Welcome to

On Feet Nation

Members

-

Donald Jimenez Online

-

Khalid Shaikh Online

-

DANGERBOY Online

-

Samuel Online

-

-

Blog Posts

ayan

Posted by ayan on May 13, 2024 at 11:07am 0 Comments 0 Likes

rt vfgjhnfd

Posted by Donald Jimenez on May 13, 2024 at 11:05am 0 Comments 0 Likes

https://jobs.police1.com/job/ev76fp/[mother-of-the-bride]-2024-(fullmovie)-online-on-streamings/ny/new-york…

Continue

Un curso de milagros: el viaje de la conciencia

Posted by Khalid Shaikh on May 13, 2024 at 11:04am 0 Comments 0 Likes

Con la ayuda de Ken Wapnick, Robert Skutch, Judith Skutch Whitson y el filántropo Reed Erickson, "The Course" se imprimió el 26 de junio de 1976 y se comercializaron… Continue

Top Content

Rumored Buzz on How To Get The Best Car Insurance Rate For Teens And New Drivers

Once certified, you will certainly then more than likely be contacted by mail, telling you it's time to include the motorist to the policy. If you overlook the notifications, the insurance coverage carrier could not restore your plan or it could require you to exclude the vehicle driver from the plan. Just How Much It Costs to Insure a 16-Year-Old Determining the price of automobile insurance coverage for any kind of a single person is very tough to do.

low-cost auto insurance cheaper cheaper insurance affordable

low-cost auto insurance cheaper cheaper insurance affordable

Most states call for every driver when driving to have automobile insurance coverage, as well as the charges and charges for not doing so will certainly differ. A young adult can be covered by their parents or guardians' policy, or they can acquire your very own. However, it is a lot more cost efficient for a young adult to be on their family's insurance coverage plan. cheaper car insurance.

Business think about just how several years you've gotten on the roadway, your mishap as well as infraction background, and the place of where your cars and truck is generally parked. With a young person on your policy, the cost typically becomes a lot more expensive (car). Naturally, a motorist's experience has a big influence on one's plan.

Research shows that, in general, males are more most likely to drive under the influence, obtain into vehicle crashes and also, particularly, get into major car accidents.

Still, most individuals think feel that private behavior is a better indication of an individual's danger than their sex identity (car). Good chauffeur standing can just be gained with time. Rates can boil down incrementally over time, depending upon your insurance carrier, but age 25 is when insurance prices often tend to drop noticeably.

Below, you'll locate the blunders they most commonly make.: A worried chauffeur may focus way too much on the automobile before them. It is very important to scan for possible dangers when driving. The capability to check is a skill learned over time. Teenagers often tend to have tunnel vision and also look straight ahead, missing potential threats like pedestrians as well as animals.: Distracted driving can be as dangerous as damaged driving.

The smart Trick of Best Cheap Car Insurance For Teens And Young Drivers In 2022 That Nobody is Talking About

insurers cheaper cars affordable car insurance cheaper car

insurers cheaper cars affordable car insurance cheaper car

: Stats reveal that when it concerns teens in harmful car crashes, speeding is often a factor. It might not always be intentional, yet it threatens all the same. Reviewing these typical errors with your teen can help them be a much safer vehicle driver. The car you choose for your teen motorist additionally affects your insurance coverage prices.

Ways to Save Money on Teenager Automobile Insurance policy While cars and truck insurance policy for teens can be expensive, there are a few means to conserve. Several insurer outline ideas, in addition to deals, that may be useful when your teen has to think about car insurance. Taking place a Parent's Plan Instead of obtaining their very own plan, it's generally best for a teenager to be added to a parent's plan.

Sharing a Car Having less cars under one plan than vehicle drivers is a big money saver. Several automobile insurance carriers will permit the teenager to be included as a second motorist. As a secondary vehicle driver, this individual is taken into consideration to not have key access to a car, and this can assist you pay a reduced rate than the key driver.

Due to that, numerous insurance coverage service providers award teens that are excellent behind the wheel with a good pupil discount rate. Discount rates can be based upon benefit, the outcomes of a motorist education and learning program, or if they travel even more than a specific range to and from college. State, Ranch, as an example, allows insurance policy holders to conserve as much as 25% if the teen within the house obtains great qualities, and also the savings can last until they are 25 years of ages.

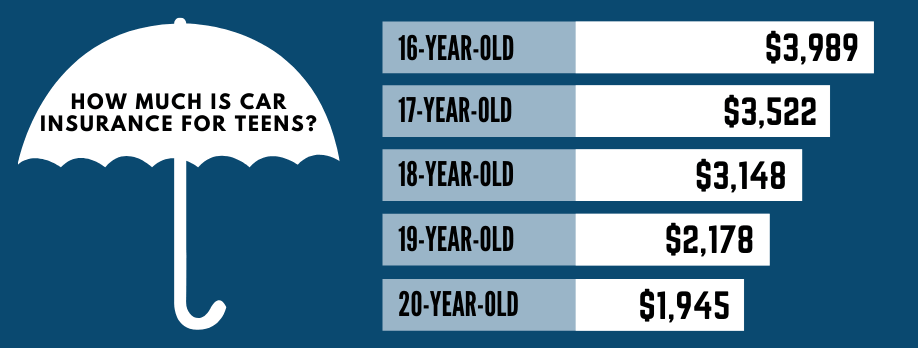

In most states, 16 is the earliest age to obtain a driver's license. But, vehicle insurance for 16-year-olds is notoriously pricey. There are a variety of factors why that is, and also there goes to the very least some capacity to minimize that expense. Average Cost of Vehicle Insurance for 16-Year-Olds The nationwide averages are as follows: As you can see, the 16-year-old male will pay an average of $921 more each year for the exact same insurance coverage as a 16-year-old lady.

Louisiana has the highest ordinary total protection prices for 17-year-olds Can teens have their automobile insurance coverage? Young adults are minors, and due to the fact they are underage, they generally are not enabled to have their auto insurance plan. They will be detailed as vehicle drivers on their moms and dad or guardian's plan.

The Single Strategy To Use For How To Save Money On Teen Car Insurance - Ramsey Solutions

However, it can be monetarily advantageous to remain on a parent or guardian's plan up until they leave and also establish their home. Final thought The lower line of the discussion is that the rate of your vehicle insurance policy will depend upon where you live and whether you get your policy or have your name included in a moms and dad's policy. cheapest car.

If the teenage chauffeur does not want to wait, they can obtain added to their parent's insurance coverage policy.

Just how much does your insurance policy increase after including a teenager is a concern we obtain constantly. If you're a parent of a teenage vehicle driver then you know it's pricey! We're going to speak about just how costly it is and offer some tips on exactly how to reduce your automobile insurance coverage costs for young teen vehicle drivers (cars).

Let's talk about why it sets you back so much and what you can do to aid lower the amount of auto insurance you pay for your young teen vehicle driver. 21 is the age where prices will certainly start to go down.

By this age, they are older and elder and also they also have numerous years of driving history so the insurance provider can much better know how high-risk they are and also just how likely they are to have a mishap. Start the procedure early, search. Just how much Does It Expense To Include a 16 Year Old To Vehicle Insurance Policy? As stated above, it can cost a great deal of money to include your 16 year old to your auto insurance policy (auto).

Take benefit of the few discounts available to young chauffeurs. This discount is not readily available with as lots of insurance companies as it used to be. It can still be a big discount as well as it's still an useful program for your young motorist to take.

Get This Report on How Much Is Car Insurance For A 17-year Old In Canada?

Just How Much Is Vehicle Insurance Policy For a 17 Years of age? While it holds true that automobile insurance for a 17 years of age is extremely expensive, it's not almost as poor as a 16 years of age without any driving experience! As you grow older annually your automobile insurance costs will continue to go down.

Just How Much Is Automobile Insurance For a 17 Year Old Female? Most every kind of insurance coverage sets their rates based off of information.

If a specific threat is less, then the rates for that insurance policy will be much less. When it comes to 17 years of age ladies, the information shows that they are better drivers than 17 years of age males. cheaper auto insurance. Women have a tendency to enter much less crashes and often tend to obtain less tickets.

liability insurance companies vans liability

liability insurance companies vans liability

How Much Is Insurance For a 17 Year Old Male? Male motorists, specifically young male motorists, have a tendency to have higher rates for car insurance.

They can sometimes have good rates for 16 year olds, however they can likewise sometimes have bad rates for vehicle insurance coverage. A person that can look at lots of various companies and discover the finest rate for your Take a look at the site here 16 year old.

Yes, you should include all drivers of your cars to your car insurance plan. There is a negative report out there where a whole lot of agents are stating that you don't require to add young vehicle drivers to your vehicle insurance coverage policy (low-cost auto insurance).

The Best Strategy To Use For 7 Ways To Save Money On A Teen Driver's Car Insurance

This is entirely false as well as these representatives are establishing these people to have a dreadful claim experience where things are covered. Liberal use is for those individuals that would certainly drive your car that do NOT live in your house and do not drive your automobile regularly (money).

In a lot of cases, if an adolescent motorist crashes your car and also they are not noted on your plan as a motorist after that there would not be coverage! Should My Young adult Get Their Own Insurance Coverage Policy? No, your teen vehicle driver must not obtain their own insurance coverage. They should be guaranteed under your plan.

Not only is it a lot more expense reliable to add your young adult to

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation