Welcome to

On Feet Nation

Members

-

Peter Online

-

Thomas Shaw Online

-

vanchuyenachau Online

Blog Posts

Top Content

Marketing Technique For Your Business

Think of an Olympic archer. He knocks the arrow, draws the string, aims, and launches the arrow as it flies real and straight into the center of the bull's eye.

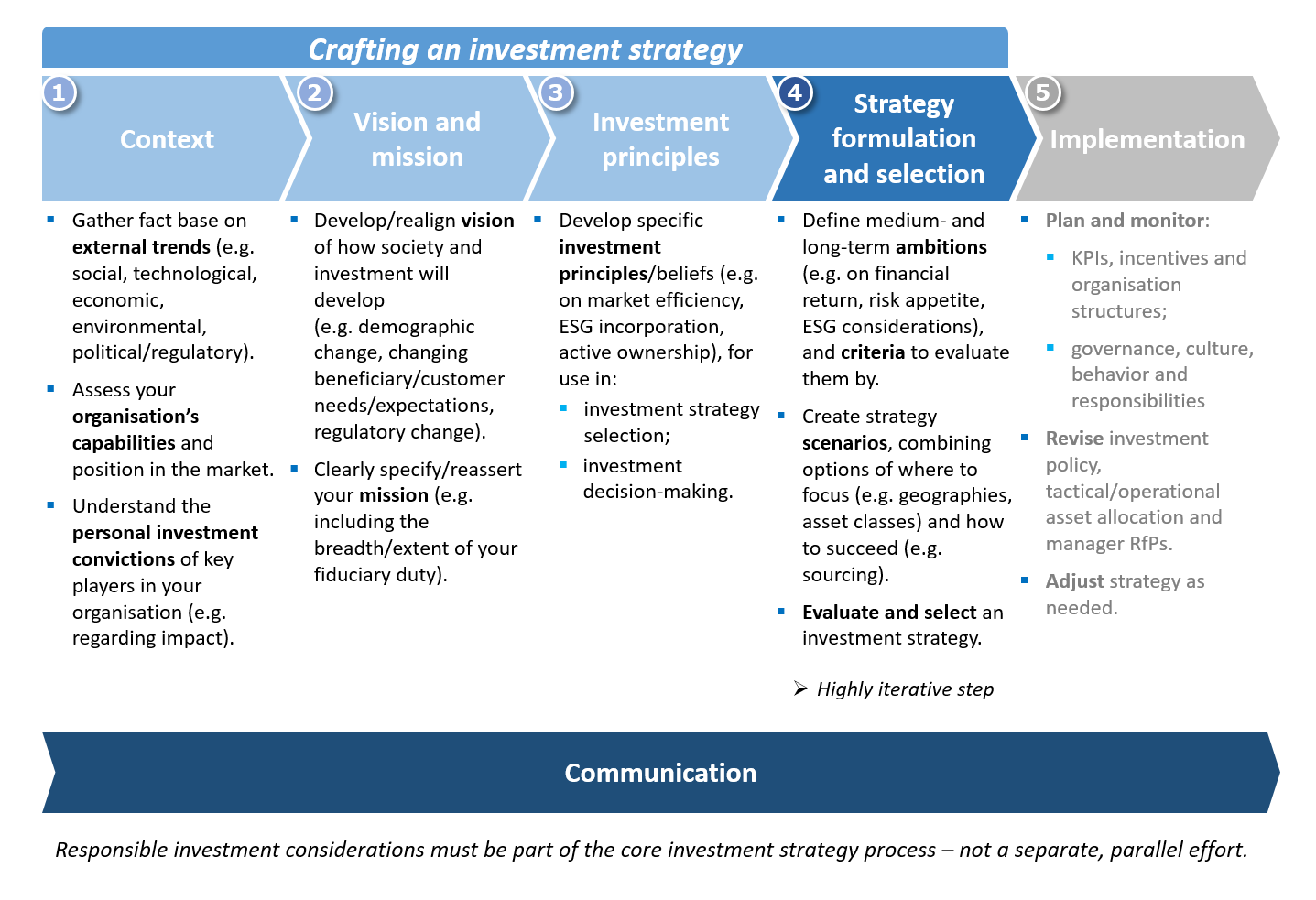

The very best Investment Strategy for the cash you keep in mutual fund: opt for short-term and intermediate-term funds equally and prevent long-lasting funds. When the bond bubble deflates and investor selling speeds up, the latter will get clobbered. Do not opt for the highest or finest quality funds that invest heavily in U.S. Treasury bonds and notes. These pay less interest because they are backed by the federal government. But they are in the exact same boat as other income funds if the bond bubble deflates and interest rates increase. Opt for high to medium quality funds for the extra interest income.

One issue with this technique is that when you stop purchasing and selling your revenues stop. So it's crucial to ensure you take a few of your revenues and buy something that will produce the earnings you will require and desire later on in your life.

Whether you have actually lost a job and are beginning to lose hope, or you have actually risked a lot in the equity market and desire to discover a safer haven, or you are simply ready to carry on and take a chance that you can think in, you need to move forward and buy yourself. there will be no much better time than right this very minute to start your own organization.

Another benefit of stop loss orders is that you do not have to keep an eye on how your stock is carrying out. You just set the order and ought to the stock rate fall to a particular level it will be sold. One drawback is that the stop price might be triggered by short term market fluctuations, to avoid investors portfolio this pick a stock-loss portion that allows the stock to vary conveniently.

By possession mix we imply stocks, big cap, mid cap, small cap, value, development, domestic, worldwide, worldwide. This can be rather complicated for the amateur, however I will describe all this in future writing. We likewise mean bonds, bonds vary in score from triple A, the safest to Junk, the riskiest. A mix of these can have a place in a lot of any portfolio. Money is another part of the property mix. Cash ranges from cost savings accounts, to CDs, to cash markets. Genuine estate is also a possession that can be integrated into the possession mix. My sixteen years of experience in the investment market reveals no advantage in risk decrease or performance increases, so I neither supporter, no consist of realty in any of my portfolios.

When it comes to trading stocks, I've gotten some fantastic ideas from monetary coordinators. First you should invest no greater than 10% of your total cost savings in stock trading. If you're just getting started, this is especially real. Find out and take that money how to take advantage of it into more money. You shouldn't even need more of your savings for the stock market since the money you have is growing anyway if you're effective.

Your final consideration is possession allotment. just how much or what percent of the money you invest should go to each fund or possession type. This will depend on your danger tolerance, whether you wish to be conservative or more aggressive. The point of this article was to get you headed in the best direction toward the finest investments and finest investment technique. For more information prior to you do something about it please refer to posts on the subject of possession allowance and investment technique. There are several offered by this same author and others.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation