Welcome to

On Feet Nation

Members

-

Theresa Online

-

JCR Desert Safari Jaisalmer Online

-

mehwishseo Online

-

Cassandra Online

-

-

Blog Posts

Top Content

The quantity you'll be able borrow is based both on how much rent you believe selling a timeshare without upfront fees you can obtain for your current residence, in addition to your earnings as well as other financial conditions. Allow to Purchase mortgages can be rather difficult, and also the series of deals available may be fairly restricted, so it's well worth consulting on the very best alternatives to suit your needs. Tracker mortgages, as the name recommends, track a nominated rates of interest, plus a set percentage, for a particular amount of time. When the base price increases, your home loan price will climb by the very same amount, as well as if the base rate falls, your rate will certainly go down. Some lenders established a minimum rate below which your rate of interest will certainly never drop but there's generally no limitation to how high it can go. Where the car loan is safeguarded versus any type of movable home it is called a pledge while where the finance is safeguarded against some stationary home of the debtor it is called a home loan.

- Nevertheless, the FHA program provides down payments for as reduced as 3.5%.

- The cost for this adaptability is typically a higher rate of interest.

- Alex decided to become a mortgage broker after he utilized one to purchase his level.

With a price cut home loan, you pay the lending institution's conventional variable price (a rate chosen by the lending institution that does not change extremely frequently), with a repaired quantity discounted. As an example, if your loan provider's typical variable price was 4% and your mortgage included a 1.5% discount, you would certainly pay 2.5%. After securing your home loan you'll pay how long are timeshare contracts a first rates of interest for a set time period. Construction lendings-- If you wish to build a home, a building and construction financing can be a good choice. You can determine whether to obtain a separate building and construction car loan for the task and then a separate home mortgage to pay it off, or wrap the two with each other (called a construction-to-permanent loan). You commonly need a higher down payment for a construction finance and proof that you can manage it.

How To Obtain A Home Loan In Your 20s

This is the common home loan payment strategy, and is the one you are most likely to be offered, whether you take out a taken care of price, variable price, or tracker mortgage. When your dealt with price deal involves an end, you will normally be automatically moved on to your loan provider's SVR. This is unlikely to supply the most effective worth for cash, so it's an excellent idea to check out remortgaging to one more repaired price deal or a is buying a timeshare worth it cheaper variable price mortgage. This indicates you do not need to bother with your settlements rising if the Financial institution of England base rate increases or your home mortgage service provider elevates its Criterion Variable Price. However, it likewise indicates you can end up losing if rate of interest drop, as a set price is locked in for the duration of the bargain and you'll typically need to pay to switch away within that time.

Cars And Truck Insurance Coverage

If you are intending to stay in your residence for a minimum of 5 to 7 years, and also want to stay clear of the capacity for modifications to your monthly repayments, a fixed-rate home loan is appropriate for you. Home loans additionally include property owner's insurance coverage, which is called for by lenders to cover damages to the house, as well as the residential property inside of it. It likewise covers details home mortgage insurance, which is normally needed if an individual makes a deposit that is less than 20% of the house's expense. That insurance is made to secure the lending institution or bank if the debtor defaults on his/her car loan.

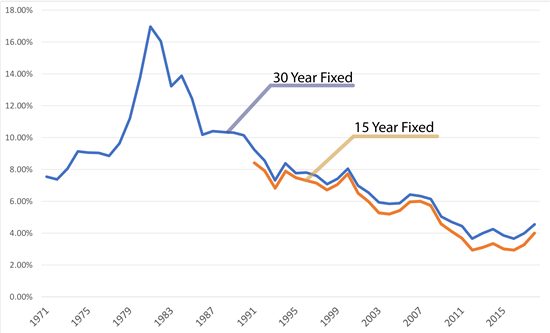

If a customer buys when rates are reduced they maintain that price secured even if the more comprehensive interest rate atmosphere climbs. Nevertheless, house customers pay a costs for locking in assurance, as the rates of interest of fixed price finances are generally greater than on adjustable price mortgage. Federal government backed programs consisting of FHA, VA & USDA loans are briefly discussed.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation