Welcome to

On Feet Nation

Members

Blog Posts

fdhffdhd

Posted by Lima on April 26, 2024 at 11:53am 0 Comments 0 Likes

fdfdhdhfdhf

Posted by Lima on April 26, 2024 at 11:53am 0 Comments 0 Likes

Top Content

Little Known Questions About When Do Car Insurance Rates Go Down? - The Zebra.

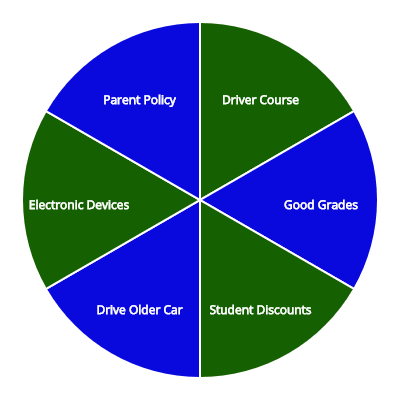

The very best way to lower your teen's automobile insurance rate is to add them to your existing insurance coverage if they currently have their own and then look for discount rates to further reduce the expense. Other notable methods to decrease the expense of teenage vehicle insurance coverage include minimizing your teen's protection and getting several quotes.

Reduce protection Thinking about how costly vehicle insurance is for young chauffeurs, your teen could save on their premium by restricting the amount of coverage they consist of on their policy.

Get several quotes The finest method to lower teenager automobile insurance is to search for quotes from a minimum of three different companies, specifically if your teen is getting their own policy. Every insurer utilizes their own approaches to compute premiums, so the rate that you get from one company may not be the same as another.

The Greatest Guide To Find Affordable Car Insurance For Teen Drivers In Va & Nc

To discover where to start, inspect out Wallet, Center's picks for the finest teen car insurance business. You can likewise find more information in our guide on how to decrease car insurance expenses.

Teaching a teen to drive is enough to test your patience, however knowing how to save money on teenage automobile insurance can be equally challenging. Thankfully, there are methods to take advantage of automobile insurance coverage discounts for teenage motorists, as long as you're prepared to do a little research and window shopping.

If you're concerned about how to afford insurance for a teen driver, it is necessary to know where to look for discount rates and which insurer are better suited for insuring your teen. Why it costs more to insure teen chauffeurs, The cost to guarantee teen chauffeurs depends mostly on whether or not they are included to your policy or on their own policy.

6 Ways To Lower Car Insurance Costs - Virginia Credit Union - Truths

Having a teenager added to your policy will be more affordable total. The reason for the higher premiums is basic: teenager chauffeurs normally practice more at-risk driving habits. According to the CDC, a teen driver is riskier behind the wheel due to the fact that they are: Unskilled Not utilizing seatbelts Most likely to drive sidetracked Higher rates of alcohol use Most likely to speed Most likely to be associated with vehicle crashes at nights and on the weekends Despite these many threat factors, it is still possible to save cash and take benefit of discount rates.

Geico, State Farm, Allstate and Travelers are all examples of carriers that reward chauffeurs with a premium discount rate upon conclusion of required chauffeur safety training courses. Remote trainee discount, If your young adult chauffeur lives away from home to attend college and leaves their cars and truck parked in your driveway, they may be eligible for a distant student discount rate.

This is a terrific discount rate to have when combined with the great trainee discount. Low-mileage discount rates, Similar to the distant trainee, if your teenager drives the automobile a low number of miles each year, then ask about a low-mileage discount. Nationwide provides the pay-per-mile alternative through its Smart, Miles program, offering coverage with a premium that changes every month, depending upon the number of miles actually driven.

5 Ways To Save On Auto Insurance With Teen Drivers In The ... for Beginners

Make the most of telematics, Modern technology makes it simpler than ever to watch on your teenagers when they take to the roadway. Several insurance providers offer electronic devices that permit you to keep track of teen driving habits. For circumstances, with Allstate families can register in the Drivewise program, in which a little gadget is installed in the car.

Where to go shopping for teen driver vehicle insurance, Knowing which providers use the finest discount rates for teen motorists while providing appropriate coverage is important. Comparing quotes is not only important, it likewise allows you to see equal coverage contrasts to ensure your teen has sufficient insurance coverage at a competitive cost.

93/5 based on premiums, monetary rankings and high customer care rankings. What is the very best utilized car for teenager drivers? The car your teen drives is a substantial element to evaluate when thinking about the cost of insurance for a teen. The kind of automobile is not only important for security functions, however likewise the expense to guarantee.

Get This Report on How To Save Money On Car Insurance For Teens - The General

Should I include my teen to my existing policy? This is another effective technique when believing about how to reduce teenage automobile insurance.

In addition to mentor by your own example, it is an excellent idea to enlist your teen in an innovative motorist's education safety course. This would be an extra-cost program that exceeds and beyond the minimum state requirements to pass a driver's examination and roadway test. Provide your teenager the opportunity to establish sophisticated abilities in a controlled environment, where they can gain from mistakes before hitting public roadways.

If your household hasn't combined policies with a single insurer yet, now is the time to think about doing so as a way to balance out the additional costs of including a teenager to your cars and truck insurance coverage. As with any other purchase, it is always a great concept to contrast shop insurance plan to discover the very best rates.

5 Simple Techniques For Teen Safe Driving Program & Discount - American Family ...

As soon as you have actually determined where you can get the finest rate, and whether it makes sense to combine all of your household's insurance policies with that single supplier, you should include your teen to the household policy instead of purchase a different policy for your child or daughter. By putting your teenager on the household insurance coverage as a covered motorist-- instead of purchasing an independent policy-- you can conserve money since all available household discount rates will also apply to the teen.

My 16-year-old child is about to get his license, and I'm scared of what that may do to our auto-insurance rates. How can we decrease insurance expenses? You're best to be stressed-- your auto-insurance premiums are most likely to escalate when your teenage kid begins driving. A few key relocations can help you cut expenses significantly.

Add some more money to your emergency situation fund so you'll have the cash to pay the deductible if anybody in your household does have a mishap. completely on older cars that are worth little more than the deductible. You may be paying more in premiums than you could ever get back from the insurance provider, even if the cars and truck is amounted to.

The 2-Minute Rule for 8 Ways To Cut Insurance Costs For Teen Drivers - Kiplinger

The insurance company that provided the best rate for you and your partner may have a few of the highest rates when you add a teenage kid to the policy (and it's practically always better to include the child to your policy rather than have him get his own policy). "One business we deal with is truly fantastic with young chauffeurs and another is dreadful," states Mujadin.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation