Welcome to

On Feet Nation

Members

-

Ab12 Online

-

Micheal Jorden Online

-

Debbie Online

-

se Online

-

-

Blog Posts

Unlocking the Excitement: The Benefits of Trial Bonuses in Online Gaming

Posted by se on April 27, 2024 at 3:50am 0 Comments 0 Likes

What are Trial Bonuses?

Trial bonuses, also known as no-deposit bonuses or free-play… Continue

Top Content

8 Easy Facts About How Much Does Car Insurance Cost By State? - Progressive Described

car insurance liability auto insurance auto

car insurance liability auto insurance auto

Various other Aspects, While not as famous in the decision, there are numerous other variables that an insurer may think about when establishing your rate, including: Line of work, Real estate circumstance, Previous insurance protection (especially, whether there's been had a space in insurance coverage)Driving experience, Discount eligibility. car.

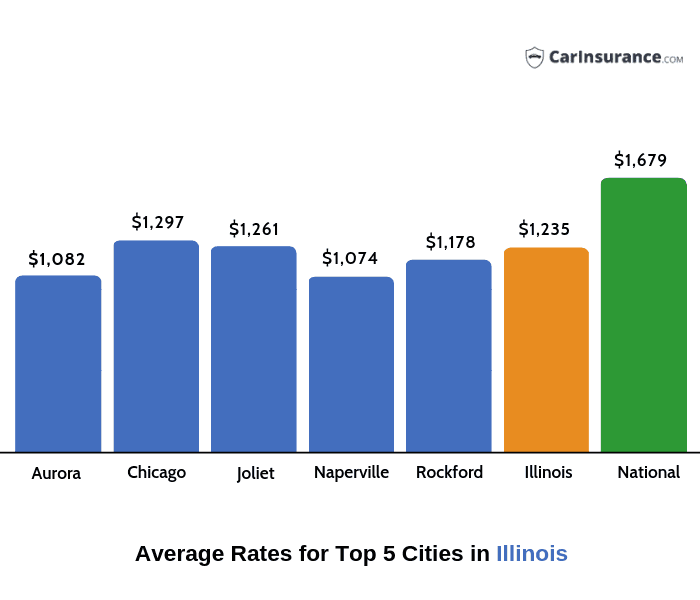

The typical automobile insurance coverage expense for full protection in the United States is $1,150 per year, or about $97 per month. A 'complete protection cars and truck insurance' policy covers you in most of them.

A complete insurance coverage plan relying on state regulations might likewise cover uninsured vehicle driver protection and also a medical protection of accident security or medical payments. A common full coverage insurance plan will certainly not cover you as well as your car in every circumstance. It has exemptions to specific incidents. IN THIS ARTICLEWhat is full protection car insurance coverage? There is no such thing as a "full protection" insurance coverage plan; it is simply a term that describes a collection of insurance policy protections that not only includes obligation coverage yet collision and also detailed too.

What is taken into consideration full protection insurance to one motorist might not be the very same as also an additional vehicle driver in the same family. Preferably, complete insurance coverage indicates you have insurance policy in the kinds and also quantities that are proper for your earnings, possessions and also run the risk of profile.

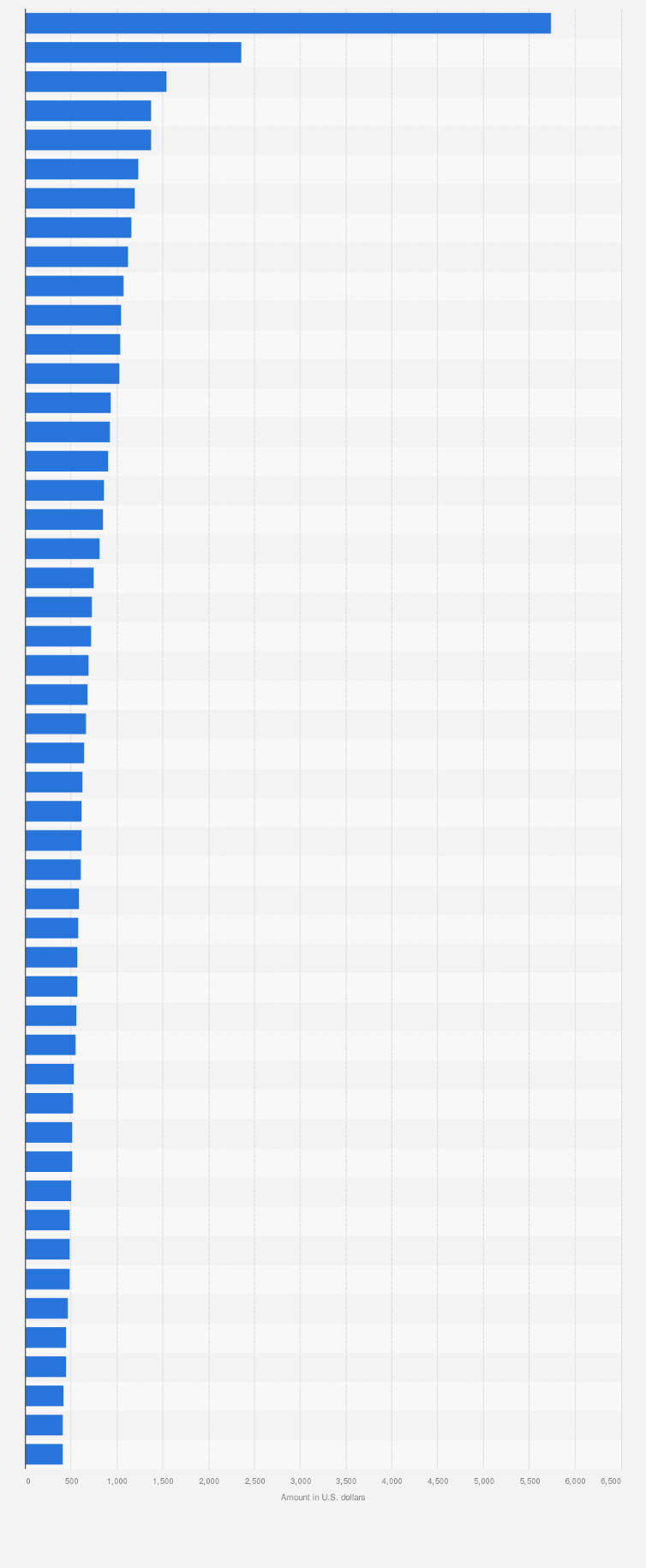

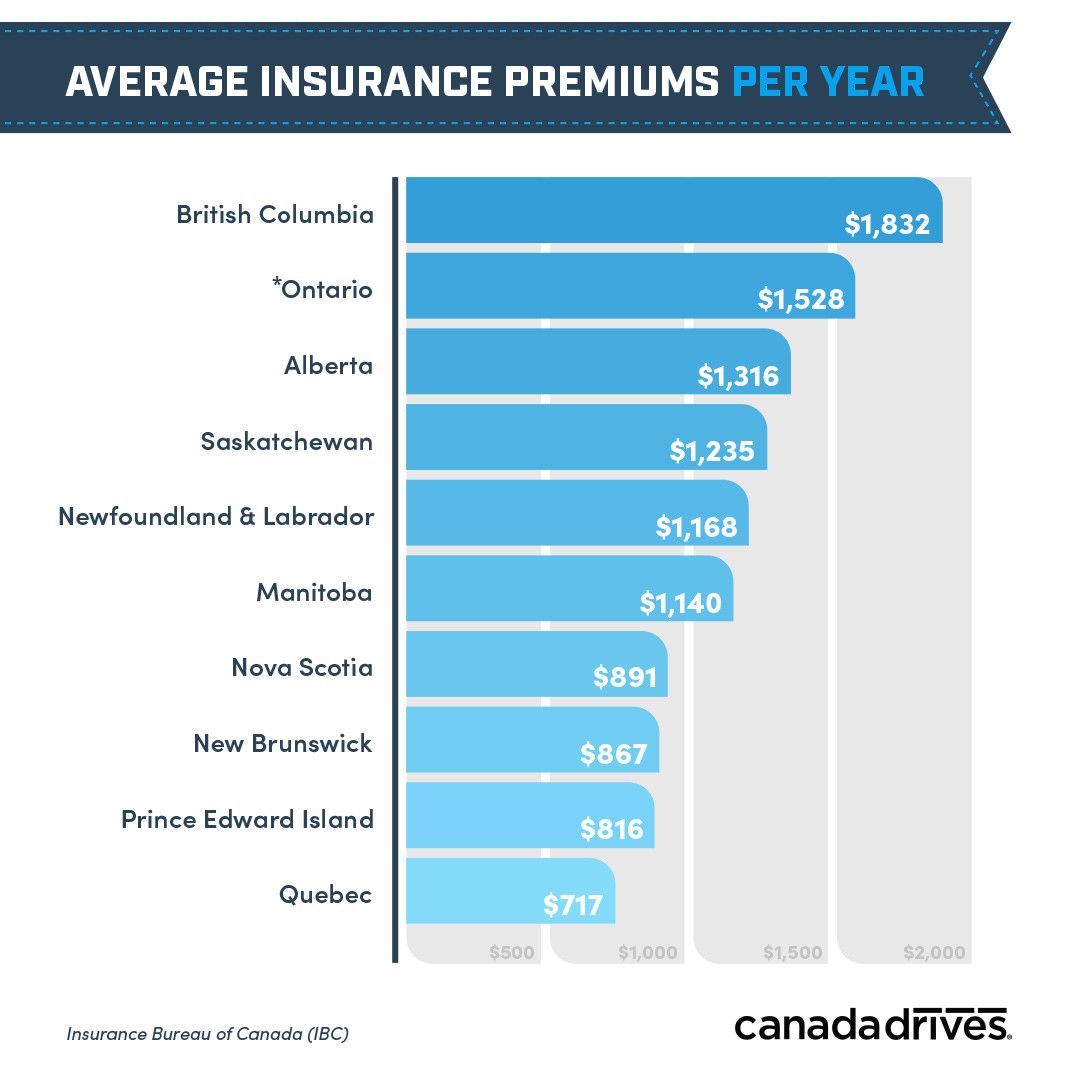

Rates also differ by hundreds and even hundreds of bucks from company to company. That's why we always suggest, as your primary step to saving money, that you compare quotes. Below's a state-by-state comparison of the ordinary yearly expense of the following coverage levels: State-mandated minimal obligation, or, simplistic coverage required to legitimately drive an automobile, Full protection obligation of $100,000 per individual harmed in a crash you create, up to $300,000 per mishap, and also $100,000 for residential or commercial property damages you trigger (100/300/100), with a $500 insurance deductible for thorough as well as accident, You'll see just how much full protection vehicle insurance policy prices monthly, and also every year (low cost).

Rumored Buzz on What Is The Average Cost Of Car Insurance? - Money Helper

The ordinary yearly rate for complete coverage with greater obligation restrictions of 100/300/100 is around $1,150 even more than a bare minimum plan. If you pick reduced liability restrictions, such as 50/100/50, you can conserve but still have respectable protection (insurance companies). The average month-to-month expense to improve protection from state minimum to full insurance coverage (with 100/300/100 restrictions) is about $97, but in some states it's much less, in others you'll pay more.

cheap car money cheaper car insurance car insurance

cheap car money cheaper car insurance car insurance

Your vehicle, approximately its fair market worth, minus your insurance Find more info deductible, if you are at fault or the various other driver does not have insurance or if it is ruined by a natural disaster or stolen (compensation and crash)Your injuries and also of your guests, if you are struck by a without insurance vehicle driver, as much as the limitations of your without insurance vehicle driver plan (without insurance driver or UM).

Full coverage car insurance policy plans have exclusions to details occurrences. Each complete cover insurance coverage will certainly have a listing of exemptions, suggesting things it will not cover. Racing or various other rate contests, Off-road use, Usage in a car-sharing program, Catastrophes such as war or nuclear contamination, Devastation or confiscation by federal government or civil authorities, Utilizing your vehicle for livery or shipment purposes; organization use, Willful damage, Cold, Wear and also tear, Mechanical failure (usually an optional protection)Tire damages, Products taken from the vehicle (those may be covered by your home owners or renters policy, if you have one)A rental cars and truck while your own is being fixed (an optional coverage)Electronics that aren't completely affixed, Personalized parts and tools (some tiny quantity may be defined in the policy, however you can usually include a biker for higher quantities)Do I require complete insurance coverage cars and truck insurance policy? You're needed to have obligation insurance policy or a few other evidence of monetary obligation in every state.

You, as a vehicle proprietor, are on the hook directly for any injury or property damages past the limits you chose. Your insurance firm will not pay greater than your limitation. Liability insurance coverage will not pay to repair or replace your automobile. If you owe cash on your lorry, your lender will call for that you get collision and also detailed insurance coverage to protect its investment.

Below are some guidelines on insuring any type of car: When the automobile is brand-new and also funded, you have to have full insurance coverage. Keep your insurance deductible manageable. When the vehicle is repaid, elevate your insurance deductible to match your available financial savings. (Greater deductibles aid decrease your costs)When you reach a point financially where you can change your car without the aid of insurance coverage, seriously consider dropping thorough and crash.

The Definitive Guide to Average Car Insurance Cost

suvs cars cheaper cheap car insurance

suvs cars cheaper cheap car insurance

com's online vehicle insurance coverage calculator to obtain our recommendation of what cars and truck insurance protection you ought to acquire. It'll additionally recommend deductible limits or if you require coverage for uninsured driver coverage, medpay/PIP, and also umbrella insurance policy. Exactly how to get low-cost complete insurance coverage cars and truck insurance? The very best means to discover the least expensive full protection cars and truck insurance policy is to shop your insurance coverage with different insurance companies.

Below are a few ideas to adhere to when looking for low-cost complete insurance coverage auto insurance: Make sure you are constant when shopping your obligation restrictions. If you choose in bodily injury responsibility per person, in physical injury liability per mishap and also in residential property damage liability per crash, constantly go shopping the very same coverage degrees with other insurance companies.

These protections are component of a complete insurance coverage plan, so a premium quote will be needed for these insurance coverages. Both collision and detailed come with an insurance deductible, so make sure always to select the very same insurance deductible when buying coverage (cheaper car). Picking a higher insurance deductible will push your premium reduced, while a reduced deductible will certainly result in a higher costs.

There are other protections that aid make up a full insurance coverage bundle. These insurance coverages vary but can consist of: Uninsured/underinsured driver insurance coverage, Injury protection, Rental reimbursement insurance coverage, Towing, Space insurance, If you require any of these added insurance coverages, always choose the very same protection levels and also deductibles (if they apply), so you are comparing apples to apples when shopping for a new policy.

Can I go down complete protection auto insurance policy? If you can handle such a loss-- that is, change a swiped or totaled automobile without a payout from insurance policy-- do the mathematics on the prospective savings as well as think about dropping insurance coverages that no longer make sense.

The Main Principles Of Farmers Insurance: Insurance Quotes For Home, Auto, & Life

Dropping extensive as well as accident, she would pay about a year a financial savings of a year. Allow's claim her auto deserves as the "actual money worth" an insurer would pay. If her automobile were totaled tomorrow and she still lugged full coverage, she would obtain a check for the automobile's actual cash money worth minus her insurance deductible.

Of program, the vehicle's value drops with each passing year, and so do the insurance premiums. Complete insurance coverage car insurance coverage FAQ's, Just how much is full coverage insurance policy on a brand-new automobile?

Maine has the most affordable complete automobile insurance rate on the various other end of the range, with an ordinary premium of a year. Just how much is complete protection insurance for 6 months?

If you are financing your automobile, your insurance firm will likely call for that you bring minimum full insurance coverage for financed automobile to shield their investment in your lorry - affordable auto insurance. Expect you aren't bring extensive or crash coverage and your vehicle is damaged in a mishap by a severe weather event or other danger.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation