Welcome to

On Feet Nation

Members

Blog Posts

Top Content

Fascination About Adding A Teen Driver To Your Insurance Policy?

Secret TAKEAWAYSAccording to the federal Centers for Illness Control and Prevention, the worst age for accidents is 16. If the student plans to leave a vehicle at home and the college is more than 100 miles away, the college student could qualify for a "resident trainee" discount rate or a student "away" discount rate.

Getting begun: An easy primer Chances are that your automobile insurance business will call you. How does the company understand?

The Ultimate Guide To Average Cost Of Car Insurance For 16-year-olds - Valuepenguin

If you don't get the call, alert your provider when your teen gets a learner's permit to talk through your alternatives and to give yourself time to compare vehicle insurance companies. In basic, allowed chauffeurs are immediately covered as a part of the parent or guardian's policy without any action needed on your part.

Use our discount guide listed below so you're not in the dark. All 50 states and the District of Columbia now have a Graduated Chauffeur's License (GDL) system, according to the Insurance coverage Institute for Highway Safety (IIHS). GDL programs conserve lives. A study by the IIHS found states with stronger finished licensing programs had a 30% lower fatal crash rate for 15- to 17-year olds.

Not known Factual Statements About Adding A Teen Driver To Your Insurance Policy?

It still includes a large cost, however you can certainly save if you select the very best automobile insurer for teenagers. We can assist. How much does it cost to include a teenager to car insurance? Let's come down to numbers. The cost of adding a teen to your automobile insurance coverage differs based upon a number of aspects.

The factor behind the hikes: Teenagers crash at a much greater rate than older motorists. The danger is 4 times as much. According to the federal Centers for Disease Control and Prevention, the worst age for accidents is 16. They have a crash rate two times as high as motorists that are 18- and 19-year-olds.

Some Known Factual Statements About Insurance For Teens - Country Financial

Just make sure your teenager isn't driving on a complete license without being formally added to your policy or their own. Once together on the exact same policy, all driving records-- including your teenager's-- affect premiums, for better or even worse.

To understand how a moving offense will impact your rates, we ran a study and discovered that the additional cost could run from 5% to as high as 20%. Teenager purchasing their own policy, Can a teen buy his or her own insurance coverage? Yes. Companies will sell straight to teenagers.

Let's Talk About Teen Drivers And Car Insurance - Online ... - Questions

That implies a moms and dad may need to co-sign-- and it's rarely cheaper. In reality, your teenager will likely have a higher premium compared to adding a teenager to a moms and dad or guardian policy. There are cases where it may make sense for a teenager to have their own policy.

, but it's a fantastic time to begin a relationship with an insurance supplier. How much is vehicle insurance for teens? Like we have actually stated, teen cars and truck insurance is pricey.

Get Best Cheap Car Insurance For Teens New Drivers In 2021 for Beginners

Young motorists are far more likely to get into cars and truck mishaps than older chauffeurs. The risk is greatest with 16-year-olds, who have a crash rate two times as high as 18- and 19-year-olds. That risk is reflected in the average vehicle insurance coverage rates for teens:16-year-old - $3,98917-year-old - $3,52218-year-old - $3,14819-year-old - $2,17820-year-old - $1,945 Rates not only depend upon age, but the business you pick.

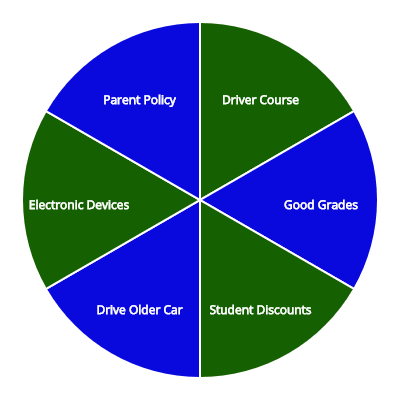

That's $361 on average. You can take extra driver education or a defensive driving course. This means go above and beyond the minimum state-mandated drivers' education and training. In some states, discount rates can range from 10% to 15% for taking a state-approved chauffeur improvement class. Online classes are a hassle-free choice, however talk to your provider initially to ensure it will result in a discount.

About Student Driver Guide - Advice: Stay On Your Parents' Policy

You could receive a discount around 5% to 10% of the trainee's premium, but some insurers market up the 30% off. The typical student away at school discount rate is more than 14%, which is a savings of $404. A simple way to lower vehicle insurance coverage premiums is to raise your deductible.

Use 's list of automobile designs to discover the cheapest vehicles to insure. This primarily involves the cars and truck's expense, how simple it is to fix and claim records. Insure. com likewise has a list of used automobiles. Keep a tidy record and you can receive a discount rate.

Cheap Car Insurance For Teens And Young Drivers - Compare ... Fundamentals Explained

With pay-per-mile, you'll pay for the range you drive, rather than driving patterns. Both discount rates are terrific for teens or households that do not drive extremely often. This isn't truly a discount and probably not a popular option for an excited teenager motorist, however it deserves thinking about. An older teen motorist is somewhat cheaper to guarantee, approximately 20% less expensive from the age of 18 to 19.

If the student plans to leave an automobile in the house and the college is more than 100 miles away, the university student could certify for a "resident student" discount or a student "away" discount, as mentioned above. These discounts can reach as high as 30%. Likewise, do well in school.

Some Known Questions About Helping Cut Costs For Teen And New Drivers - Geico.

Both discount rates will need you to contact your insurance coverage service provider so they can start to apply the discount rates. While you're on the phone with them, don't be reluctant to ask about other possible discounts. Student's authorization insurance coverage, You can get insurance with an authorization, but many cars and truck insurance coverage companies consist of the allowed teenager on the parents' policy without any action.

When that time comes, be sure to visit the rest of this article for guidance on choices and discount rates. Likewise, it may be smart to contact your insurance coverage provider for all options available to you. Select no protection cost savings choice, It's possible to tell your insurer not to cover your teenager, however it's not a provided.

Little Known Facts About Car Insurance For Teens - Nationwide.

Through an endorsement to your policy, you and your insurance coverage business equally concur that the chauffeur isn't covered, which indicates neither is any mishap the motorist causes. Not all business enable this, and not all state do either. Adding a teen chauffeur cheat sheet, Talk with your carrier as quickly as your teenager gets a driver's license.

If there's a new teen chauffeur in your household, you require to guarantee them. Including a teen driver to your policy can be costly, so check with your representative or insurance coverage business.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation