Welcome to

On Feet Nation

Members

-

Khalid Shaikh Online

-

alex Online

-

Linda Online

Blog Posts

A Class in Wonders Road to Internal Peace

Posted by Khalid Shaikh on April 28, 2024 at 3:53am 0 Comments 0 Likes

Top Content

Some Known Details About The Best Cheap Car Insurance For New Drivers - Valuepenguin

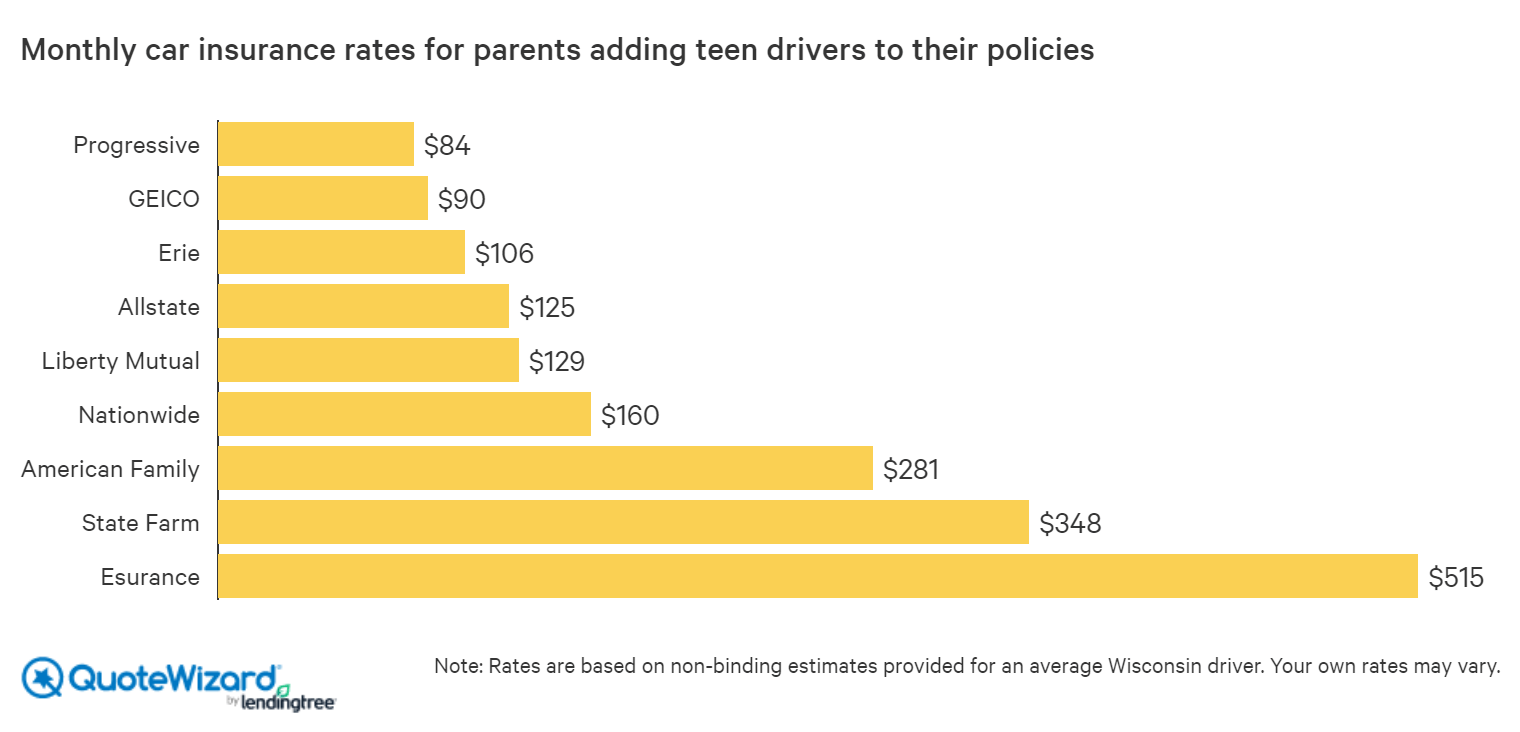

While doing so will raise your insurance coverage prices, your policy's coverage as well as deductibles will certainly likewise apply to your teen (cars). You may likewise be able to conserve cash by signing up for a multi-car insurance plan. A higher car insurance deductible might lower the price, however might mean a lot more out-of-pocket expenditures after an accident.

Obtaining the right protection that Continue reading best fits your needs is crucial for saving money on your teenager's car insurance plan. Find out more about Nationwide's automobile insurance coverage kinds today.

According to the Centers for Illness Control as well as Prevention, chauffeurs ages 15 to 19 are four times more probable to collapse than older chauffeurs, making auto accident the No. 1 cause of death for teenagers. Even teenagers with clean crash documents will face high auto insurance prices for several years because of their lack of driving experience.

liability perks money cheapest car insurance

liability perks money cheapest car insurance

cheapest car affordable low cost business insurance

cheapest car affordable low cost business insurance

, yet buying a car for the teen and placing him on his own policy isn't one of them. The average yearly price estimated for a teen chauffeur is $2,267.

The best way to hold prices down is to make certain your teen keeps a tidy driving record. Including a teen to your insurance plan will no question boost your rates, yet there are points you can do to balance out the new prices and lower your cars and truck expenditures.

About Car Insurance For New Drivers Over 21 [2022 Rates]

Because new vehicle drivers are simply getting their driver's license, they commonly do not have a main driving document or history. Comparable to the method not having a credit report account can lead to greater interest prices on things like financings or a credit report card, auto insurance policy premiums may be greater when there is no proven history.

Some individuals believe that your automobile insurance coverage rate will drop automatically as soon as you reach a particular age, but it's not true; that's just a misconception. One more factor automobile insurance coverage might additionally be a lot more costly is if you can't demonstrate a track document of safe driving or constant insurance coverage in time.

New motorists originate from all strolls of life, and also different aspects add to the price you get (new chauffeur or otherwise). Being a new motorist is just one component of the danger evaluation. Car insurers may look at your zip code, credit rating score, marital standing, type of vehicle, as well as even more to figure out the degree of threat.

We also located that people that don't have established credit backgrounds (like immigrants) can pay regarding the very same premium as somebody with a DRUNK DRIVING.

Some Known Facts About Motor Vehicle Division Nm - The Duties Of The Motor Vehicle ....

If that's the instance, pay-per-mile protection is ideal vehicle insurance coverage for brand-new chauffeurs since you pay based on just how much you drive. Why pay even more when you may have the ability to pay also much less based on the miles you drive? Allow's have a look at 7 reasons pay-per-mile protection is good car insurance for brand-new motorists.

So with pay-per-mile insurance, you can conserve cash by paying for the miles you drive - cheap insurance. 2. You got your license as well as started driving later in life If you grew up in a significant city that depends on public transport, you might have never needed to learn exactly how to drive or had a chance to find out.

Saving Money on Teenager Automobile Insurance Coverage Plans So you've got your new chauffeur's permit and also, as you're most likely mindful, it's prohibited to hit the roads without car insurance coverage. You probably also recognize that insurance coverage rates are based on just how most likely you are statistically to enter a collision. As a new chauffeur, the numbers aren't on your side.

But, there are some points teenagers and also moms and dads can do to save money on insurance prices. Get on your moms and dads' plan. It's typically more affordable to include a teen to their parents' plan, as opposed to be insured separately. A lot of business won't charge an additional premium till the teenager is a certified motorist.

Deliberate concealment can affect coverage. Excellent qualities pay off. Many insurance companies provide a discount, some as high as 25%, for students that maintain a B standard. Driver experience. Graduated Chauffeur Licensing law requires teens to log 50 hours with a knowledgeable vehicle driver, however taking a formal vehicle drivers educating program will likely save on insurance.

How How Much Is Car Insurance For A 16 Year Old can Save You Time, Stress, and Money.

Penalties can land you back in the passenger seat. Death as well as injury are the greatest rate drivers can spend for drinking and also driving, however even if you handle to endure, a D.U.I. ticket will set you back teens large time (car insured). As a teen driver, you'll likely be terminated and if you can obtain insurance, anticipate to pay a much greater rate for the next 3-5 years.

Acquire greater than 3 as well as teenagers deal with cancellation or non-renewal. Drive an "insurance friendly" vehicle. Autos that are a favored target for thieves, are costly to repair, or are considered "high efficiency" have much greater insurance policy expenses. Before you get a car, contact your insurance company to get a quote on what it will certainly cost to guarantee.

Some insurer such as SAFECO offer technology to help parents track teen motorist habits such as global placing systems (GENERAL PRACTITIONERS) which record where a vehicle is driven and exactly how fast. American Family members companions with a company that installs in-vehicle cams to monitor chauffeur behavior. Typically Asked Inquiries Regarding Vehicle Insurance A.

The greatest insurance coverage prices are paid by any type of male vehicle driver under the age of 25. His price after that hinges on whether he's married and also whether he has or is the primary driver of the automobile being guaranteed. With the rise in young women chauffeurs in the last twenty years, nonetheless, the accident rates in between the genders are night out.

No. You need to have a legitimate vehicle driver's license. Likewise, in many states, you have to be 18 before you can own a vehicle without an adult's name on the auto enrollment. A. Car insurance coverage usually last 6 months. Some last one year. You will get a notice when it's time to renew your insurance policy.

What Does Auto Insurance For Teen Drivers - Allstate Do?

Conserving Cash on Teenager Vehicle Insurance Plan So you've got your new chauffeur's permit and also, as you're probably mindful, it's illegal to strike the roads without automobile insurance policy. You possibly additionally recognize that insurance coverage rates are based upon how likely you are statistically to get right into a crash. As a novice driver, the numbers aren't on your side. money.

There are some things young adults and also parents can do to conserve cash on insurance policy rates. Jump on your parents' policy. It's typically less costly to add a teen to their moms and dads' policy, as opposed to be insured independently. The majority of firms won't bill an added premium until the teenager is a licensed motorist.

Motorist experience. Graduated Driver Licensing regulation requires teens to log 50 hours with a knowledgeable motorist, yet taking an official drivers training program will likely conserve on insurance coverage.

Penalties can land you back in the traveler seat. Death and injury are the highest cost drivers can pay for alcohol consumption as well as driving, but also if you manage to survive, a D.U.I. ticket will cost teenagers big time. As a teen motorist, you'll likely be cancelled as well as if you can get insurance coverage, anticipate to pay a much greater price for the following 3-5 years (insurance).

Acquire even more than 3 and teenagers deal with cancellation or non-renewal. Drive an "insurance friendly" lorry. Cars that are a favored target for thieves, are pricey to repair, or are considered "high performance" have much greater insurance policy prices. Before you purchase a car, contact your insurance company to obtain a quote on what it will certainly cost to guarantee.

Some Known Factual Statements About How Much Does It Cost To Add A Driver To Your Car Insurance?

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation