Welcome to

On Feet Nation

Members

-

PandaGeneral Online

-

olismith Online

-

-

-

Marketing Expert Online

-

Blog Posts

Swamp Cooler Repair

Posted by PandaGeneral on September 24, 2024 at 1:36am 0 Comments 0 Likes

Comprehensive Swamp Cooler Services: Installation, Maintenance, Repair, and Replacement

Swamp coolers, also known as evaporative coolers, offer an energy-efficient and environmentally friendly alternative to traditional air conditioning systems. Particularly suited for dry climates, these coolers can significantly lower indoor temperatures while consuming less electricity. To keep your swamp cooler running efficiently, it’s crucial to invest in professional services, including…

ASC

Posted by JYUTGFRDSXA on September 24, 2024 at 1:25am 0 Comments 0 Likes

Top Content

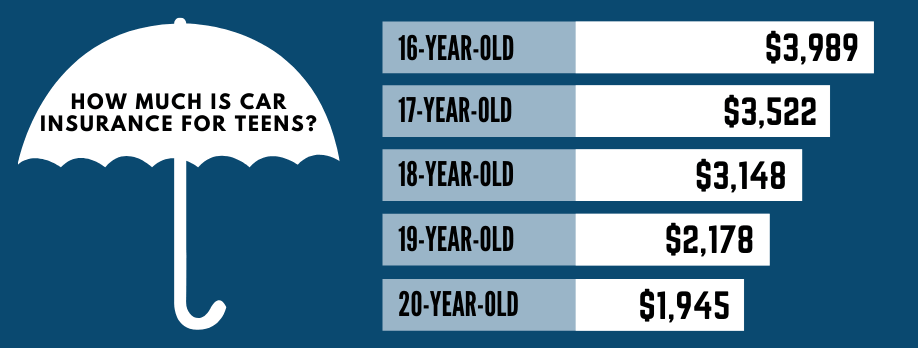

The Buzz on How To Insure Teen Driver

But keep in mind that it's usually more cost-efficient to bundle policies. If you're not currently spending for all your insurance requires under one carrier, you might consider making the switch to combine and conserve! 6. Compare Main and Secondary Motorist Expenses Once you add a teenager to your policy, they'll be designated as a primary or secondary chauffeur to the vehicles you own.

All 3 must be listed on your policy. In this scenario, if you have three or more cars, an insurance coverage agent will automatically appoint your teenager as the main chauffeur of one vehicle. To conserve cash, ask your representative if you can make your teenager the main driver of the car that is least expensive to insure.

Note: You can't be a main driver for two vehicles unless you have more cars and trucks than people. 7. Implement the Significance of a Clean Driving Record, Great drivers are rewarded by insurance companies. That implies if your teenager begins driving as quickly as they're legal and keeps a clean record, you could see those rates constantly drop over the coming years.

The Of Teen Safe Driving Program & Discount - American Family ...

The more understanding and skills they have, the better driver they'll be! Sign Your Family Up for a Defensive Driving Course Your teen isn't the only household member who can take chauffeurs ed.

10. Believe Thoroughly About Raising Your Deductible Do you have money saved away for an emergency situation? If so, you may desire to think about raising your deductible (the money you have to pay in the occasion of an accident prior to insurance kicks in). Doing so would lower your month-to-month expenses, but is not encouraged unless you have an emergency fund set up.

Automobile insurance coverage doesn't have to be costly with a teen behind the wheel. There might be much more discount rates readily available to you and your household when it comes to automobile insurance coverage. Every insurer has different policies and rates, and state laws can impact those too, so be sure to go over alternatives with your agent.

An Unbiased View of Nine Ways To Reduce Your Teen Driver Auto Insurance Costs

She likes utilizing her enthusiasm for composing and tracking marketing patterns to help Aceable's students learn necessary skills to be successful in their lives and professions.

Vehicle insurance is required to protect you economically when behind the wheel.!? Here are 15 techniques for saving on automobile insurance costs.

Lower vehicle insurance rates may also be readily available if you have other insurance coverage with the same company. Maintaining a safe driving record is crucial to getting lower car insurance coverage rates. How Much Does Vehicle Insurance Expense? Automobile insurance expenses are various for each driver, depending upon the state they live in, their option of insurer and the type of protection they have.

About Nine Ways To Reduce Your Teen Driver Auto Insurance Costs

The numbers are fairly close together, suggesting that as you spending plan for a brand-new car purchase you may require to consist of $100 or so each month for automobile insurance coverage. Note While some things that affect car insurance rates-- such as your driving history-- are within your control others, expenses may also be affected by things like state guidelines and state accident rates.

As soon as you know just how much is automobile insurance coverage for you, you can put some or all of these methods t work. 1. Make The Most Of Multi-Car Discounts If you acquire a quote from an auto insurer to guarantee a single car, you might wind up with a greater quote per lorry than if you asked about guaranteeing a number of motorists or vehicles with that company.

If your kid's grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a great trainee discount rate on the coverage, which typically lasts up until your kid turns 25. These discount rates can range from as little as 1% to as much as 39%, so make certain to show evidence to your insurance coverage agent that your teenager is a great trainee.

Some Ideas on 6 Effective Ways Parents Can Reduce Car Insurance Rates For ... You Need To Know

Allstate, for example, offers a 10% automobile insurance coverage discount rate and a 25% homeowners insurance coverage discount when you bundle them together, so check to see if such discounts are offered and appropriate. Pay Attention on the Road In other words, be a safe chauffeur.

Travelers uses safe motorist discount rates of between 10% and 23%, depending on your driving record. For those unaware, points are generally assessed to a chauffeur for moving offenses, and more points can result in greater insurance premiums (all else being equal). 3. Take a Defensive Driving Course Sometimes insurance coverage companies will supply a discount for those who complete an authorized protective driving course.

Make sure to ask your agent/insurance company about this discount prior to you sign up for a class. It's crucial that the effort being used up and the expense of the course translate into a huge enough insurance cost savings. It's likewise crucial that the chauffeur sign up for a certified course.

Not known Factual Statements About 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

4. Look around for Better Vehicle Insurance Coverage Rates If your policy is about to restore and the yearly premium has increased considerably, consider looking around and obtaining quotes from contending business. Every year or 2 it most likely makes sense to get quotes from other companies, just in case there is a lower rate out there.

What good is a policy if the company does not have the wherewithal to pay an insurance claim? To run a check on a specific insurance company, consider inspecting out a website that rates the financial strength of insurance business.

In basic, the fewer miles you drive your automobile per year, the lower your insurance coverage rate is likely to be, so constantly ask about a business's mileage limits. Usage Mass Transit When you sign up for insurance, the business will normally begin with a questionnaire.

The 8-Minute Rule for 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

Find out the precise rates to guarantee the various cars you're considering before making a purchase., which is the amount of money you would have to pay prior to insurance coverage picks up the tab in the occasion of an accident, theft, or other types of damage to the lorry.

Improve Your Credit Score A motorist's record is clearly a big aspect in identifying automobile insurance costs. It makes sense that a chauffeur who has actually been in a lot of accidents might cost the insurance company a lot of money.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation