Welcome to

On Feet Nation

Members

-

GRAHAM MULFY Online

-

rimeton454 Online

-

Deuslye Online

-

Khalid Shaikh Online

-

jack452 Online

-

James carter Online

Blog Posts

Top Content

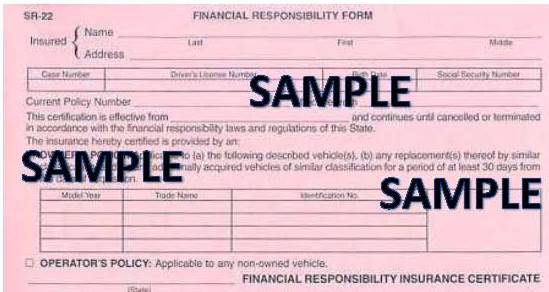

An Unbiased View of Illinois Sr-22 Insurance

Do you require even more info on SR22 Insurance Needs as well as car insurance policy protection? To obtain a customized vehicle insurance quote, telephone call Insurance policy Navy today at 888-949-6289. * This item might not be offered in every state, please contact one of our insurance representatives for more info.

There are several methods a person's vehicle driver permit can be suspended under the Mandatory Insurance Coverage Legislation. Detailed listed below are the reasons an individual can be suspended as well as the reinstatement needs. - If you have been suspended since you were involved in an accident in Missouri as well as a judgment was made against you in court for falling short to spend for the problems, you have to send the adhering to items to the Motorist Permit Bureau prior to you can be reinstated: A court approved installment (repayment) plan or accredited file from the court showing that you have actually spent for the problems in complete - liability insurance.

You have 10 days from the mail day shown on the notice to file the accident report - dui. If you fall short to do so, your motorist certificate and/or car enrollment will be put on hold. If you have actually been suspended for stopping working to submit a mishap record, you must send out the following products to the Vehicle driver License Bureau prior to you can be reinstated: A finished.

$20 reinstatement cost. Money order or individual check is acceptable. Please include your full name, day of birth, as well as driver license number. - If you have been put on hold because you were the individual responsible in a crash and also fell short to pay the various other person(s) in the mishap for the vehicle/property damages or personal injuries, you have to send out the following products to the Driver License Bureau prior to you can be renewed: Proof that you have paid or cleared up the accident with the various other individual(s).

You must send the adhering to products to the Driver Permit Bureau prior to the end of the suspension duration prior to your driver permit can be renewed on the qualification day: Evidence of responsibility insurance policy (duplicate of your insurance coverage recognition card) - car insurance. Proof of insurance policy have to be kept for 3 years from the date you became eligible to be renewed.

Things about Sr-22 & Insurance: What Is An Sr-22? - Progressive

$200 if it is your 2nd infraction (dui). $400 if it is your 3rd or subsequent infraction (insurance group). - If you have actually been suspended since you were entailed in a crash in another state as well as you did not have any kind of insurance coverage in result at the time of the crash, you have to send the complying with products to the Driver License Bureau before you can be reinstated: Reinstatement or Clearance Letter from the state where you were associated with the crash.

The SR-22 filing is called for if you were initially suspended as a result of a car mishap. If not, you can submit proof of insurance by offering a duplicate of your insurance policy recognition card. Evidence of insurance policy need to be kept for the remainder of the three-year period that you were initially called for to keep an SR-22 filing.

If you're somebody who has actually lately been founded guilty of website traffic infractions, including a DUI, negligent driving, or driving uninsured, it's most likely you're going to require an SR22 (deductibles). This asks the concern, just what is SR22 insurance policy, and also what is it utilized for? An SR22 is an extremely essential document for those who have a background of driving-related violations.

It can often be gotten along with the automobile insurance policy coverage you pick. This means you'll be paying higher insurance costs for your automobile than somebody without any crashes or violations on their document, and it will certainly limit your selection in insurance companies.

There are lots of concerns chauffeurs finish up having about SR22s, along with a variety of various other details they ought to recognize if they occur to require one. Discover additionally as we discuss what you ought to recognize about just how these filings function, why you might require one, just how to discover budget-friendly SR22s and even more in our short article listed below. insurance companies.

Fascination About Sr-22 Information : Oregon Driver & Motor Vehicle Services

In fact, SR22s don't elevate the rate of your insurance coverage. You will certainly often listen to an SR22 referred to as SR22 insurance policy, which perplexes lots of people into believing it's a specific type of insurance coverage.

The SR22 is just a document confirming that your insurance provider guarantees you are bring the correct coverage legitimately mandated by the court to a state's DMV. You will have the necessary auto insurance policy in addition to the SR22. The state has to be exceptionally attentive when it comes to controling which drivers ought to not be enabled back out when traveling, specifically with offenses such as driving under the impact, without insurance, or recklessly to the factor of endangerment - auto insurance.

A DUI conviction is an additional reason, as we mentioned formerly. Getting into a car mishap while uninsured is additionally a common cause for an SR22. If you are in a mishap as well as you have no coverage, you will not be able to appropriately cover any damages or injuries to the other motorist and their vehicle. insurance.

These factors are added to your vehicle driver's certificate after each significant offense you have actually had. The DMV and also your vehicle insurance policy business will certainly maintain track of the amount of offenses you have as well as if you have actually ended up being a responsibility when traveling. So, if you are labelled as a constant web traffic wrongdoer, you might additionally need the SR22 to get your permit restored.

While SR22s will obtain you back on the roadway quicker, you must remember it will be expensive - car insurance. Just How You Can Obtain an SR22 You can obtain your SR22 from an insurance coverage business, but you'll have to acquire the car insurance coverage. The objective of the form is to show that you've gotten and also will certainly preserve particular insurance policy protection.

A Biased View of Washington And Oregon Sr-22 Insurance Quotes - Vern Fonk

This will reveal that you have insurance policy coverage and also limitations mandated by regulation. You will get your own copy you can utilize as evidence of verification (car insurance). If needed, many states keep this electronically in their records so it can be looked up promptly when required by the Department of Motor Vehicles.

What is SR22 Non-owner Auto Insurance Coverage? When you have an owner-operator certificate, any chauffeur running the automobile is covered.

What is The Cost of SR22 Insurance Policy? An SR22 can set you back vehicle drivers a whole lot in terms of insurance rates, however have you ever asked yourself exactly how much it would actually take to cover a year's worth?

While the very best cost is usually around $15, you might be paying as long as $50 for the single charge for declaring, depending on what company files it and also the amount of fees are consisted of in the insurance coverage you're checking out. The cost of SR22 filings varies and also will typically be much extra costly than a plan without one, according to The typical boost in your prices is 89%, but it can range from 31% completely to 375% (credit score).

SR22 Insurance Costs in Different States While you can get a harsh price quote of what SR22s price, it will certainly be identified by the state you reside in. This is why it's useful to have a suggestion of what they set you back from state to state. For instance, in Illinois, you have an ordinary insurance protection price of $1,176, which goes up to $2,217.

The 30-Second Trick For Understanding Sr22 Insurance And How It Works

If you remain in a state such as Wisconsin, you'll see a 56% rise of $1,784 from $1,147, just a $647 distinction. You can browse the web to all states and also their prices when an SR22 is added. Will my Insurance Coverage Rates Decrease When I No More Need To Lug SR22 Insurance Policy? It is not assured that your prices will certainly drop after you are no much longer called for to lug an SR-22, but it might take a while for them to return.

For DUI sentences, your rate might never return down once again and also can become worse relying on other traffic offenses in the meanwhile. The length of time am I Called for to Have an SR22? You would be required to preserve an SR-22 in many states for three years, with the duration varying from one to five years. division of motor vehicles.

You must likewise realize that the beginning date and also for how long you need to lug an SR-22 varies by state, so it helps to contact the Division of Motor Automobiles in your details state to discover when

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation