Welcome to

On Feet Nation

Members

-

Leisa Online

-

Thomas Shaw Online

-

Peter Online

-

Frederick Online

-

TracksNTeeth Online

-

Blog Posts

Top Content

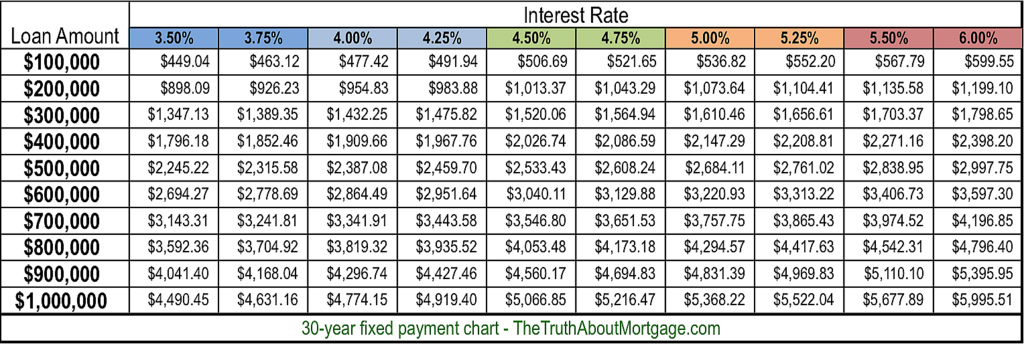

Todays Home Loan Prices

Candidates require to meet minimum eligibility demands as well as collateralise a property to get funding at favourable terms. The adhering to actions clarify on the complete mortgage loan procedure. We provide a selection of home loans for getting a new residence or refinancing your existing one. Our Understanding Center offers simple home mortgage calculators, academic write-ups and more. As well as from getting a lending to managing your home mortgage, Chase MyHome has everything you need.

- So if your price on a $200,000 home loan is 3.5% as well as you pay $4,000 for 2 discount rate factors, your new interest rate is 3%.

- APR is necessary due to the fact that it can aid you recognize the full cost of your home loan if you decide to maintain it for the entire term.

- If you intend on keeping your home loan lasting, after that a fixed-rate home mortgage is perfect.

- Track fads in interest rates, make proper use of the available home mortgage models and also because method enhance the funding of your residential property.

- Conserve enough for a 20 percent deposit and you'll generally pay much less.

You can choose this rate if you are acquiring or building a home in which you are mosting likely to live as soon as it has a BER score in between A1 and B3. You can pick in between a fixed rates of interest, a variable, or a combination of both. Deal may alter or be withdrawn any time without notification. Utilize the equity in your home to settle every one of your personal credit history under one simple, low passion, protected lending option.

Trainee Finances

Repayment liability-- A mortgage needs consumers to make a month-to-month repayment of such advance via EMIs. Under reverse home loan funding, repayment of the advancement is not instant, and recovery is carried out only under specific conditions. The '5' in a 5-year mortgage rate stands for the regard to the mortgage, not to be puzzled with the amortization duration.

Exactly How Are Home Mortgage Prices Established?

At the top of the web page, you can choose what sort of mortgage rates you want to see. Remember that these are average prices for comparison shopping. Your specific rate will certainly rely on multiple aspects, including your credit score, the size of your car loan, the location of your house and also the regard to your home loan. We obtain present mortgage rates daily from a network of home loan lending institutions that offer residence acquisition as well as re-finance finances.

The SBI Loans Versus Residential property scheme can be borrowed versus household in addition to pick industrial homes. You can mortgage both commercial as well as residential properties to protect the ICICI Small business loan Versus Residential or commercial property plan. The documentation is hassle-free with very little requirements and you can anticipate a fast disbursal of the funding.

Just how much Thehouse Click for source you can afforddepends on a variety of factors, including your income as well as financial obligation. To get your picture, usage ourFind as well as Comparetool to create a picture for any one of the home loans shown. When your fixed period ends the rate will relocate to the HSBC Criterion Variable Rate, unless youswitch your HSBC rate.

So if your future house has a worth of $200,000, you'll obtain the very best prices if the lending is for $160,000 or less. While low average mortgage and refinance prices are a promising sign for a much more budget friendly funding, bear in mind that they're never an assurance of the price a loan provider will supply you. Home mortgage prices differ by customer, based upon variables like your credit scores, funding kind, and also deposit. To obtain the very best rate for you, you'll want to collect prices from numerous loan providers. After obtaining a home mortgage, the lender will offer a Lending Quote with details regarding the funding. Pay specific interest to which lender has the most affordable home loan price, APR, as well as projected major as well as interest settlement.

If the down payment is much less than 20%, home mortgage insurance coverage may be called http://beckettgeua257.timeforchangecounselling.com/fha-re-finance-r... for, which can raise the month-to-month repayment as well as the APR . However, the Fed does set borrowing prices for shorter-term finances in the united state by relocating its federal funds rate. The federal funds rate can have a knock-on effect on 10-year Treasury bond returns, which is what many mortgage prices are linked to. Essentially, the Fed does not straight set home mortgage rates, but its policies can affect the monetary Browse this site markets and also movers that do.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation