Welcome to

On Feet Nation

Members

-

GRAHAM MULFY Online

-

ramy Online

-

DANGERBOY Online

Blog Posts

Top Content

More About How To Shop For Car Insurance To Get The Best Deal - Business ...

Compare your vehicle insurance quotes, Comparing quotes from several companies is the best way to get quality protection at a budget-friendly rate. You may find that one insurer charges much less than another for identical protection.

Even if your automobile is brand name new, you'll need insurance coverage in location prior to you can take it home. Which comes first, the vehicle insurance coverage or the car? Don't fret, it's easy to set up a policy to start right when you need it, even if you do not have a vehicle.

You can even set your policy to begin on the exact same day you're settling the purchase of your automobile, even if it's days or weeks away (in truth, many car dealerships will need you to show evidence of insurance as part of the car-buying process). That way you can make sure you're covered prior to you take your vehicle home.

Tips For First-time Car Insurance Buyers - Bankrate Can Be Fun For Anyone

It's unlawful in most states to drive without protection and plus, you'll want to be covered in case you enter an accident. Otherwise, you could end up paying countless dollars for damage that might've been covered. If you're captured driving without automobile insurance in a state where it's required, you could end up with tickets and fines, or you might lose your motorist's license and vehicle registration.

So if you trigger a mishap and you do not have car insurance, you could be looking at Additional resources countless dollars in medical costs or car repair work for the other party. Just how much more do brand-new motorists spend for car insurance coverage? Vehicle insurance coverage premiums are essentially based upon how much of a risk you would be to guarantee.

For a full-coverage policy, her average annual rate was $1,416, based upon quotes from three significant insurance provider. When a teen chauffeur was added to her vehicle insurance policy, the average yearly rate increased to $3,204 that's over two times as much as what she would be paying for herself alone.

Tips For Getting Car Insurance For 18 Year Olds - Carsdirect - An Overview

Join an existing vehicle insurance plan, Keep your rates as low as possible by including yourself to an existing automobile insurance coverage, presuming you live with other drivers. Their premiums might be greater if you're included, but it will still be more affordable than getting a policy on your own.

2. Keep a clean driving record, As a new driver, you may not have a driving history yet, but driving safely for years can conserve you in the long run; most business tend to look at the last 3-5 years of your driving history when computing your rates, so accidents and violations ultimately fall off your record.

5. Search for automobile insurance, The very best way to guarantee you're getting the most affordable rates on car insurance coverage is to look around and compare quotes from numerous carriers. When you have actually gotten enough quotes, you can compare them side-by-side and pick the carrier that offers the many coverage at the most affordable rate.

Fascination About How To Register And Insure A Purchased Vehicle In Alberta

Can you be rejected vehicle insurance? Automobile insurance companies can deny you coverage for any factor except those forbidden by law. A history of unsafe driving and tickets and violations are some of the main factors a vehicle insurer may deny you coverage. While novice drivers don't need to fret about that, you might still be rejected protection based on other aspects, including being a brand name new chauffeur.

Find The Integrated Cost Savings If you're relocating to a huge city, space-saving compact cars can be a great choice since they're simple to park and can provide excellent fuel economy gradually. The possibility to conserve cash on gas long term can make hybrid and electrical cars appealing choices, states Crane.

"These automobiles tend to be pretty costly when they're new," she states, "so it might be best for those on a spending plan to look for used designs." 4. Get Insurance! While you're looking around to compare car insurance coverage, bear in mind the numerous elements that can assist you get a cheaper automobile insurance premiumand lower your overall monthly car expenses.

Do You Need Auto Insurance Before You Buy Your Car? Can Be Fun For Everyone

It's an outright necessity. What is insurance? Insurance coverage is an agreement in between you and your insurance provider in which you pay the insurance provider a particular quantity of cash and, in return, the company will safeguard you from significant monetary losses due to a mishap for a given amount of time.

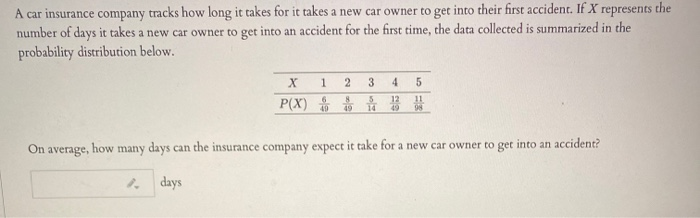

How can the cars and truck insurance coverage company cover the cost of claims and stay in business? Statistically, the insurance business understands how numerous members of your group will get into mishaps.

What kind of automobile insurance coverage should I get? This depends upon a number of elements. You desire to get liability coverage to secure yourself against claims in case you cause an accident. If your vehicle is older, you might not desire to get accident insurance because you might pay more for the premiums than the car is worth.

Tips For Getting Car Insurance For 18 Year Olds - Carsdirect Can Be Fun For Anyone

Below is a listing of the different type of protections a policy might consist of and what they do. pays medical costs of other individuals injured in a mishap that you triggered. It likewise covers the expense of lawsuits if you must be sued. spends for other individuals's property damaged in a mishap for which you are accountable.

There are generally limits defined in the policy. pays your medical expenses if you're hurt in an accident triggered by somebody who has no insurance or inadequate insurance to cover the costs. In some states, it will also cover damage to your residential or commercial property. pays for damage to your car when you are at fault in a mishap involving another vehicle or some other object.

Is there more than one kind of insurance system? There are two standard types of insurance coverage systems states can pick for their residents: or. In a tort system, the insurer of the individual who caused the mishap is accountable for paying for residential or commercial property damage, bodily injuries and other economic expenses.

Not known Details About 18 Tips On How To Get Cheaper Car Insurance - Gocompare

High-performance vehicles are tempting, however not just are they expensive to operate, they're costly to insure. Select a cars and truck with a great security record, that's less costly to fix which's not on the cars and truck thieves' most-wanted list. The deductible is the quantity of a claim that you pay. Typically, it's $100, $200 or $500.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation