Welcome to

On Feet Nation

Members

-

asimseo Online

-

SpaDeals123 Online

-

DANGERBOY Online

-

basitkhatr6666 Online

-

Snehal Shaha Online

-

Blog Posts

Lucky88 đưa tin: Sốc với cảnh ngôi sao ĐT Pháp bị buộc xích vào cổ

Posted by Lucky88 on April 29, 2024 at 5:45am 0 Comments 0 Likes

Sốc với cảnh ngôi sao ĐT Pháp bị buộc xích vào cổ

Xem thêm: https://lucky88.vip/news/category/Nhan-dinh-bong-da

Lễ ăn mừng hoành tráng của Inter được tổ chức sau chiến thắng 2-0 trước Torino tại vòng 34 Serie A. Thầy trò HLV Simone Inzaghi diễu hành trên xe bus giữa… Continue

The Candle Builders Compendium Titles for Accomplishment

Posted by Ab12 on April 29, 2024 at 5:45am 0 Comments 0 Likes

As clients see the variety of candles, their eyes alight with question, the candle… Continue

Hepatitis C Treatment Market Share, Overview, Competitive Analysis and Forecast 2031

Posted by Prajakta on April 29, 2024 at 5:44am 0 Comments 0 Likes

FutureWise Research published a report that analyzes Hepatitis C Treatment Market trends to predict the market's growth. The report begins with a description of the business environment and explains the commercial summary of the… Continue

Culinary Creativity with Seafood Inspiring Menus with Quality Ingredients from Suppliers

Posted by jackharry on April 29, 2024 at 5:43am 0 Comments 0 Likes

Top Content

How What Is The Most Important Car Insurance Coverage? - The ... can Save You Time, Stress, and Money.

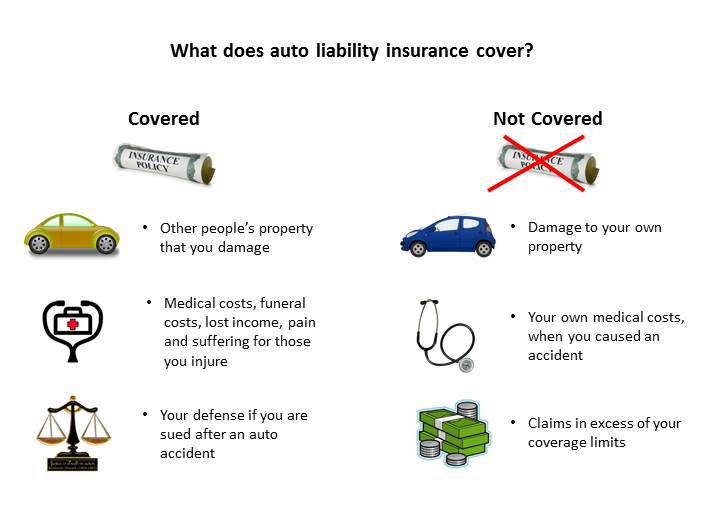

com to identify specifically just how much you directly may require. With many kinds of auto insurance readily available, it can be tricky decoding which intends make one of the most sense as well as just how much you'll need of each. Among one of the most usual are liability insurance coverage, which spends for others injuries or building damages when you cause a cars and truck mishap, as well as uninsured driver insurance coverage, which pays for your medical costs if a person without insurance or with inadequate insurance policy collisions into you as well as you or your automobile experience injuries (cheaper auto insurance).

If your vehicle breaks down or you're in a crash and also your automobile goes to the store, rental insurance coverage will certainly cover the expense of a rental cars and truck for the days your auto isn't driveable. Commonly, you'll be qualified to rent an automobile as much as a specific dollar amount and also you'll be reimbursed by the insurance provider for the price of the automobile (cheaper auto insurance).

If this all appears really expensive, remember this: Getting a higher deductible can decrease the premium. "The deductible is what you need to pay when you sue as well as the insurance coverage business gets the remainder of the loss. If your vehicle experiences $2,000 in problems and you have a $500 deductible, your insurance provider will certainly provide you $1,500 for the problems," states Masterson - insure.

With the ordinary price of a new cars and truck at $30,000, however, acquire at least $35,000 in insurance coverage. When a hit-and-run motorist, or somebody that's inadequately insured, strikes your vehicle, uninsured-motorist and underinsured-motorist insurance coverage pays for the clinical, rehabilitation, funeral, and pain-and-suffering costs of the sufferers in your car - low cost.

Buy this protection at the exact same limits as your bodily-injury responsibility protection. Commonly referred to as "no-fault," this covers medical, recovery as well as funeral expenses for family participants, as well as some lost wages and also at home treatment. Unless your health and also impairment coverages are small, get the minimum called for. If your budget plan permits, think about the complying with alternatives: Pays to repair or replace your cars and truck after a mishap.

Pays if your auto or its components are swiped, or if your automobile is damaged by fire, water or various other risks. Lenders will certainly also need this insurance coverage. For both, you'll have to pick a deductible: a buck amount you fork over to the repair shop prior to the insurance provider antes up (risks).

Get This Report about Automobile Insurance - Nc.gov

Call teenagers as the periodic drivers of your least-expensive car, and also make sure they only drive that vehicle (automobile)., as well as your background of insurance claims with various other insurance providers.

A minimum amount of automobile insurance is called for in virtually every state, however also in the states where car insurance coverage is not needed, you're still obliged to spend for any damages you trigger with your cars and truck, as well as the ideal means to do that is to have cars and truck insurance policy. Many states simply need responsibility coverage, which covers any residential property damages or injuries you are accountable for (cheaper).

Some states also require injury defense (PIP) and some need at the very least some quantity of uninsured/underinsured motorist (UM/UIM) protection. Your state's needed minimums are a just starting factor when it comes to establishing your insurance coverage limits. They don't give sufficient protection for a lot of people to guarantee they are safeguarded in situation of a mishap.

There are just 2 states that do not require you to have a minimum quantity of car insurance: New Hampshire and also Virginia. In Virginia, vehicle drivers can pay the state a $500 fee instead of automobile insurance. However even in these states, motorists are still liable for spending for the damage they cause, and the very best means to make certain you can do that is to have vehicle insurance policy.

You might not need to purchase even more than the legally called for minimum in your state. As long as you have health and wellness insurance coverage and some type of disability insurance and understand your passengers do too you'll probably have the ability to cover any kind of medical expenditures or lost incomes after a crash (credit). Just how much uninsured/underinsured vehicle driver protection do I need? Uninsured/underinsured motorist coverage (UM/UIM) covers the expenses if you remain in an accident brought on by a motorist who either doesn't have insurance, or whose insurance policy can not pay for the complete extent of the damage they created.

Some car insurance companies provide individual thing insurance coverage, which covers personal possessions in your cars and truck if they're damaged or swiped, as well as separate rental car replacement insurance coverage to pay for a rental car if your own is in the shop after a covered loss. If you're a rideshare chauffeur, you might additionally desire to see if your auto insurance coverage provider supplies rideshare coverage to shield you throughout the time that your application gets on but you don't have a guest. The ordinary cost of cars and truck insurance in the United state

This is what vehicle drivers pay on average for various degrees of coverage: State minimum insurance coverage$621Full protection (50/100/50)$1,721 Complete protection (100/300/100)$1,822 The exact amount you'll pay for automobile insurance policy will certainly depend on a number of individual aspects like your age, where you live, the make as well as model of your automobile, as well as your driving history - vehicle insurance.

We do not sell your details to third parties. Regularly Asked Inquiries, Is $4,000 a whole lot for auto insurance policy? The average cost of cars and truck insurance in the U.S. is around $1,652 each year, so in contrast, yes, a $4,000 costs is an above-average rate for vehicle insurance policy. The quantity you pay for automobile insurance policy can depend on lots of private factors, like your age, your driving background, as well as where you live.

The ordinary price of car insurance coverage in the U.S

This is what chauffeurs pay on standard for different degrees of insurance coverage: State minimum protection$621Full insurance coverage (50/100/50)$1,721 Full coverage (100/300/100)$1,822 The specific amount you'll pay for auto insurance will depend on a number of private factors like your age, where you live, the make and version of your vehicle, and your driving history.

8 Easy Facts About Idoi: Auto Insurance - In.gov Described

The typical expense of automobile insurance policy in the United state is around $1,652 per year, so in contrast, yes, a $4,000 premium is an above-average price for auto insurance coverage. The quantity you pay for automobile insurance policy can depend on numerous specific factors, like your age, your driving history, and where you live.

If you have a home or have financial savings, both could be taken to pay your debt. Setting reduced coverage limits can suggest reduced rates, yet you take the chance of needing to pay much, a lot more than you'll save by skimping on insurance coverage. Just how much is car insurance policy? The typical expense of automobile insurance coverage in the U.S

This is what drivers pay generally for different levels of protection: State minimum coverage$621Full protection (50/100/50)$1,721 Full insurance coverage (100/300/100)$1,822 The specific amount you'll spend for automobile insurance will certainly depend upon a number of individual elements like your age, where you live, the make as well as design of your car, and also your driving background.

We do not market your details to 3rd parties. Often Asked Inquiries, Is $4,000 a lot for automobile insurance? The ordinary price of car insurance coverage in the U.S. is around $1,652 annually, so in contrast, yes, a $4,000 premium is an above-average rate for vehicle insurance policy. Yet the quantity you pay for vehicle insurance coverage can depend on numerous private factors, like your age, your driving history, as well as where you live.

If you have a home or have cost savings, both can be taken to pay your financial obligation - trucks. Setting reduced insurance coverage restrictions can imply low rates, however you run the risk of having to pay a lot, a lot more than you'll save by skimping on coverage. Just how much is car insurance? The average cost of cars and truck insurance in the U.S

Some Known Details About Car Insurance Calculator - How Much Insurance Do You Need?

This is what motorists pay on standard for various degrees of protection: State minimum coverage$621Full coverage (50/100/50)$1,721 Complete insurance coverage (100/300/100)$1,822 The specific amount you'll pay for auto insurance coverage will depend on a variety of specific variables like your age, where you live, the make and also version of your car, and your driving background.

We don't market your details to 3rd parties - dui. Regularly Asked Inquiries, Is $4,000 a lot for vehicle insurance policy? The

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation