Welcome to

On Feet Nation

Members

-

se Online

-

dnna mayugh Online

-

Debbie Online

-

Adrian Online

-

Alice Online

-

Khalid Shaikh Online

-

-

DANGERBOY Online

-

Blog Posts

Unlocking Success: The Power of SEO Services

Posted by se on April 28, 2024 at 3:48am 0 Comments 0 Likes

What is SEO?

SEO is the practice of… Continue

Top Content

What Are The Major Sorts Of Home Mortgage Loan Providers?

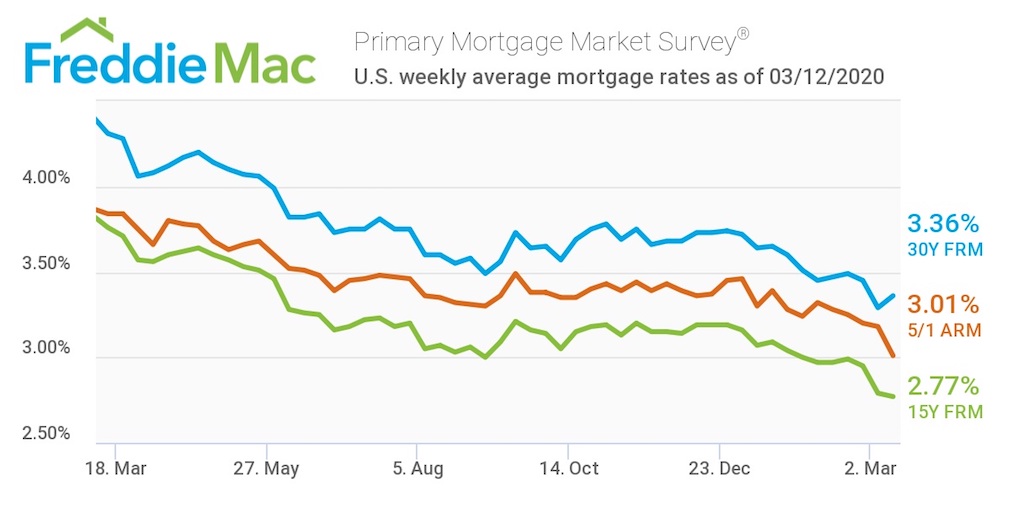

The standard ARM finance which resets yearly is thought about to be rather high-risk due to the fact that the settlement can change from year to year in considerable quantities. The complying with table allows you to compare present prices and month-to-month payments for numerous common mortgage types. If you can not get a traditional loan due to a lower credit score or minimal cost savings for a down payment, FHA-backed and USDA-backed lendings are a great option.

Yet allows beginning with a number of standard home mortgage terms you will certainly wish to know with before starting on your own home loan purchasing experience. Comprehending these terms cancel wyndham timeshare contract is very important due to the fact that the differences in these areas are what makes each kind of home loan one-of-a-kind. For each and every sort of mortgage listed below, you'll see its advantages as well as the sort of consumer it's finest for. This page wraps up with a reference of terms defining various types of home loan. Tracker prices are a type of variable price, which implies you can pay a various amount to your loan provider each month. Tracker prices work by following a specific rate of interest to determine what you pay monthly, after that including a fixed amount on the top.

- What are standard fundings and exactly how do they compare to various other funding choices?

- Unlike traditional finances, unusual finances are insured by the federal government.

- An individual's credit score is also reviewed when deciding to extend a mortgage.

- This timeframe can vary from 2 years at the lower end, all the way as much as ten years in some instances.

You won't understand for particular just how much your payments are mosting likely to be throughout the bargain period. An excellent option for those on a limited budget who desire the stability of a repaired monthly payment. Borrowers with non-Fannie Mae or Freddie Mac mortgages; those with at the very least 20 percent residence equity; those looking for an ARM or cash-out refinance. Property owners looking for a home equity loan who would certainly get little or no financial savings from refinancing their current mortgage.

Repaired And Drifting Loan Against Home Rate Of Interest

Bear in mind that brokers won't have accessibility to items from direct lending institutions. You'll want to shop a few lending institutions on your own, in addition to 1 or 2 mortgage brokers, to ensure you're obtaining the best loan uses feasible. This means the rate will certainly not change for the whole term of the home loan also if rate of interest rise or fall in the future. A variable or variable-rate mortgage has a rate of interest that fluctuates over the lending's life based on what rate of interest are doing.

What Are The Documents Needed For Education Financing?

A tracker home loan relocates straight in line with the Bank of England's official rate. Inspecting your credit report up to 6 months previously obtaining a mortgage can give you time to have actually any kind of errors dealt with and deal with any type of areas for issue. A benefit of a SVR home mortgage is that the consumer is normally cost-free to pay too much or leave the arrangement without sustaining a penalty. As an example, if a specific takes out a $250,000 mortgage to buy a house, then the principal funding quantity is $250,000. " Exactly how can I tell if I am working with a mortgage broker or a home loan lender? " What's the distinction between a home loan broker and a home mortgage lending institution?

Call our support if you are dubious of any type of deceptive activities or if you have any type of concerns. Mortgageloan.com is a news timeshare exit team average cost as well as details service offering editorial web content and directory info in the area of mortgages and lendings. Mortgageloan.com is exempt for the accuracy of info or responsible for the accuracy of the rates, APR or lending information uploaded by brokers, loan providers or advertisers.

This details might be various than what you see when you check out a financial institution, company or certain item's site. All economic items, shopping product or veterans timeshare services exist without service warranty. When examining offers, please assess the financial institution's Terms. If you discover discrepancies with your credit history or info from your credit report, please contact TransUnion ® directly.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation