Welcome to

On Feet Nation

Members

-

asimseo Online

-

basitkhatr6666 Online

-

Blog Posts

Top Content

About 7 Tips For Insuring Your Teen Driver (Without Breaking The Bank)

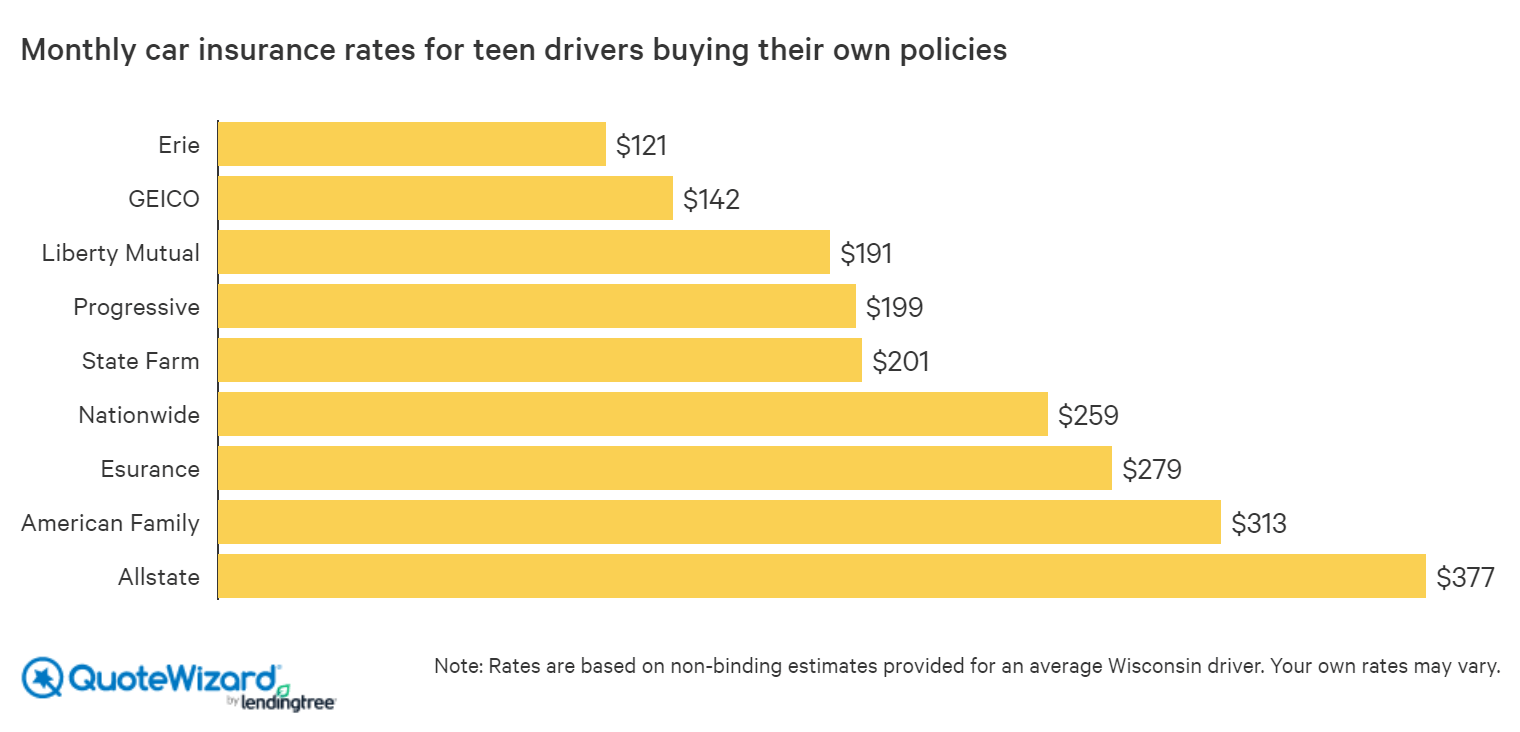

The very best thing to do is to be contributed to a family member's policy rather than purchasing your own. But there are other methods to get the most inexpensive possible car insurance coverage for a 16-year-old. Search at multiple insurance provider Every insurer offers various rates, and the discrepancy is particularly high when it pertains to teens we found that going with one insurance company over another can amount to countless dollars conserved throughout a year.

You should gather quotes from a number of different insurance provider to be positive you're paying just possible. Discover discounts for 16-year-old chauffeurs To balance out the high expense of insurance for 16-year-olds, many insurer provide a range of targeted particularly for young chauffeurs. Here are some typical deductions to look out for.

0 or better), you can see a decrease in rates.: Lots of insurance provider will offer you with a telematics driving tracker, which decreases your rates after you've shown that you drive safely. For instance, it might reveal that you don't suddenly begin or stop, or swerve on the road.

The How To Lower Car Insurance For A Teenager - Shopping Guides Diaries

: Sixteen-year-old chauffeurs are likely to have just recently taken motorist's education, but numerous states permit you to take a motorist's education course to immediately minimize your car insurance coverage rates in New york city state, the discount is 10%.: This discount applies more often to college students than 16-year-old high schoolers, but if you're more than 100 miles far from house for school (such as boarding school), and you don't have an automobile with you, you'll normally certify to have your insurance coverage rates lowered.

Purchase a cars and truck that's less expensive to insure If you or your parents are buying a new or used automobile for you to drive when you turn 16, one major factor to consider is how much it costs to guarantee. The cost of cars and truck insurance differs significantly by car design for example, we found in our study of that a Honda CR-V, the automobile with the most affordable regular monthly rates, is 33% cheaper to insure than a Ford Mustang.

Plus, if you do get in a mishap, a cars will be more pricey to repair. Drop detailed and accident protection Among the most basic methods for teens to reduce their insurance coverage bills is to reduce the amount of protection they're paying for. The most commonly eliminated parts of car insurance coverage are, which spend for the repair of your own automobile.

The smart Trick of Adding A Teen To Your Auto Insurance Policy - Incharge Debt ... That Nobody is Discussing

Both protections are optional unless you have an automobile loan or lease. Dropping extensive and crash protection is normally a much better concept when your vehicle is older and not worth as much money.

How to get automobile insurance coverage for a 16-year-old For 16-year-olds who are just adding themselves to their parents' policy, supporting the wheel can be as easy as calling your insurance representative or going to your insurer's site. Adding a 16-year-old to a car insurance policy is a perfect time to check with other insurance companies to see how much they charge for their coverage and to think about changing insurance coverage companies in order to conserve money.

Along with it being more costly, there will likely be an additional step in the process. They'll most likely need to have a parent authorize or guarantee the agreement, as minors can't sign legally binding agreements. Methodology Our study used automobile insurance prices estimate from thousands of ZIP codes across nine of the most populated states in the U.S.

The smart Trick of Teen Car Insurance - Usagencies That Nobody is Discussing

The rates used were sourced publicly from insurance provider filings. The rates pointed out in this research study ought to be utilized for comparative functions only, as your own quotes may be different. Source.

A lot of people prefer this option when it pertains to guaranteeing a teenage driver. There are some insurer that will not even permit a teen to own his/her own policy and some that will automatically include your teen to an existing policy as soon as she or he turns 16 years of ages.

Get This Report about Adding A Teen To Your Auto Insurance Policy - Incharge Debt ...

Here are some pros and cons to think about. You can normally save a substantial amount of cash by including your teen to an existing policy. The base rate will normally be less expensive, and there are likewise lots of methods to lower the cost a lot more if you know how to do it.

Some insurance coverage business will provide numerous security features for teen drivers as well, like a device that can help monitor their driving. Adding a teenager to your policy will increase your rates.

Due to this, there is no other way to insure a teenager without taking on some extra expense. The greatest danger and disadvantage that includes putting a teen driver on your policy is the threat of losing your good chauffeur discount, if you have one. If your teenager gets into a mishap (even if he or she is not at fault) or a traffic violation, you might lose the good chauffeur discount rate you have actually built for yourself.

The Definitive Guide to Best Car Insurance For Teens And Young Drivers In 2021 - Cnet

The statistics about teenage chauffeurs aren't excellent. According to the Insurance Institute for Highway Safety (IIHS), 16-year-olds enter accidents nearly 10 times regularly than motorists between the age of 30 and 59. No surprise car insurance premiums are so high for this age group. Not all vehicle insurance coverage companies take the very same dim view of young drivers.

Keep in mind, the greater the threat, the higher the cost of insurance coverage premiums. By far, the finest way to lower cars and truck insurance coverage costs for teenagers is for them to keep their driving record tidy.

Moms and dads must understand what the laws are and firmly insist that their boys and daughters follow them. Do you break the speed limitation and tailgate? Do you shout at other drivers when you're behind the wheel? If you do these things, how can you expect your kids to act differently? Start viewing your own driving long prior to they get their license and you'll have a a lot easier time encouraging them to be safe chauffeurs.

Some Ideas on How To Add A Teen Driver To Your Policy - Tips For Insuring Teens You Should Know

Rather than establishing an independent policy for your teen driver, put them on your automobile insurance coverage as an extra driver. In this method, all the discount rates applied to your policies will be passed on to them. Here's a creative idea-- discover just how much you save if your teenager gets a good grade point average and pass it on to them.

Call your cars and truck insurance coverage business to discover out which schools are covered before paying huge bucks. Don't attempt to live vicariously through your teen by providing the hot automobile you could not get in high school. Getting your teen a safe vehicle to drive, with the latest security equipment, will decrease your premiums.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation