Welcome to

On Feet Nation

Members

-

goditac499 Online

-

Thomas Shaw Online

-

JamesWilson09 Online

-

Aarti Ghodke Online

-

-

Blog Posts

Premium Quality Stainless Steel Clamp Manufacturer in India - Ladhani Metal Corporation

Posted by Ladhani Metal Corporation on September 23, 2024 at 3:30am 0 Comments 0 Likes

Ladhani Metal Corporation, a well-known Stainless Steel Clamps Manufacturer in India, is a prominent participant in the country's…

ContinueUnprecedented Growth: Green Ammonia Market

Posted by Aarti Ghodke on September 23, 2024 at 3:20am 0 Comments 0 Likes

The Green Ammonia Market is poised for significant growth, with its size valued at USD 408.75 million in 2023 and expected to reach USD 40,772.17 million by 2030, growing at an extraordinary CAGR of 93% over the forecast period. Green ammonia is produced by combining green hydrogen and nitrogen through an electrochemical Haber-Bosch system, offering a carbon-free alternative for industrial use. This process utilizes electrolyzers, powered by renewable… Continue

How to Pick the Best Slots on Gudang138 Using RTP Data

Posted by geekstation on September 23, 2024 at 3:18am 0 Comments 0 Likes

Global Energy Storage Market to Expand at 19% CAGR, Valued at USD 20.97 Billion in 2023

Posted by Aarti Ghodke on September 23, 2024 at 3:15am 0 Comments 0 Likes

The global Energy Storage Market was valued at USD 20.97 billion in 2023 and is projected to grow at a robust CAGR of 19%, reaching USD 70.89 billion by 2030. Energy storage systems (ESS) are becoming essential in the transition towards renewable energy, offering solutions for grid stability and managing the variability of renewable sources like solar and wind. Despite the declining costs of these systems, significant investments and supportive policies… Continue

Top Content

4 Easy Facts About Best Car Insurance For Young Adults - Bankrate Shown

This is the typical distinction between the different car insurance coverage rates for different profiles. Distinction in between teen vehicle insurance coverage and young driver car insurance This is also a very important area to cover for all the parents and the teenager and young drivers. A lot of moms and dads get confused between teen cars and truck insurance and young driver automobile insurance coverage.

It is very important to understand that teen cars and truck insurance is different from automobile insurance coverage for young drivers. Teenager cars and truck insurance is for the teenagers that are legally eligible to drive; drivers in between 16 years and 19 years old. While young motorists are the ones in between 21 years and 25 years of age.

Some nationwide insurer still consider teen drivers and young drivers the same. It can be a bit pricey for young motorists and a bit economical for teen motorists. It is always much better to make it clear with your provider. Before buying your policy, ask the insurance provider about teenager motorists and young chauffeurs.

The location where the chauffeur lives play a significant role in the car insurance expense. A motorist living in Hawaii may get lower insurance coverage rates as compared to a driver in California.

Facts About Cheapest Car To Insure For Teenager: Everything You Need To ... Uncovered

These elements include the condition of the roadway, the environment type, and the criminal activity rate of the state. The business then analyses all these aspects and then chooses what the insurance rate will be for the driver., if a state has high crime rates then the possibilities of car stealing are greater.

The gender of the motorist affects a lot on the cars and truck insurance expense for any state, city, or location. Typically, we can say that a male teenager driver needs to pay $380 extra as compared to a female teen motorist. As per the insurance coverage providers around the nation, have much clean record and zero to one at-fault mishap on record.

Plus they tend to cross the speed limit more as compared to female chauffeurs. As an outcome, insurer discover female motorists much more secure clients than male chauffeurs. Usually, the female teen driver pays $3180 for minimum coverage, while a male chauffeur pays $3975 for minimum protection. Let's see the breakdown of this to have a clear photo.

Adding a teen child can increase your insurance coverage rates by $1098 every year. And this is much lower than the typical insurance coverage expense for a male teen chauffeur. The reason behind this is; according to insurance carriers around the country, female motorists are much safer as compared to male chauffeurs. These rates vary for different vehicle insurance companies.

The Best Car Insurance For Young Adults - Bankrate PDFs

Get as many discount rates as possible The best part of getting teen cars and truck insurance coverage is you can obtain a trainee discount rate. Every business has its terms for trainee discounts. On average, the motorist needs to have at least an average of B grade or greater to get qualified.

And then you just need to compare the rates from all these business to examine which one has the most inexpensive rates. By integrating the rates you'll get a much better concept of how different companies charge for the exact same policy. Yes, each company can have a various rate for the very same motorist.

Insurance provider link the automobile to either a beacon-like device or an app. This assists them to save the associated to the driving routines. Based on this information the insurance carrier can supply you a personalized insurance rate. But it is essential to remember that if the business discovers that your driving routines threaten then the rates can also increase.

Add a teen motorist to the moms and dad's policy The finest method to get the most inexpensive car insurance for brand-new drivers is to include them to their moms and dad's policy. There are some amazing advantages of staying in your moms and dad's policy.

The Greatest Guide To How To Save On Car Insurance For Teens

Plus you'll likewise get other discounts like multiple automobiles discount rates and even great and knowledgeable chauffeur discount rates. Integrating all these discount rates your insurance coverage rates can get reduced to nearly 60 percent of your existing rates. Furthermore, if the parents have spent for the cars and truck then it is required to get an insurance coverage under the moms and dad's name.

Thus they have no other choice than to add their policy under their moms and dad's existing policy. 5. Prevent high-value automobiles for the teen chauffeurs Yes, we understand your teen kid or daughter is requesting that high valued high-end vehicle. However the insurance rate for that automobile can nearly be double that of any low-valued car.

Again this can impact your insurance coverage rates. The actual cost value of that car will be low thus your insurance business will supply lower insurance coverage rates for the automobile. Can my teen drive my cars and truck if he or she is not listed on the policy?

If the person enters a mishap then the company can deny the claim. 2. Do teenagers require to get complete coverage cars and truck insurance? No, teen chauffeurs can drive legally with the state's minimum needed coverage. However full protection insurance is suggested for teenagers to avoid huge repair work bills. 3.

How Much Does It Cost To Add A Teenager To Car Insurance? Things To Know Before You Get This

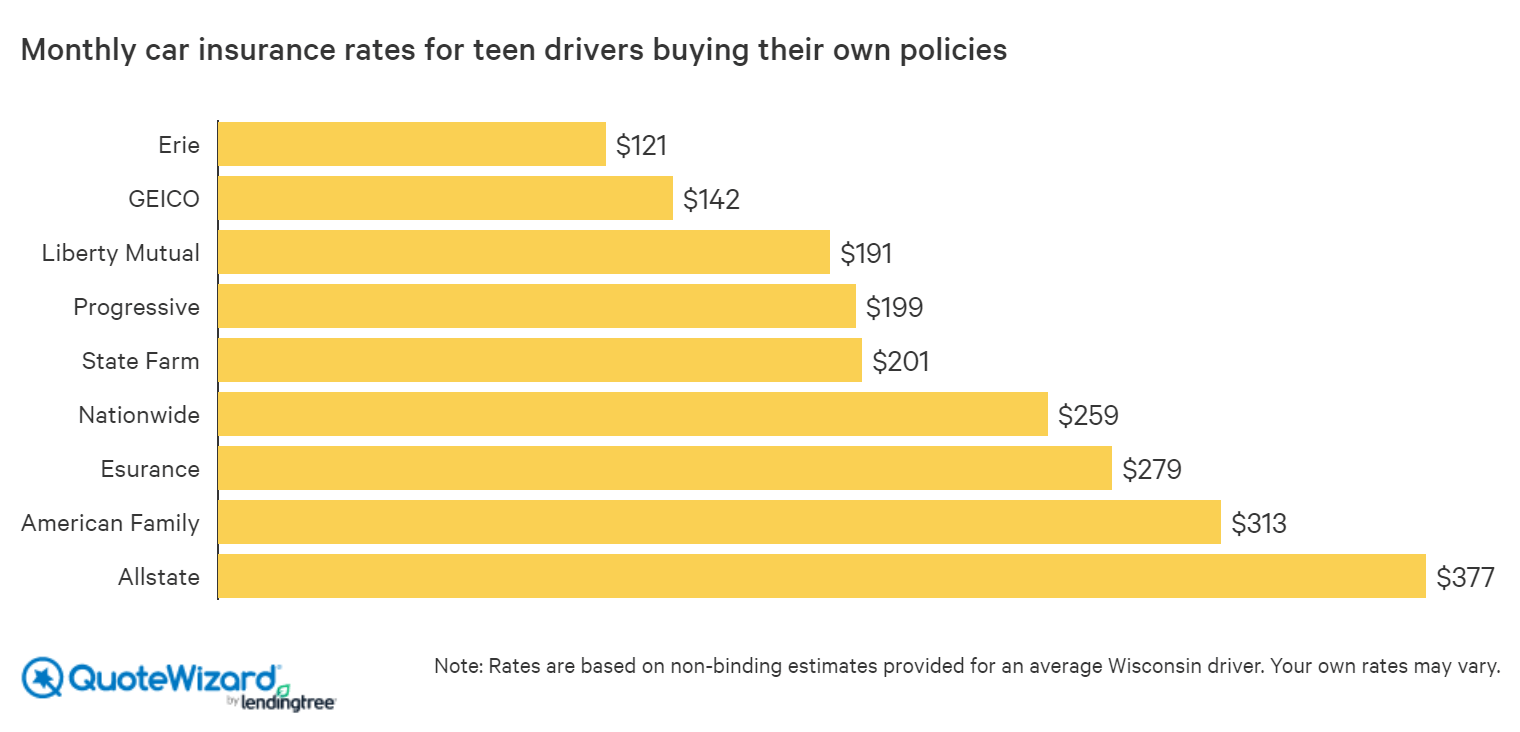

The factor behind this is; as per the insurance coverage business around the country, teen motorists have the greatest involvement in big road accidents. Plus they get involved in negligent driving and DUIs. 4. Which is the very best company to purchase cars and truck insurance for 17 years old? Offering the credit to one business will be unjust to other companies.

The leading five automobile insurance coverage companies for teen motorists are; Allstate, Progressive, Erie, Nationwide, and USAA. Is it better to add the teenager motorists to the parent's policy? Adding a teenager motorist to a parent's policy can be a clever choice.

Still, have some doubts about buying cars and truck insurance for teenager chauffeurs? We have an expert group for you. Get in touch with us today and talk about all your inquiries.

When shopping for the most inexpensive car to insure for a teenager, you must consider a number of factors in addition to the type of car. Some of these aspects include the teen's age, state of house, and gender. Most Affordable Automobiles to Insure for Teenagers, These are the top 10 least expensive vehicles to insure for teenagers, including the typical yearly automobile insurance expense: Mazda MX-5 Miata: $2640.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation