Welcome to

On Feet Nation

Members

-

Health Mart Pharmacie Online

-

Deuslye Online

-

Angel Ambulance Online

-

saranmobik Online

-

Zola Montero Online

-

Maitri Maheshwari Online

Blog Posts

/acquista-eroina-bianca

Posted by Health Mart Pharmacie on April 26, 2024 at 7:02am 0 Comments 0 Likes

https://healthcarefarmacia.com/Prodotto/a-215-ossicodone-actavis/…

Continue

/acquista-eroina-bianca

Posted by Health Mart Pharmacie on April 26, 2024 at 7:01am 0 Comments 0 Likes

https://healthcarefarmacia.com/Prodotto/a-215-ossicodone-actavis/…

Continue

/acquista-eroina-bianca

Posted by Health Mart Pharmacie on April 26, 2024 at 7:01am 0 Comments 0 Likes

https://healthcarefarmacia.com/Prodotto/a-215-ossicodone-actavis/…

Continue

Top Content

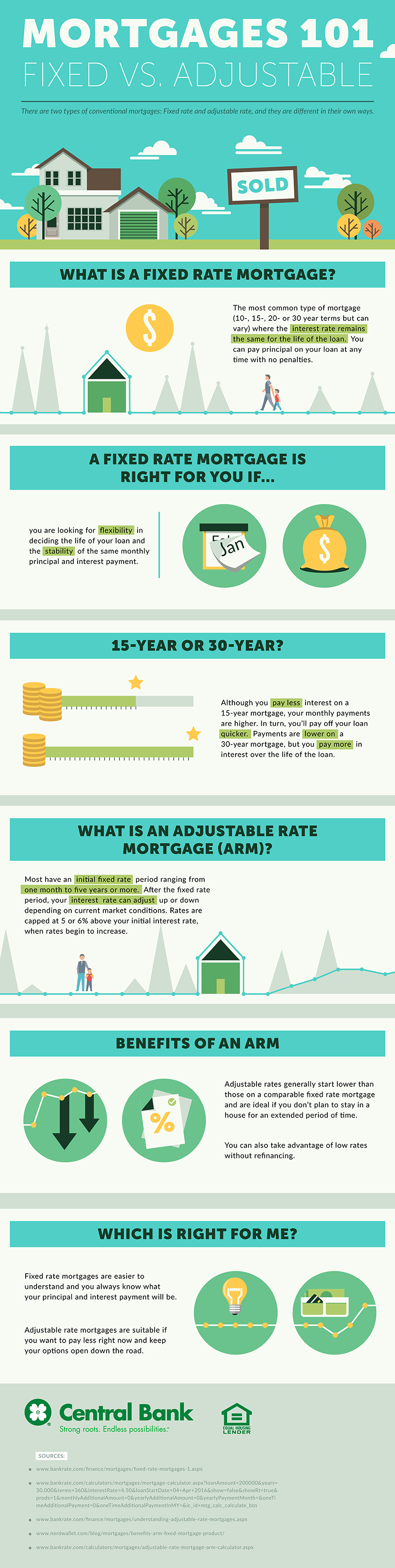

Exactly How Reverse Home Mortgages Work

Bankrate complies with a stringent editorial policy, so you can trust that our content is honest as well as precise. Our award-winning editors and also reporters create truthful and also accurate material to help you make the best monetary choices. The content produced by our editorial team is objective, accurate, as well as not influenced by our advertisers. Bankrate complies with a strict content plan, so you can rely on that we're placing your interests first.

- Reverse home loans permit home owners to convert equity in their home right into cash, while maintaining ownership.

- You can make regular monthly repayments, you can pay quarterly, bi-monthly, semi-annually or simultaneously.

- The majority of home owners with reduced or modest earnings can qualify for these car loans.

- The restriction for your reverse home loan depends on your age, residence value, rates of interest, as well as readily available equity.

A reverse home loan becomes due once all consumers have actually passed away or relocated permanently out of the house, among other situations. As we said above, in 2021, the optimum amount that can be borrowed under an HECM loan is $822,375. The limitation for a big reverse home loan, on the various other hand, can be as high as $4 million. Exclusive reverse home mortgage-- This is a private car loan not backed by the federal government. You can generally receive a larger lending advance from this sort of reverse home https://www.facebook.com/wesleyfinancialgroup/ loan, specifically if you have a higher-valued home. There are different sorts of reverse home mortgages, as well as every one fits a different monetary demand.

Your beneficiaries might not be able to keep the house if they can't manage to repay the lending. If you transform your mind Additional hints within 1 month, simply repay your funding, and also we'll reimburse the application cost completely. Contact a HUD-approved therapist if you're unsure a deal is genuine. If you owe greater than your home deserves, you have an undersea home loan. Victoria Araj is an Area Editor for Rocket Home loan and also held functions in home loan banking, public relationships and also even more in her 15+ years with the company. She holds a bachelor's degree in journalism with an emphasis in political science from Michigan State College, and a master's degree in public administration from the University of Michigan.

What Are The Needs For A Reverse Home Mortgage, And How Can You Get Started?

Exclusive firms offer reverse home mortgage programs using higher finance amounts than the HECM loan limitations set by the FHA. You might be able to obtain more cash from the outset than with a HECM, but these exclusive reverse car loans don't have government insurance policy support and may be more pricey. Many customers choose a House Equity Conversion Home Loan, which is backed by the Federal Housing Administration. A debtor that wishes to move out of a house yet keep it as a rental property will need to locate a way to pay off the reverse home loan. To maintain the residential or commercial property, customers may be able to make use of cost savings to settle the reverse home mortgage or re-finance to a forward home loan.

Your Finance Is Due If You Move Right Into Long

They can do this with cash they have available to them or they may pick to obtain other financing in their name. As I stated previously, we do not recommend reverse mortgages for every person. In the past, many took into consideration the reverse mortgage loan a last hope. If you are within 6 months from your next birthday celebration, I will immediately compute you a year older.

I would certainly encourage you to contact an estate lawyer to be sure whatever is in order now though while mom is still able to authorize extra papers if needed. It is totally approximately you as well as there are no adverse ramifications for paying at odd periods or all at once. I would highly recommend you contact a loan provider prior to you do anything else to determine the cleanest way to finish the deal. If not up until after, he will certainly be called for to additionally go through a great deal of the paperwork and the counseling.

Below's just how reverse home loans work, and also what home owners considering one requirement to understand. Single-purpose lendings are commonly the least pricey type of reverse mortgage. These finances are offered by nonprofits and state and local governments for particular purposes, which are dictated by the loan provider

If you hold appropriate title, reside in the building and also are at the very least 62 years old, you can get a reverse home mortgage on the house. Or you can mix the line of credit scores with the period or term alternatives to have both a settlement for life or of your picking which would be either a customized period or modified period. If they pick this remedy, the sale will certainly conclude equally as with any kind of other sale as well as the profits would certainly first pay off any kind of existing liens on the home and afterwards be provided to the sellers at closing. If the house is not worth as much as is owed on the financing, the beneficiaries have the choice of settling the finance at the lower of the quantity owed or 95% of the present market value, whichever is much less.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation