Welcome to

On Feet Nation

Members

-

basitkhatr6666 Online

-

Jack Miller Online

-

Maitri Maheshwari Online

-

Khalid Shaikh Online

-

Tim Online

-

Larry Online

-

hr executive search firms Online

-

Ab12 Online

-

QKSEO Online

Blog Posts

Top Content

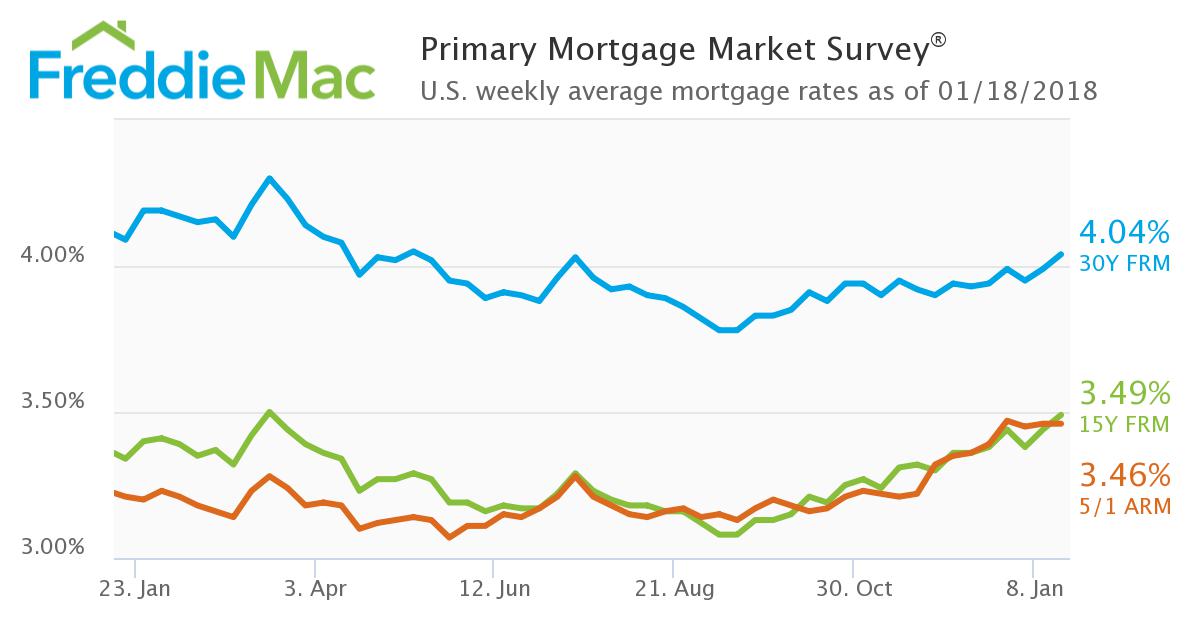

Today's Home Loan Rates

The rates of interest might be rather more than that of a conventional home mortgage. Determine your approximated FHA car loan month-to-month repayment using this FHA home mortgage calculator. That means someone with a reduced down payment however very high credit rating might likely obtain a low PMI price and also conserve cash compared to an FHA finance. However somebody with the exact same down payment as well as poor Go to the website credit history might pay 1.25% of their car loan balance per year for PMI-- a lot more pricey than FHA's 0.85%. If you have a greater credit rating with less than 20% down, you're may find conventional PMI much cheaper.

- Any type of modification to among these things can straight impact the details rate of interest you'll receive.

- FHALoans.com will not bill, seek or approve fees of any type of kind from you.

- In total passion, you 'd pay $57,466 over the life of the lending.

- It does not offer cash-out, so your new car loan can not surpass your initial loan amount.

While reduced ordinary home mortgage and also refinance rates are a promising indicator for an extra budget-friendly funding, bear in mind that they're never ever a warranty of the rate a loan provider will use you. Home loan rates differ by borrower, based on variables like your credit rating, funding kind, as well as deposit. To get the most effective price for you, you'll intend to collect prices from several lenders. Throughout the years, FHA home mortgage prices have actually usually been more than traditional home mortgage rates. Because the year 2000, FHA funding rates were generally 0.125% to 0.25% higher than standard car loans. Yet except for the years adhering to the late 2000s economic crisis (2010-- 2015), for a number of years, FHA finance prices were less than conventional home loans.

Send Out Money Conveniently With Zelle ®

For a summary of the differences between FHA home Home page mortgages and also traditional lendings, refer to the table listed below. When you select an FHA financing, keep in mind of the required finance restrictions. If you need an especially huge quantity, relying on your location, an FHA lending may not be a readily available alternative. If this https://www.onfeetnation.com/profiles/blogs/the-federal-get-home-lo... holds true, you could need to look for a conventional loan provider who agrees to fund a bigger car loan amount.

Exactly How Fha Mortgages Work

Any change to one of these points can directly impact the particular rate of interest you'll get approved for. Comparing quotes from three to 4 lending institutions makes sure that you're getting the most affordable mortgage rate for you. And, if lending institutions recognize you're searching, they may even be more ready to forgo specific costs or use much better terms for some customers. Check your debt-to-income ratio.Your DTI proportion is the amount you pay toward financial debts each month, split by your gross regular monthly income. Numerous lenders intend to see a DTI proportion of 36% or less, but it depends upon which kind of home mortgage you obtain.

And also your own might be higher or lower than average depending upon your individual finances. All Lending Estimates use the same layout so you can quickly contrast them side-by-side. If you have greater than 20% equity in your house-- and also a credit history above 620-- you can possibly make use of a conventional cash-out re-finance instead. You might leave with a sign in hand and also get rid of home mortgage insurance policy settlements. Variable-rate mortgages pretty much always have lower initial mortgage rates than fixed-rate lendings. The much less time you're paying passion, the less interest you'll pay.

The greater your credit history, the reduced your rates of interest will certainly be on your 30-year fixed home mortgage. If you choose to re-finance your house, you'll usually locate the same prices. Because there are no details purchase or refinance rates, you'll be estimated at the home mortgage prices offered. Therefore, the rate and also settlement results you see from this calculator might not mirror your real scenario. You might still get approved for a lending also in your circumstance does not match our assumptions. To obtain even more precise and tailored outcomes, please phone call to talk to among our home mortgage specialists.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation