Welcome to

On Feet Nation

Members

-

Robinjack Online

-

Harry Online

-

Yashi Vaidya Online

Blog Posts

Marijuana and Suffering Management: Discovering Its Effectiveness

Posted by Harry on May 16, 2024 at 1:21am 0 Comments 0 Likes

A Quick Record of Marijuana

Marijuana includes a extended… Continue

CAR T-Cell Therapy Market Growth, Size, Share, Industry Report and Forecast to 2024-2034

Posted by Yashi Vaidya on May 16, 2024 at 1:21am 0 Comments 0 Likes

Implementation of stringent building codes and regulations aimed at improving energy efficiency in construction projects is predicted to encourage the adoption of insulation materials to… Continue

Expert PDF to CAD Conversion Services | MOS

Posted by Managed Outsource Solutions on May 16, 2024 at 1:21am 0 Comments 0 Likes

Explore our reliable PDF to CAD conversion solutions to streamline your workflow. We transform PDF files into accurate and editable CAD files.https://www.managedoutsource.com/services/pdf-to-cad-conversion/

Customize Wallpaper Printed Service Provider in Kanpur

Posted by bsoftindia on May 16, 2024 at 1:11am 0 Comments 0 Likes

Top Content

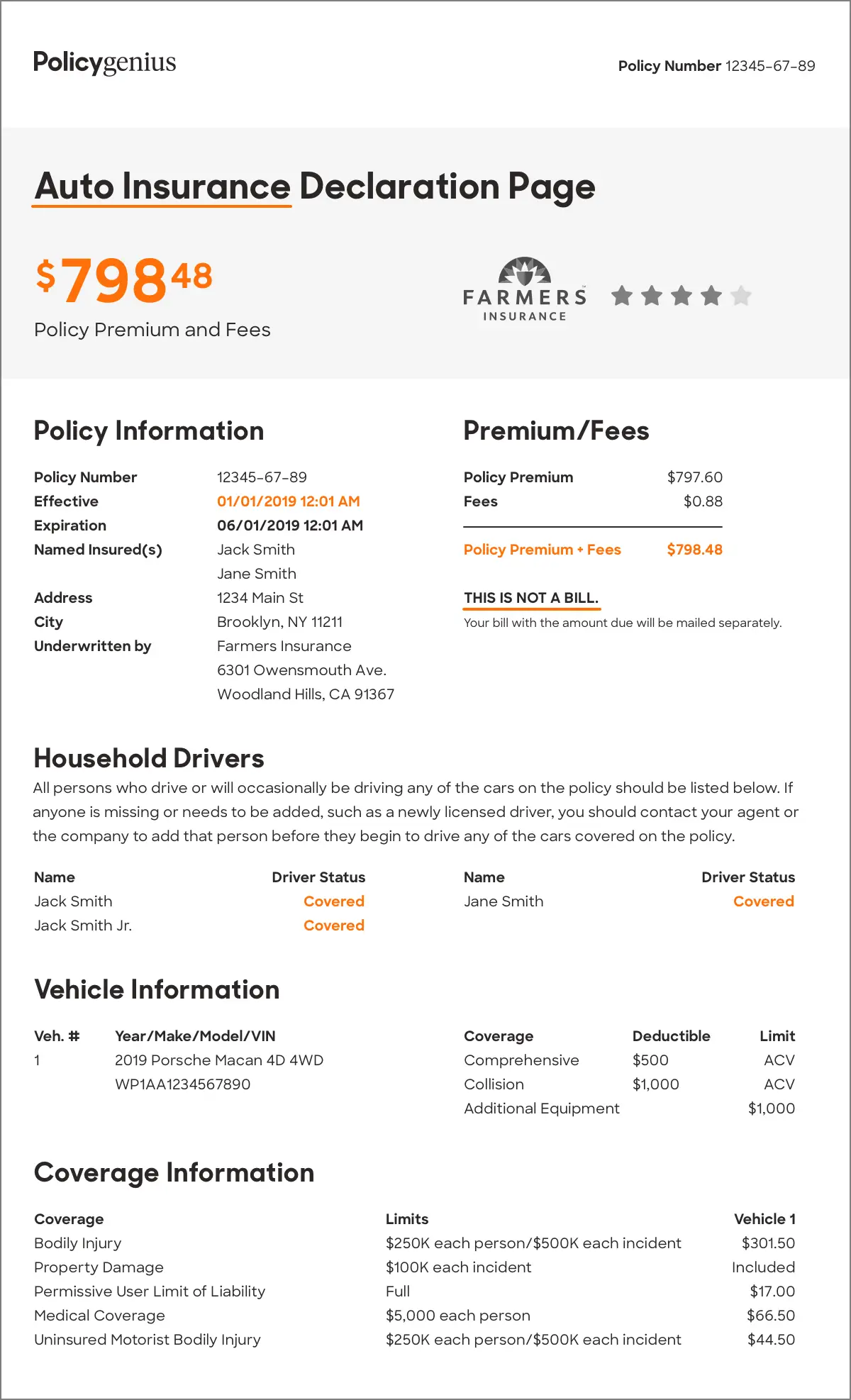

Top 25 What Is A Deductible Car Insurance Resources Fundamentals Explained

Insurance deductible defined An insurance deductible is a quantity of money that you on your own are accountable for paying toward an insured loss. When a catastrophe strikes your residence or you have an auto mishap, the quantity of the insurance deductible is deducted, or "deducted," from your insurance claim repayment. liability. Deductibles are the way in which a risk is shared between you, the insurance holder, as well as your insurer.

An insurance deductible can be either a certain dollar quantity or a percentage of the total amount of insurance on a policy. The amount is developed by the regards to your protection as well as can be located on the affirmations (or front) page of standard house owners and auto insurance coverage. State insurance policy regulations strictly dictate the way deductibles are incorporated into the language of a plan and also just how deductibles are carried out, and also these regulations can differ from one state to another - insurance.

In case of the $10,000 insurance coverage loss, you would certainly be paid $8,000. In case of a $25,000 loss, your case check would be $23,000. Note that with car insurance or a homeowners policy, the deductible applies each time you sue. The one major exception to this is in Florida, where hurricane deductibles especially are applied per period as opposed to for each and every tornado (auto insurance).

vehicle auto insurance vehicle insurance cheapest car

vehicle auto insurance vehicle insurance cheapest car

To make use of a a homeowners plan instance, an insurance deductible would relate to residential or commercial property damaged in a rogue barbecue grill fire, however there would certainly be no insurance deductible versus the responsibility part of the plan if a melted guest made a medical claim or sued. insurance. Raising your deductible can save money One method to save cash on a home cars owners or vehicle insurance coverage is to increase the deductible so, if you're looking for insurance, inquire about the choices for deductibles when comparing plans (cheap car insurance).

Going to a $1,000 deductible may save you even more. Many homeowners and also occupants insurance companies use a minimal $500 or $1,000 deductible (car).

Not known Details About Who Pays For My Deductible After A Car Accident? - The ...

In some states, insurance holders have the alternative of paying a greater costs in return for a traditional dollar insurance deductible; however, in risky seaside areas insurance firms might make the percent insurance deductible mandatory (low-cost auto insurance). job in a similar means to cyclone deductibles and also are most common in locations that usually experience severe windstorms and also hailstorm.

Wind/hail deductibles are most generally paid in percentages, usually from one to 5 percent. You can pick one deductible for your house's structure and one more for its components (note that your home mortgage firm may require that your flood insurance coverage deductible be under a specific quantity, to assist ensure you'll be able to pay it) (liability).

Insurance providers in states that have higher than average threat of quakes (for example, Washington, Nevada and also Utah), often set minimum deductibles at around 10 percent. In California, the fundamental California Earthquake Authority (CEA) policy includes a deductible that is 15 percent of the replacement expense of the main residence structure as well as beginning at 10 percent for extra coverages (such as on a garage or various other barns) (low-cost auto insurance).

Your auto insurance policy deductible is generally a collection amount, state $500. If the insurance adjuster identifies your case amount is $6,000, as well as you have a $500 insurance deductible, you will certainly obtain a claim payment of $5,500. Based on your deductible, not every car mishap warrants a claim. If you back into a tree leading to a little damage in your bumper, the cost to fix it may be $600.

Deductibles differ by policy and also driver, as well as you can choose your automobile insurance coverage deductible when you purchase your policy.

The Best Guide To What Is A Car Insurance Deductible? - Credit Karma

Contrast quotes from the leading insurer. Which Automobile Insurance Policy Protection Kind Have Deductibles? Simply as there are various kinds of car insurance policy protection, there are varying deductibles based on those various sorts of coverage. It's important to comprehend just how much the car insurance deductible is for each and every kind, so you'll understand what you're anticipated to pay in case of a claim.

insurance companies car insurance business insurance cheapest auto insurance

insurance companies car insurance business insurance cheapest auto insurance

Liability car insurance policy protection does not have a deductible. This coverage pays your costs if your car is harmed by something other than a collision with one more vehicle or things. This might include fixing damage from hailstorm, hitting a deer or replacing a broken windscreen (vehicle insurance). It likewise will certainly pay to cover the price of replacing taken products.

This coverage spends for repair services to your vehicle when you are at fault. This can be when your auto is harmed in a crash with another lorry or an object such as a tree or wall surface. This deductible is usually the highest possible deductible you will certainly have with your car insurance coverage (car insured).

In that case, you would certainly not pay a collision deductible. Accident security insurance coverage pays the clinical expenses for the chauffeur as well as all guests in your cars and truck. Without insurance motorist protection pays your costs when you are in an auto accident with a driver who is at fault however does not have insurance or is insufficiently insured to cover your expenses (cheaper cars).

cheap auto insurance vehicle insurance dui liability

cheap auto insurance vehicle insurance dui liability

What Is the Typical Deductible Cost? Because customers select differing kinds of auto insurance policy coverage with different financial restrictions, deductibles can vary substantially from one driver to the next - cheapest car.

All about What Is A Car Insurance Deductible? - Promutuel Assurance

Furthermore, your cars and truck insurance policy deductible will differ based on that protection as well as the price of your costs. Typically talking, if you choose a policy with a greater insurance deductible, your premium will certainly be lower (cheap car). This can be a great option as long as you can pay that higher insurance deductible in the occasion of a crash.

You can save an average of $108 per year by boosting your insurance deductible from $500 to $1,000. For those with limited spending plans, selecting a reduced premium as well as a greater deductible can be a way to guarantee you can spend for your vehicle insurance coverage. If you can manage it, paying a higher premium could mean you do not have to come up with a whole lot of money to pay a lower insurance deductible in the event of an accident.

It is essential to have your concerns regarding automobile insurance coverage deductibles answered prior to that takes place, so you know what to anticipate. Increase ALLWho pays an insurance deductible in a mishap? Do you pay if you're not to blame? When there's an automobile crash, the at-fault motorist is needed to pay the vehicle insurance deductible.

suvs trucks insured car auto insurance

suvs trucks insured car auto insurance

risks insurance companies cheapest laws

risks insurance companies cheapest laws

If the at-fault motorist does not have insurance policy or adequate insurance coverage to cover the various other motorist's expenses, the no-fault vehicle driver can utilize his car insurance coverage as secondary coverage to pay the costs. vehicle insurance. When do you pay a deductible if you are needed? Usually, if you are needed to pay a car insurance coverage deductible, the quantity of the deductible will be subtracted from your insurance claim payment when it is issued. car.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation