Welcome to

On Feet Nation

Members

Blog Posts

Top Content

Indicators on Car Insurance Claims: Understand The Do's And Don'ts - Salvi ... You Should Know

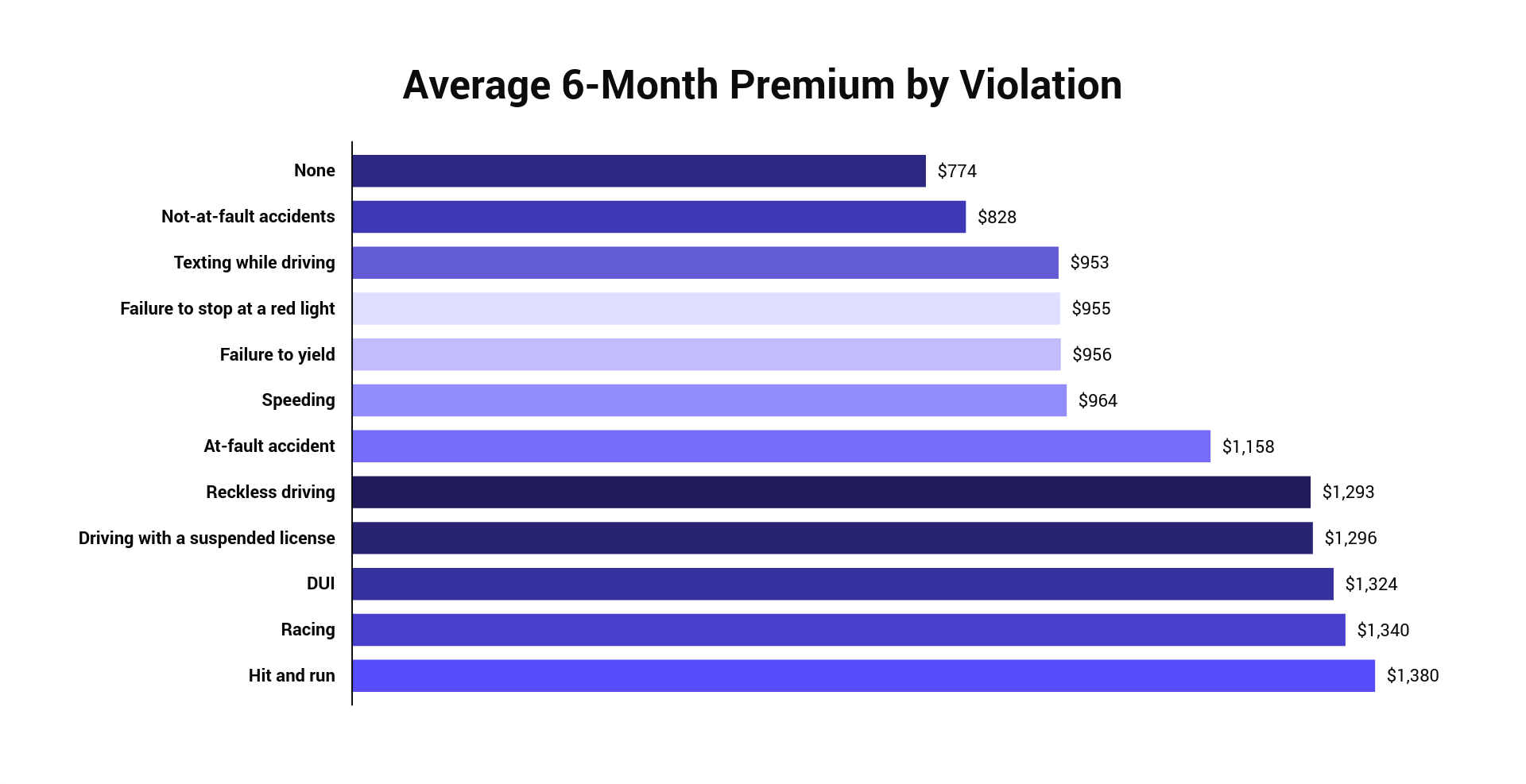

"The majority of states use a point system to track infractions by chauffeurs, and usually, points will accumulate on your driving record if you remain in an at-fault accident or several, or if you're founded guilty of specific traffic offenses." It's the points on your driving record that the insurer see as a red.

flag and a factor to raise your rates,"says Adams. Why Do Insurance Rates Go Up After an Accident? For insurance coverage companies, it's everything about threat. The more driving danger you demonstrate, the more you might have to pay for your auto insurance premiums. Following a mishap, you'll normally file a claim and pay out your deductible. Your insurance company will adjust your rates after an accident to reflect any new information they have on your driving history.

The How Long Does An Accident Stay On Your Record In Ny? PDFs

The expense of your car insurance premium is based on a number of elements, from your age, gender, marital status, and where you prepare to park the vehicle, to your driving historyincluding any mishaps or traffic violations on your record. Just due to the fact that you have actually had accidents in the past does not indicate your insurance premiums will be affected forever. While the particular calculations utilized to identify premium costs differ from one insurance business to another, it may be helpful practical drivers motorists know understand long accidents generally normally stay remain their insuranceInsurance coverage

In general, you can expect more severe mishaps, such as ones caused by driving under the influence (DUI)or careless driving, or multiple accidents in a short period of time, to stay on your record longer than a minor single mishap. Having a major at-fault accident or multiple at-fault accidents on your record likely will result in a superior boost for a few years, too. The excellent news: you probably do not require to tension about that car accident you were in more than five years back, Unlike other types of records, like your, mishaps and other events don't instantly disappear from your driving record after a set quantity of time.

Additional charges will trigger this theoretical chauffeur's vehicle rates to increase, and the quotes offered to this driver on Insurify will increase as an outcome. Over time, as we see, car premiums will decrease back to their initial price point (in the majority of cases with non-standard carriers) or to a rate that's only slightly greater. Typically, this policy only uses to your first at-fault mishap. The intensity of the accident likewise contributes, too. A small accident that doesn't result in any injuries is unlikely to result in a sky-high rate hike. On the other hand, a significant accident with injuries or residential or commercial property damage is far more most likely to affect your premiums. If you have a longstanding history of excellent driving practices, keep it up! Whether you recognize it or not, it's saving you a little bit of cash each month. Alex Lancaster is an author, traveler, and cat person living in Southern California. With a background in copywriting and content strategy, she loves simplifying the complex and making connections.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation