation-adjusted in this instance, however the investor is locked into a 1% interest rate instrument in an environment where higher coupon rates are likely to be available.

For investors who are cautious about risk, the lower return from TIPS could be acceptable in exchange for the sense of security that comes with the US Treasury bond.

Recommendations on how to sidestep versus rising prices

We have to be careful when we start talking about the best of anything in the investing world. The best hedge against Inflation is likely to be different for a 25-year old than for a 65-year old.

An investor's tolerance for risk also affects what their ideal Inflation hedge will look like. A risk-averse investor may avoid commodities because of volatility while the risk-tolerant investor loads up on physical Silver and shares of energy ETFs.

Why is Gold a quibble opposing Inflation

Gold is regarded as a security against Inflation due to the fact that the cost of Gold tends to increase as the purchasing ability of the currency which it is priced erodes.

The price of an gentleman’s dress is used as the most classic illustration of Gold being used as an instrument to hedge against Inflation.

In 1922, a tailor-made wool suit (a AEURoebespoke suit) and an extra pair of pants cost about $25 US Dollars, and gold was priced at $20.67 per an ounce.

Fast forward to the present and similar manaEUR(tm)s suit costs $1500 to $2000, with Gold being sold for approximately $1800 an ounce.

This is 100 years in which just one ounce Gold has shielded its owner from the devastation of Inflation.

How to buy Gold

There are numerous ways for you to make an investment in Gold. As we have already mentioned the most effective Gold Investment involves purchasing the physical metal and storing it locally where you have ready access to it.

Once the foundation is set and the foundation is set, there are many methods to make investments in Gold:

Physical Gold Trusts and ETFs (e.g., Sprott Physical Gold Trust PHYS, or GLD)

Mining stocks, warrants and options

Self-directed Precious metals IRAs (Gold IRAs)

Gold futures

The options available on Gold futures

Physical Gold Trust

These Physical Gold Trusts such as GLD (SPDR Gold Shares Trust) are misleading as they provide investors with the illusion that they own physical Gold when all the owner actually has is shares of a security which is (supposedly) tied in some way to physical Gold.

It is crucial to understand this fact: Gold Trusts are not securities, but Gold itself. These are physical derivatives Gold but they don't give an buyer any ownership interest in actual metal.

The Gold Trust shares are supposedly redeemable for physical metal, but only investors who have a solid financial foundation can do this.

The Sprott Physical Gold Trust (PHYS) will require that investors redeem their shares in 400oz increments. With gold at around $1780 an ounce that means an investor must purchase seventy-one thousand dollars of PHYS to ensure it's possible to get actual gold.

GLD, the SPDR Gold Shares Trust, has an an even more stringent threshold for receiving physical Gold.

Investors who are qualified can redeem 100,000 shares of GLD at a date and time, and can request delivery of Gold in physical form. For today’s rate (01/07/2022) that equates to an Investment of approximately $16.8 million US dollars.

Self-directed Precious metals IRA

Precious metals IRAs provide investors with a means to build a Gold stock market hedge using tax-advantaged Retirement money.

If an investor is prepared to pay the penalty of 10% for the early withdraw of tax-deferred and tax-exempt money (401K, 403b or traditional IRA or traditional IRA, etc. ) The money is basically locked in a type of IRS-approved Investment vehicle until the age of 59 and 1/2 .

Gold IRAs fall in this category of approved investments and offer investors the protection and security of physical Gold ownership, without paying penalties or taxes in the process.

Verdicts

In this short article we've discussed primarily the use of Gold to hedge against the stock market risks caused by inflation.

Stock Portfolios can be subject to other risks in addition to Inflation. There is equity

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation