Welcome to

On Feet Nation

Members

-

Peter Online

-

Thomas Shaw Online

-

vanchuyenachau Online

Blog Posts

Dịch vụ vận tải hàng hóa đi Đồng Nai chuyên nghiệp

Posted by vanchuyenachau on April 26, 2024 at 12:03am 0 Comments 0 Likes

Giới thiệu top 5 công ty vận tải hàng hóa bắc nam đi Đồng Nai uy tín nhất hiện nay

Vận chuyển Á Châu vinh hạnh được xếp đứng đầu danh sách công ty vận tải chuyên nghiệp

Đội xe hoạt động liên tục đều đặn các ngày trong tuần, thời gian vận chuyển 3 - 4 ngày hàng đi Bắc Nam và 2 - 3 ngày hàng từ miền Trung đi ĐỒng Nai

Giá cước cạnh tranh, dịch vụ uy tín chất lượng…

Top Content

5 Best Trading Platforms For Beginners 2021 - Stockbrokers.com

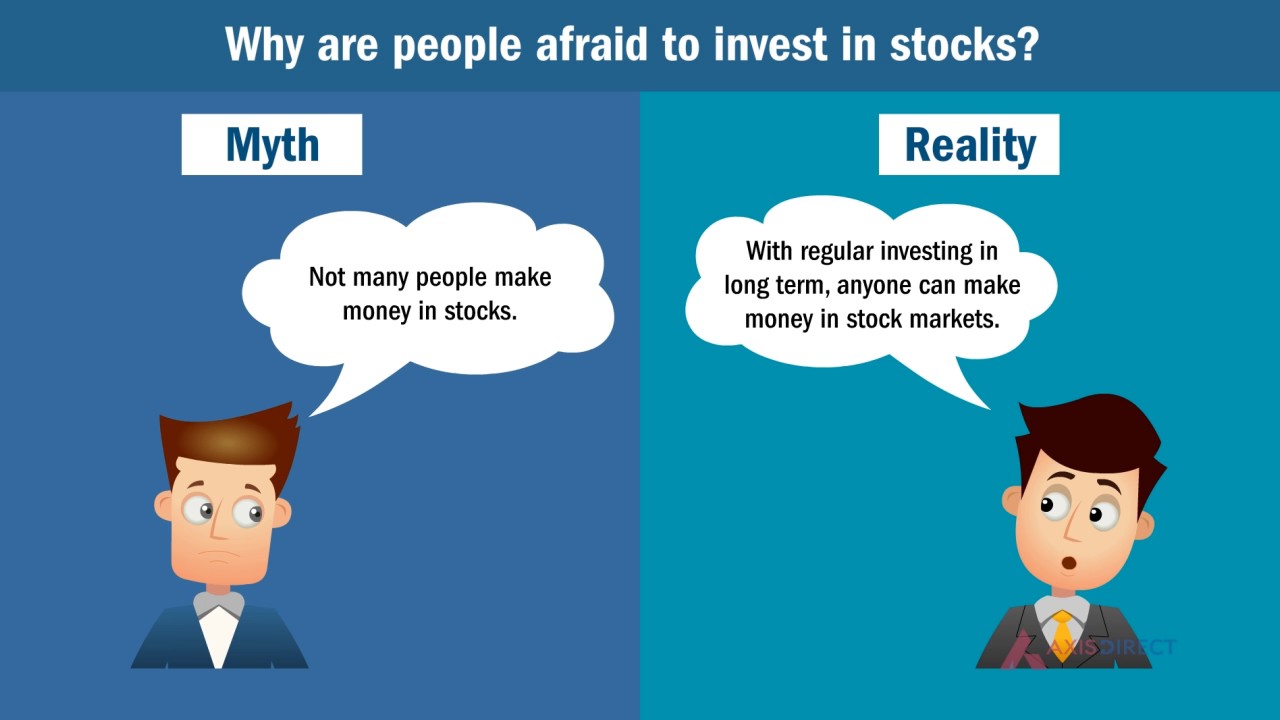

Wanting to maximize your cash and beat the cost of inflation!.?. !? You want to purchase the stock exchange to get higher returns than your average cost savings How to Start Investing in Stocks account. However learning how to buy stocks can be daunting for someone simply starting. When you buy stocks, you're acquiring a share of a business.

There are various methods to invest and utilize your cash. There's a lot to understand prior to you get begun investing in stocks. It is essential to understand what your essential objectives are and why you wish to begin investing in the very first place. Understanding this will assist you to set clear objectives to pursue.

Do you want to invest for the brief or long term? Are you conserving for a down payment on a home? Or are you attempting to construct your savings for retirement? All of these circumstances will impact just how much and how strongly to invest. Lastly, investing, like life, is naturally risky And you can lose cash as easily as you can earn it.

One last thing to think about: when you anticipate to retire. For instance, if you have 30 years to conserve for retirement, you can use a retirement calculator to examine how much you might need and how much you need to save every month. When setting a budget, ensure you can manage it which it is assisting you reach your goals.

Investing in small-cap, mid-cap, or large-cap stocks, are a way to buy different-sized business with differing market capitalizations and degrees of danger. If you're wanting to go the Do It Yourself route or want the alternative to have your securities expertly managed, you can consider ETFs, shared funds, or index funds: ETFs are a type of exchange-traded financial investment product that must register with the SEC and allows financiers to pool money and buy stocks, bonds, or properties that are traded on the US stock market.

Index-based ETFs track a particular securities index like the S&P 500 and invest in those securities included within that index. Actively handled ETFs aren't based on an index and rather aim to accomplish an investment goal by purchasing a portfolio of securities that will meet that goal and are handled by a consultant.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation