Welcome to

On Feet Nation

Members

-

sam harries Online

-

bobbie48uio Online

-

barongtagalog Online

-

George Online

-

Saurabh Tiwari Online

-

Robert Online

-

George Online

-

-

Blog Posts

jacksonville commercial general contractors

Posted by bobbie48uio on April 26, 2024 at 2:23am 0 Comments 0 Likes

https://armadaconstructionjax.com/general-contractor-jacksonville-fl/

Top Content

What The Interest Rate Increase Suggests For Your Mortgage, Financial Obligation As Well As Financial Savings

" Small changes in rates of interest can have considerable results on costs for homebuyers," Staley states. By supplying your email address, you are consenting to receive the Modern Money e-newsletter from Discover. Signing up for this newsletter will not affect any other e-mail preference you might have with Discover. Discover might likewise make use of the https://postheaven.net/lygrig2kqp/nevertheless-if-rates-fall-you-will-not-profit-unless-you-reactivate-the e-mail address to give information to you on services and products. The Financial institution of England has warned about careless loaning as well as the rate increase will contribute to that mood songs. Somebody currently on a tracker on a ₤ 150,000 home mortgage over 25 years would pay ₤ 617 a month as well as ₤ 185,218 for the complete term.

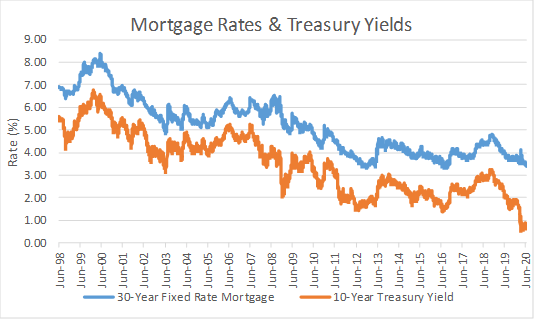

If you have a variable price tracker home loan, connected to the BoE base rate you are most likely to see a prompt impact on your home loan settlements if there is a rate of interest increase. Component of this equation is the fact that government bonds and company bonds use completing long-term fixed-income financial investments. The cash you can earn on these completing investment items affects the yields the MBSs supply. The overall problem of the bigger bond market indirectly affects just how much lending institutions charge for home loans. Lenders need to produce sufficient yields for MBSs to make them competitive in the overall financial debt security market. Lenders will initially consider the general cost of loaning in the economic situation, which is based on the state of the economic situation and also government monetary plan.

To aid support our coverage job, and also to continue our capacity to offer this web content free of charge to our viewers, we receive settlement from the business that advertise on the Forbes Expert website. F THE economic situation is a device, then financial policymakers are backroom designers. On November fourth they held the Bank of England's rates of interest stable at 0.1%, however seem poised to modify it upwards quickly.

- These expenses are reflected in the interest rate, which account for the lending institution's costs rolled into the mortgage price.

- In this post, we'll review exactly how the Federal Get affects home mortgage rates through its policies.

- The tables listed below show how much your home mortgage settlements could enhance if loan providers handed down a base price increase completely.

- Yet Britons' spending on various other points fell by near to 4 times as a lot, revealing that indirect results of financial plan were additionally at the office.

It's really crucial that you recognize just how a modification in interest rates could influence your capability to pay. However if the rates of interest is 1% greater, the monthly repayment will be higher, at ₤ 651. The rates of interest high road banks establish depend upon more than simply Bank Rate. Current, it's sometimes called the 'Financial institution of England Base Rate' or perhaps just 'the rate of interest'. It is necessary to keep an eye on whether they climb, drop or stay the same. If you're a saver, the cost savings rate tells you just how much cash will certainly be paid right into your account, as a percent of your cost savings.

I Have Actually Obtained A Home Loan

In between August 2016 and also November 2017, the base price went to a lowest level at 0.25%. Since August 2018, the UK's base rates of interest raised from 0.5% to 0.75%, noting the 2nd boost of the decade (the base price was previously changed from 0.25% to 0.5%). Aggregate demand is the overall amount of products and solutions demanded in the economic situation at a given general rate degree at an offered time.

Everybody's circumstance is different, which is why you can use our Explore Interest Fees tool to see what you can expect based on your individual elements. Factors, additionally referred to as price cut points, reduced your interest rate in exchange for an ahead of time fee. By paying points, you pay more ahead of time, however you receive a lower interest rate and as a result pay less with time. Points can be an excellent choice for somebody who understands they will certainly maintain the financing for a very long time.

A Series Of Rate Increases In The Future Might Place The Brakes On The Uks Runaway Residential Or Commercial Property Market

Specifically considering that house worths in the united state have actually been increasing. Please review the Complete Terms & Conditions, Personal Privacy Policy, Cookie Click to find out more Plan, Exactly how this site is financed and MSE's Editorial Code. We do not as a basic plan explore the solvency of business discussed, however there is a danger any type of company can have a hard time and it's rarely made public up until it's too late.

In comparison to mortgage holders, a base rate increase is a positive for savers. Reduced rate of interest have punished savers over recent years, especially older individuals that 'd functioned as well as conserved tough as well as prepared to live off the interest. When your fixed-rate deal pertains to an end, if you don't remortgage onto another offer it reverts to your lender's conventional variable price. Around 2 million individuals are estimated to be on their lending institution's SVR.

Why Tenants Should Focus On How The Federal Book Impacts Home Loan Rates

" With elevated inflation pressures as well as a quickly strengthening labor market, the economy no longer requires raising amounts of plan support," said Powell. He concentrates on economics, mortgage credentials as well as individual money topics. As somebody with spastic paralysis spastic quadriplegia that requires the use of a mobility device, he additionally takes on write-ups around customizing your home for physical obstacles and wise home tech. Before joining Rocket Home mortgage, he freelanced for various papers in the City Detroit area. On top of that, the Fed acts as an essential regulatory authority for much of the whole U.S. banking system.

Bond costs as well as home loan rate of interest have an inverted relationship with one another. That indicates that when bonds are more pricey, home loan prices are reduced. The opposite is also true-- when bonds are cheaper, home mortgage interest Check over here rates are higher. We'll additionally take a look at which types of mortgages mirror the results of the bond market on their home mortgage prices.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation