Welcome to

On Feet Nation

Members

-

dnna mayugh Online

-

Tracy Online

-

Louis Online

-

Donna Online

-

umair Online

-

smithmorgan Online

-

Jerold Galarza Online

-

jack452 Online

-

Jerry Online

Blog Posts

BEST RELOADING BRASS NOW AVAILABLE IN STOCK

Posted by smithmorgan on September 19, 2024 at 8:13am 0 Comments 0 Likes

BEST RELOADING BRASS NOW AVAILABLE IN STOCK

Posted by smithmorgan on September 19, 2024 at 8:13am 0 Comments 0 Likes

BEST RELOADING BRASS NOW AVAILABLE IN STOCK

Posted by smithmorgan on September 19, 2024 at 8:13am 0 Comments 0 Likes

BEST RELOADING BRASS NOW AVAILABLE IN STOCK

Posted by smithmorgan on September 19, 2024 at 8:12am 0 Comments 0 Likes

Top Content

The 10-Second Trick For 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

If your city sees a lot of car break-ins, thefts, or vandalism, you'll be charged more for insurance coverage compared to someone who lives in a more secure area. If you're reluctant to switch plans or insurance coverage service providers due to the fact that you're fretted about the work included, don't be. It most likely comes as no surprise that where you live has a bearing on what you pay for car insurance.

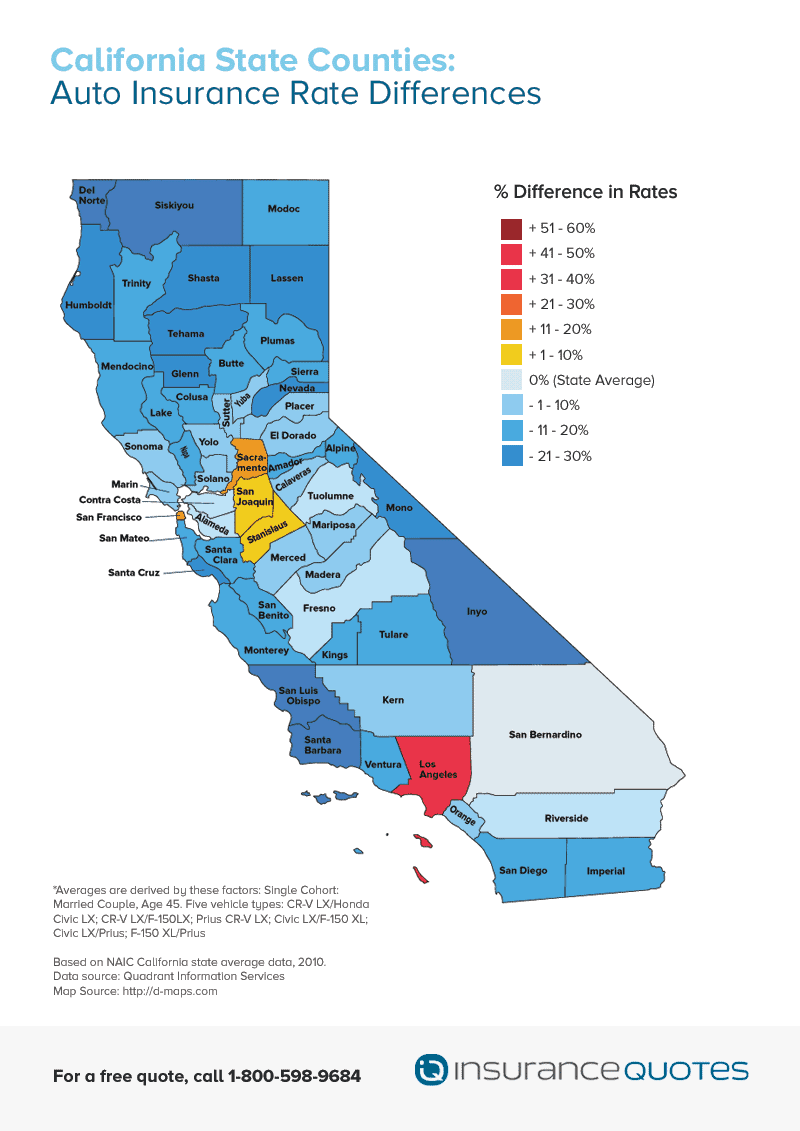

A new study that examines automobile insurance rates in California suggests place might be an even higher pricing element than most people understand. The research study, commissioned by, took a look at the economic effect of ZIP codes on cars and truck insurance premiums throughout the state. According to the National Association of Insurance Coverage Commissioners, the average car insurance premium in California was$746 for one automobile.

"Merely put, if you live in a city where there are more people, there's also going to be more traffic. When it concerns insurance premiums by county, individuals residing in cities in the main third of the state can anticipate to pay one of the most. Here are the three most pricey counties to buy auto insurance coverage in California: 18 percent higher than the state average. 9 percent higher.

All About Why Is Car Insurance So Expensive In California?

Here are the 3 most costly L.A. ZIP codes: 51 percent greater than the state average. And here are the three least expensive L.A. ZIP codes, beginning with the most inexpensive: 7 percent higher than the state average. 10 percent greater.

The swings aren't as considerable in some of California's other large metro areas. "Prop 103 forced insurer to look mostly at how we drive, not where we live. And if that had not happened, you 'd be seeing much larger differentials from zip to zip, "states Doug Heller, an independent consumer supporter with the Customer Federation of America. "It didn't deny insurance coverage companies from utilizing postal code completely, however it decreased their impact, which is ultimately great for the customer."No matter which California ZIP code you call home, here are 4 pointers to save money on automobile insurance: According to Lehman, most consumers do not think of their car insurance typically enough, and this end up costing them more cash in the end. "That doesn't imply you need to change business whenever, however there's always a chance that a much better deal is out there."Lots of chauffeurs may be entitled to discounts on their car insurance protection but insurance companies generally will not grant them automatically so policyholders need to ask if they receive cost breaks. Usually car insurance provider will charge more for younger drivers and provide reduced rates for older drivers. Insurance providers see young chauffeurs as unskilled and have a higher risk of getting in accident. In California, the typical teenager driver between the age of 16 and 19 will pay$ 240. 18 monthly while a chauffeur in their 40s.

Get This Report on Car Insurance Rates By State 2021: Most And Least Expensive

will pay an average of $148. 64 Generally, chauffeurs who presently have automobile insurance protection will receive a more affordable month-to-month rate than chauffeurs who do not. Because vehicle insurance coverage is a requirement in all 50 states, business might question why you don't presently have coverage. Due to the fact that of this, they may see you as a greater threat chauffeur. Coverage, Avg monthly rate Complete Protection$160. 59 Liability Only$83. 15 The stats listed on this page are from our own in house reporting. We track and tape quotes that carriers have actually supplied based on different criteria. The rates and averages revealed on this page must only be used as a price quote. Whether you're new to the state and trying to find auto insurance coverage, or you have actually resided in California for years and wish to find the finest inexpensive car insurance in California, without stinting protection, you'll discover the info you need here. This guide to from our veteran personnel of insurance experts and editors. You'll find out how much protection to buy, just how much it will cost, and learn how auto insurance in California works to protect you and your household. Key Highlights, The typical vehicle insurance coverage rate in California is California is the seventh most costly state for auto insurance coverage in the country, its typical rate is$ 367 more a year than the nationwide average annual rate of$1,758. California insurance provider mostly consider the variety of years you've been driving, your driving record and the number of miles you drive when deciding just how much you pay. But every company utilizes its own approach for examining danger. That's why the cost for the exact same policy can vary significantly among insurance provider and why you ought to compare rates. Even with a traffic ticket, contrast shopping can save you money. You'll see that the distinction between the highest rate and the lowest in the table below is$1,320, on average, according to Automobile, Insurance. com's rate analysis. State Farm is the most affordable automobile insurer for young drivers and students in California buying a full protection policy.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation